Smart Money Saving Ideas for 2026: Thriving in an Era of Financial Intelligence

Introduction: The Evolving Landscape of Personal Finance

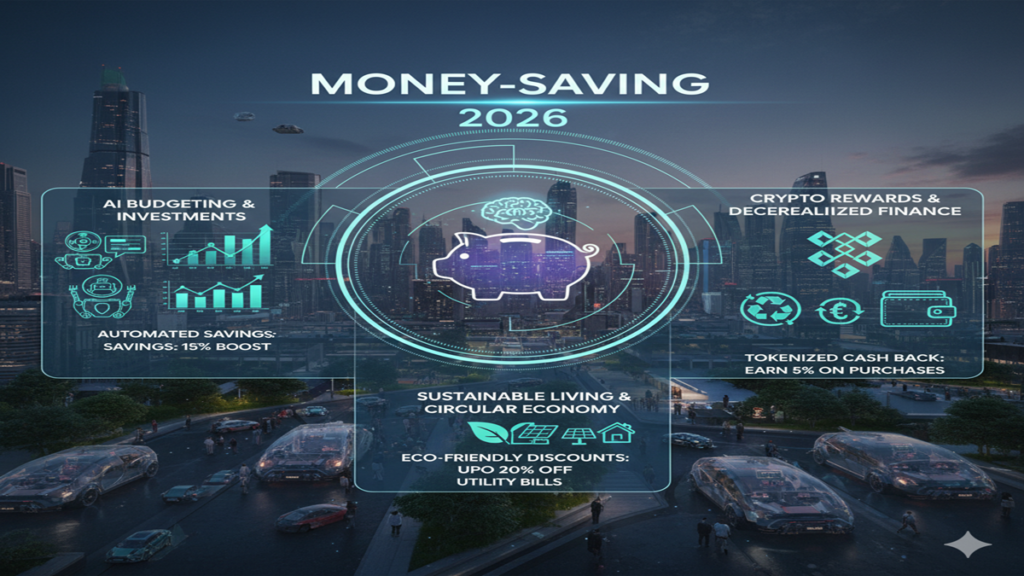

Smart Money Saving Ideas 2026 As we approach 2026, the concept of “saving money” has transformed from simple coupon-clipping to a sophisticated integration of technology, behavioral psychology, and strategic planning. The post-pandemic economy, marked by fluctuating inflation rates, evolving workplace structures, and accelerating technological advancement, demands a more nuanced approach to personal finance. Today’s smart money saving isn’t about deprivation—it’s about optimization, automation, and intentional living. This comprehensive guide explores forward-thinking strategies that align with emerging trends, technological developments, and shifting consumer behaviors to help you build financial resilience in 2026 and beyond.

Section 1: The 2026 Financial Mindset Shift

From Budgeting to Cash Flow Intelligence

Traditional budgeting methods are giving way to dynamic cash flow management. In 2025-2026, successful savers will utilize AI-powered financial platforms that categorize spending in real-time, predict future expenses based on patterns, and offer proactive suggestions. These systems don’t just track where your money went—they forecast where it should go, considering irregular income streams common in the gig economy and hybrid work models.

Implementation Strategy: Begin transitioning now by using apps that offer predictive analytics. Gradually move from monthly budgeting to weekly “financial check-ins” where you assess upcoming obligations against projected income. This fluid approach better accommodates the variable income patterns that characterize modern work.

The Value-Expenditure Alignment

Consumers increasingly seek alignment between spending and personal values. This isn’t merely ethical consumerism but a strategic approach to reducing waste. By consciously directing funds toward purchases that bring genuine satisfaction or align with long-term goals, you naturally eliminate frivolous spending. Research indicates this values-based approach reduces overall consumption by 23% while increasing satisfaction with purchases.

Actionable Tip: Create a “values hierarchy” for your spending. Rank categories (health, education, family experiences, sustainability, etc.) and evaluate regular expenses against this hierarchy. You’ll likely identify several automatic expenditures that don’t align with your stated values and can be eliminated without perceived sacrifice.

Section 2: Technology-Enabled Saving Strategies

AI-Powered Subscription Audits

By 2026, the average household will manage 15+ digital subscriptions. “Subscription fatigue” represents a significant financial drain, with many users paying for services they rarely use. AI tools now exist that not only track your subscriptions but analyze usage patterns, suggest consolidations, identify overlapping services, and even negotiate better rates on your behalf.

2026 Implementation: Look for financial aggregators that offer automated subscription management. These services will soon proactively cancel underutilized services (with user permission) and alert you to price increases before they hit your account.

