Demystifying the Sarkari Exam Salary List: Your Guide to Pay Scales, Perks, and Career Growth

Sarkari Exam Salary List The allure of a “Sarkari Naukri” (government job) in India is multifaceted, blending job security, social prestige, and a structured, rewarding career path. For lakhs of aspirants navigating the labyrinth of UPSC, SSC, State PSCs, and banking exams, one of the most compelling yet confusing aspects is the salary. The term “Sarkari Exam Salary List” often leads to fragmented and outdated information. This comprehensive guide aims to demystify the salary structure for all major government exams, explaining the pay scales, allowances, and the hidden financial benefits that make these positions so coveted.

Understanding the Foundation: The 7th Central Pay Commission (7th CPC)

Before delving into specific exams, understanding the 7th CPC, implemented in 2016, is crucial. It replaced the complex “Pay Band + Grade Pay” system with a streamlined “Level” system. Salaries are now defined by:

- Pay Matrix Level: Ranging from Level 1 (lowest) to Level 18 (highest e.g., Cabinet Secretary). Each level corresponds to a set of basic pay increments.

- Basic Pay: The core component of the salary, upon which all allowances are calculated.

- Dearness Allowance (DA): A cost-of-living adjustment, revised quarterly as a percentage of the basic pay. Currently, it stands at 50% of basic pay for central employees, significantly inflating the total salary.

- House Rent Allowance (HRA): Varies based on city classification (X, Y, Z).

- Travel Allowance (TA), Medical Benefits, etc.: Other significant additions.

Net Salary = Basic Pay + DA (currently 50%) + HRA (8%-27%) + Other Allowances – Deductions (NPS, Insurance, etc.)

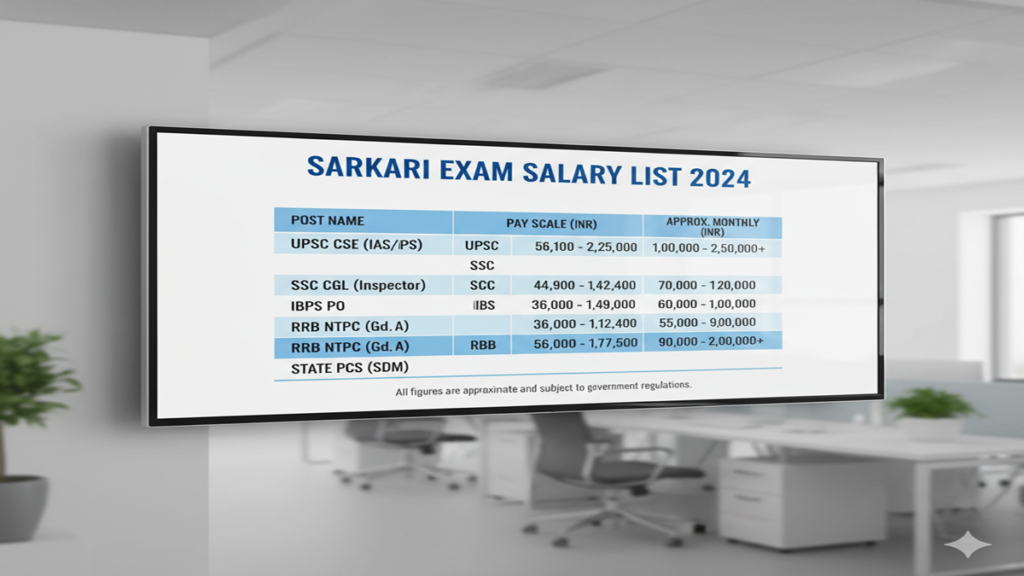

Sarkari Exam Salary List: A Tier-Wise Breakdown

Here is a detailed, tier-wise breakdown of salaries for jobs acquired through major Sarkari exams, updated with current figures including 50% DA.

Tier 1: All India Services & Group A (Central Civil Services)

Exams: UPSC Civil Services Exam (IAS, IPS, IFS, IRS, etc.), UPSC Engineering Services Exam (IES), UPSC Combined Defence Services (CDS).

- Designations: IAS, IPS, IFS, IRS Officer, IES Officer, Defence Officer.

- Entry Level: Typically, Level 10 or Level 8 of the Pay Matrix.

- Basic Pay (Entry): ₹56,100/- (Level 10) for most. For example, an IAS officer starts at ₹56,100.