Predictive Price Optimization

Dynamic pricing is becoming more sophisticated, but so are consumer tools. Browser extensions and apps now employ machine learning to predict optimal purchase timing based on historical price data, seasonal trends, and inventory cycles. For significant purchases (appliances, electronics, travel), these tools can recommend waiting periods that typically yield 15-30% savings.

Pro Tip: Combine predictive tools with traditional strategies. For instance, use price prediction to determine when to buy, then employ cashback portals and credit card rewards for additional savings layers.

Automated Micro-Investing from Savings

The line between saving and investing continues to blur. “Round-up” applications that invest spare change have evolved into sophisticated systems that automatically allocate portions of identified savings (from coupon use, price adjustments, or subscription cancellations) directly into diversified investment portfolios. This creates a seamless savings-to-investment pipeline that builds wealth from money you’ve already decided not to spend.

Section 3: Lifestyle Integration Savings

The Hybrid Living Economy

The normalization of remote and hybrid work has created new saving paradigms. Reduced commuting costs are just the beginning. Savvy individuals are leveraging geographic flexibility through “geoarbitrage”—living in lower-cost areas while maintaining higher urban salaries. Meanwhile, the “digital nomad” trend evolves into “strategic relocation,” where families move to regions with lower costs of living, better tax structures, or both.

2026 Consideration: If your employment allows location independence, conduct a comprehensive analysis of potential relocation destinations. Factor in not just housing costs but taxes, insurance rates, transportation infrastructure (if you travel occasionally to headquarters), and lifestyle expenses. The savings differential can accelerate financial goals by years.

The Circular Economy Participation

Buying new is increasingly a last resort. By 2026, premium refurbished markets for electronics, furniture, and even clothing will dominate certain categories. Simultaneously, peer-to-peer rental platforms allow you to monetize underused assets (tools, parking spaces, even specialty kitchen equipment) while accessing others’ items rather than purchasing.

Strategic Approach: Before any significant purchase, check refurbished marketplaces with certification guarantees. For items you need temporarily or infrequently, explore rental options. For items you own but use infrequently, list them on sharing platforms to generate offsetting income.

Health as Financial Strategy

Preventive health measures represent one of the highest-return investments. With healthcare costs continuing to rise, a focus on nutrition, exercise, and stress management pays dual dividends. Employers increasingly offer premium discounts for healthy behaviors tracked through wearables, creating direct financial incentives. Additionally, the expansion of telehealth provides quality care at reduced costs for non-emergency situations.

Implementation: Maximize employer wellness incentives, which are becoming more substantial. Invest in quality food and fitness rather than treating medical issues later. Consider a Direct Primary Care (DPC) membership for predictable primary care costs.

Section 4: Systemic Financial Optimizations

Next-Generation Debt Management

Rather than generic debt repayment strategies, 2026 brings AI-customized debt optimization. These systems analyze all debts, interest rates, cash flow, and potential balance transfer offers to create dynamic repayment schedules that minimize total interest paid. Some even temporarily adjust investment contributions when mathematically advantageous to accelerate debt clearance.

Action Plan: If managing multiple debts, use a free online debt optimization calculator to determine whether avalanche, snowball, or a hybrid method saves the most. Monitor for balance transfer opportunities with extended zero-interest periods, but factor in transfer fees.

Insurance Ecosystem Optimization

Annual insurance review is becoming continuous. New services monitor your insurance portfolio, alerting you to better rates, coverage gaps, or overlapping policies.

2026 Strategy: Consider UBI for auto insurance if you’re a low-mileage, safe driver. Bundle policies where discounts apply, but don’t automatically assume bundling is cheapest—sometimes separate policies from specialized providers offer better value.

Tax-Efficient Saving Structures

The distinction between retirement and non-retirement savings is blurring. Health Savings Accounts (HSAs) have emerged as powerful triple-tax-advantaged savings vehicles for those with high-deductible plans. Meanwhile, Roth conversions in low-income years and strategic tax-loss harvesting in investment accounts are becoming standard practices for informed savers.

Important Note: Tax strategies are highly individual. Consult with a tax professional to develop a multi-year tax planning strategy that aligns with your income projections and retirement timeline.

Section 5: Community and Collaborative Saving

Collaborative Consumption Networks

Neighborhood-based buying clubs, tool libraries, and skill-exchange networks reduce individual ownership burdens. Digital platforms now facilitate these exchanges with reputation systems and scheduling tools. Participating in just two collaborative networks can save the average household $1,200+ annually.

Getting Started: Search for existing networks on platforms like Nextdoor or Facebook Groups, or initiate one focused on a specific category (gardening equipment, power tools, party supplies).