- In-Hand Salary (Approx., at entry):

- Basic Pay: ₹56,100

- DA (50%): ₹28,050

- HRA (27% for X city): ₹15,147

- TA & Other Allowances: ₹5,000 – ₹10,000

- Gross: ~₹1,05,000 – ₹1,10,000

- Deductions (NPS, CGHS, etc.): ₹15,000

- Approx. In-Hand Salary: ₹90,000 to ₹1,00,000 per month.

- Growth: At the apex scale (Cabinet Secretary, Level 18), the basic pay reaches ₹2,50,000, with a total monthly package exceeding ₹3,00,000.

Tier 2: Central Group B & State Group A Services

Exams: UPSC CAPF (Assistant Commandant), State PSC Civil Services (SDM, DSP, BDO), SSC CGL (for Group B Gazetted posts).

- Designations: CAPF Assistant Commandant, State Police Service Officer (DSP), State Civil Service Officer (SDM/BDO), SSC CGL posts like Assistant Audit Officer, Income Tax Inspector.

- Entry Level: Levels 7, 8, or 9 of the Pay Matrix.

- Basic Pay (Entry): Ranges from ₹44,900/- (Level 7) to ₹56,100/- (Level 8).

- In-Hand Salary (Approx.):

- Basic Pay: ₹44,900 – ₹56,100

- DA (50%): ₹22,450 – ₹28,050

- HRA: ₹8,982 – ₹15,147

- Approx. In-Hand Salary: ₹65,000 to ₹90,000 per month, depending on city and posting.

Tier 3: Non-Gazetted Officers (Central & State)

Exams: SSC CGL (Non-Gazetted), SSC CHSL, Railway Recruitment Boards (RRB NTPC), IBPS PO/CLERK, State PSC Clerk/Police Exams.

- Designations: Tax Assistant, Auditor, Divisional Accountant (SSC CGL), Lower Division Clerk (SSC CHSL), Station Master (RRB), Probationary Officer (IBPS), Police Sub-Inspector (State).

- Entry Level: Levels 4, 5, 6, or 7 of the Pay Matrix.

- Basic Pay (Entry): Ranges from ₹25,500/- (Level 4) to ₹44,900/- (Level 7).

- In-Hand Salary (Approx.):

- SSC CGL (Auditor/Tax Assistant): ₹45,000 – ₹60,000/month.

- IBPS Probationary Officer: ₹52,000 – ₹55,000/month (initial months), rising quickly with increments.

- Railway NTPC (Station Master/Commercial Clerk): ₹35,000 – ₹50,000/month.

- State Police SI: ₹40,000 – ₹55,000/month (varies by state).

Tier 4: Clerical & Support Staff

Exams: SSC CHSL, SSC MTS, RRB Group D, State Govt. Clerk Exams.

- Designations: Postal Assistant, Data Entry Operator (DEO), Multi-Tasking Staff (MTS), Railway Track Maintainer, Office Clerk.

- Entry Level: Levels 1, 2, or 3 of the Pay Matrix.

- Basic Pay (Entry): ₹18,000/- to ₹21,700/-.

- In-Hand Salary (Approx.): ₹22,000 to ₹35,000 per month. While the starting figure seems modest, job security, defined working hours, and a full pension (for those under the old scheme) add immense value.

Specialized & Technical Departments

- Teaching & Research: UGC NET Assistant Professor (Entry Basic Pay: ₹57,700 as per Level 10), ISRO Scientist (₹56,100 at entry), DRDO Scientist.

- Public Sector Undertakings (PSUs): Through GATE, BARC OCES, etc. Salaries often exceed traditional government scales. An MT in a Maharatna PSU like ONGC or NTPC can start with a CTC of ₹16-20 Lakhs per annum.

- Defence Forces: Through NDA, CDS, AFCAT. A Lieutenant in the Army starts with a package of approx. ₹80,000-90,000/month (including all military-specific allowances).

Beyond the Basic Pay: The “Real” Salary of a Sarkari Job

The in-hand cash is just the tip of the iceberg. The true value lies in the comprehensive benefits package:

- Job Security & Regular Increments: Assured career progression with annual increments and periodic promotions. No fear of arbitrary layoffs.

- Pension & Retirement Benefits: For employees under the Old Pension Scheme (OPS), it’s a lifelong financial haven. The National Pension System (NPS) for post-2004 appointees is also a robust, contributory scheme.

- Allowances (The Game Changer):

- Dearness Allowance (DA): Inflation-proofs your salary. Currently at 50% and likely to rise.

- House Rent Allowance (HRA): Up to 27% of basic for metros.

- Travel Allowance (TA): For official and sometimes personal travel.

- City Compensatory Allowance (CCA): For high-cost cities.

- Special Duty Allowance (SDA): For postings in difficult areas like the North-East (can be substantial).

- Field Area Allowances: For defence and CAPF personnel.

- Healthcare: Subsidized, high-quality medical treatment for self and family through CGHS/REHS.

- Work-Life Balance: Fixed working hours, ample leave (casual, earned, medical), and national holidays.

- Subsidized Facilities: Government accommodation in many posts, loans at concessional rates, and access to clubs and recreational facilities.

- Social Status & Impact: The respect and ability to influence public policy and implementation is an intangible yet significant reward.

Choosing the Right Exam: Aligning Aspiration with Compensation

Your career choice should not be based on starting salary alone. Consider:

- Long-Term Growth: An IAS officer may start at ~₹90,000 but in 20 years can head departments with immense power and compensation. A PSU job may start higher but have a different growth curve.

- Nature of Work: Do you want field work (IPS, CAPF), policy-making (IAS, IFS), technical challenges (IES, ISRO), or financial regulation (IRS, RBI)?

- Exam Difficulty vs. Reward: The UPSC CSE is arguably the toughest, offering the highest career trajectory. Exams like SSC CGL or IBPS PO offer a great balance of respectable pay, good work profile, and relatively lower competition.

State Government vs. Central Government Salaries: Key Differences

- Pay Commissions: States generally adopt the central pay commission recommendations but with a time lag and sometimes modifications.

- DA Rates: DA for state employees can differ and is often lower than central rates, impacting total salary.

- Allowances: HRA, TA, and special allowances vary significantly from state to state based on their finances. Prosperous states like Maharashtra, Gujarat, or Karnataka often offer better packages than some others.

- Rule of Thumb: Central government jobs usually offer slightly higher and more uniform pay, while state government jobs offer deeper connection to one’s home region and culture.

Future Outlook: Pay Revisions and Trends

Salaries are not static. The DA is revised every six months. A major revision will come with the 8th Central Pay Commission, expected around 2026, which will provide the next significant hike. Furthermore, as the government competes with the private sector for talent, especially in technical roles, we are seeing more attractive, performance-linked packages in sectors like Railways, PSUs, and financial institutions.

Conclusion: More Than Just a Number

The “Sarkari Exam Salary List” reveals a structure designed for dignity, security, and gradual prosperity. While the initial in-hand figure might sometimes be lower than elite private sector packages, the holistic view—factoring in allowances, benefits, work-life balance, pension, and unmatched job security—often makes the government job a superior lifetime financial decision. For an aspirant, the key is to look beyond the starting salary, understand the pay matrix of the target post, and choose an exam that aligns with both your financial goals and your passion for service. Your preparation is an investment in a career that guarantees not just a salary, but a stable and respected life.

Frequently Asked Questions (FAQs)

1. Which Sarkari exam gives the highest starting salary?

While top-level civil services (IAS/IPS) offer excellent packages, entrance exams for top Public Sector Undertakings (PSUs) like ONGC, NTPC, BHEL through GATE or specific MT exams often offer the highest starting Cost-to-Company (CTC), sometimes ranging from ₹16-25 lakhs per annum. In traditional government, the IAS, IFS, and IRS (Indian Revenue Service) have among the best growth-oriented compensation packages.

2. Is the salary the same across all states for the same post (e.g., Police SI)?

No, salaries for the same post differ across states. They are determined by the respective State Pay Commissions. While the basic pay might be similar as per central matrix adoption, the Dearness Allowance (DA) and other local allowances vary greatly depending on the state’s finances. An SI in Maharashtra or Tamil Nadu may earn significantly more than an SI in a state with weaker finances.

3. What is the major deduction from a government employee’s salary?

The single largest deduction for employees recruited after January 1, 2004, is the contribution to the National Pension System (NPS), which is 10% of (Basic Pay + DA). Other common deductions include Central Government Health Service (CGHS) contributions, income tax (as per slab), and sometimes group insurance.

4. How much does the Dearness Allowance (DA) impact the total salary?

DA has a massive impact. At the current rate of 50%, it directly adds half of your basic pay to your salary. For example, if your basic pay is ₹50,000, DA adds ₹25,000 immediately. It is revised every six months to offset inflation, making the salary inflation-proof. A future hike to 52% or 54% will further increase the total.

5. Do government officers get a salary during their training period?

Yes, most government officers receive a stipend or salary during training. For example, an IAS officer at the Lal Bahadur Shastri National Academy of Administration receives a stipend (currently around ₹45,000-₹50,000 per month). Similarly, officers in the Armed Forces, RBI, and banking sectors receive a fixed stipend or a reduced initial salary during their probationary training period. This is considered part of the service tenure.