Family Office Approach for Middle Class

Inspired by wealth management for the ultra-rich, “family office” principles are being adapted for middle-income households. This involves creating a formal family financial plan that includes multi-generational goals, shared resources, and coordinated purchasing power. Families collectively negotiate with service providers, share subscriptions, and pool resources for bulk purchasing.

Implementation Idea: Hold a family financial summit to align on goals and identify collaboration opportunities. Even simple coordination like shared streaming services or group phone plans can yield meaningful savings.

The Psychology of Sustainable Saving

The most advanced saving strategies fail without the right mindset. Behavioral economics highlights several 2026-relevant principles:

Friction Design: Intentionally add steps to spending processes (like 24-hour waiting periods for non-essential purchases over a set amount) while reducing friction for saving (automated transfers).

Progress Visualization: Use visual trackers for debt reduction or savings goals. Digital dashages that show “days to goal” based on current behavior are particularly motivating.

Social Accountability: Financial goals shared within a trusted community have significantly higher achievement rates. Consider a saving challenge with friends or an online community with similar objectives.

Conclusion: Saving as Wealth Creation

Smart money saving in 2026 transcends mere frugality. It represents a holistic integration of technology, behavioral insight, and strategic planning that transforms residual income into genuine wealth-building. The common thread across all these strategies is intentionality—making conscious, informed decisions that align financial behavior with life goals. As tools become more sophisticated, the fundamental principle remains: understanding the difference between price and value, and allocating resources accordingly. By adopting these forward-thinking approaches, you’re not just saving money; you’re purchasing financial freedom and future opportunity.

Start your 2026 financial strategy today by implementing one technology enhancement and one behavioral shift. Within months, these compound into significant financial momentum, positioning you not just to weather economic uncertainties, but to thrive within them.

Frequently Asked Questions (FAQ)

Q1: With inflation potentially continuing into 2026, how can I save effectively when everything costs more?

A: Inflation makes strategic saving even more critical. Focus on “high-impact” savings categories: negotiate fixed expenses like insurance and subscriptions, reduce energy costs through home efficiency improvements, and shift spending toward less-inflation-affected categories (like experiences over goods where possible). Most importantly, ensure your savings are earning competitive interest—high-yield savings accounts and certain government bonds often outpace inflation. Also, consider that some “inflation protection” comes from reducing dependence on volatile costs: growing herbs/vegetables, learning basic repair skills, and building community exchange networks.

Q2: Are automated financial apps safe to use, and how do I choose a reliable one?

A: Security is paramount. Choose apps from established financial institutions or fintech companies with strong reputations. Look for: bank-level encryption (256-bit SSL), two-factor authentication, clear privacy policies explaining data usage, and preferably, FDIC insurance for cash holdings. Read independent security reviews and check if the company has experienced any public breaches. Start with apps that offer “view-only” access initially, and never share login credentials for your primary bank account—use the secure connection methods (like OAuth) that banks provide for third-party services.

Q3: How much time should I realistically spend managing these smart saving strategies?

A: The goal of smart saving is actually to reduce time spent on finances through automation and efficiency. Initially, you might spend 4-6 hours setting up systems: linking accounts, configuring automated transfers, auditing subscriptions, and researching optimal providers. Once established, maintenance should require no more than 30 minutes weekly for review and 2-3 hours quarterly for deeper analysis. The most effective systems run autonomously, alerting you only when action is needed (like a subscription price increase or better insurance rate).

Q4: I have a limited income. Are these strategies still relevant?

A: Absolutely. Many smart saving strategies have the highest proportional impact for limited incomes. Focus first on eliminating “leaks”—unused subscriptions, high-interest debt, and inefficient services. Technology-assisted strategies like price prediction and cashback apps require no upfront investment. Collaborative economy participation (sharing, swapping, buying clubs) often saves most for those with constrained budgets. Remember that percentage-wise, saving $50 on a $200 utility bill (25% reduction) is more significant than saving $100 on a $1,000 bill (10%). Start with one or two high-impact, no-cost strategies and build from there.

Q5: How do I balance between aggressive saving and enjoying life in the present?

A: This is the essential balance. The smartest savers distinguish between deprivation and optimization. Instead of eliminating enjoyment, they optimize it: seeking equal satisfaction at lower cost through strategic timing (travel during shoulder seasons), value alignment (spending on what truly matters to them), and experience creativity (free community events, nature-based recreation). Allocate a specific “guilt-free” spending category in your plan. The psychological benefit of knowing your financial future is secure often enhances present enjoyment more than impulsive spending ever could. Periodic “saving sprints” for specific goals can be balanced with normal, optimized spending the rest of the time.