Navigating Medical Financial Crossroads: An In-Depth Comparison of Personal Loans vs. Credit Cards

Loan Vs Credit Card For Medical Expenses A sudden medical emergency or a planned but costly procedure throws not just your health, but your financial stability into sharp relief. In the United States, where medical debt remains a leading cause of personal bankruptcy, finding the right funding mechanism is critical. Two of the most common avenues are personal loans and credit cards. While both can bridge the gap between medical necessity and financial reality, they are fundamentally different tools with distinct advantages, drawbacks, and long-term implications. This comprehensive guide will dissect each option across multiple dimensions—from interest rates and repayment structures to credit impact and flexibility—to empower you to make an informed, strategic decision during a stressful time.

Chapter 1: The Landscape of Medical Debt Financing

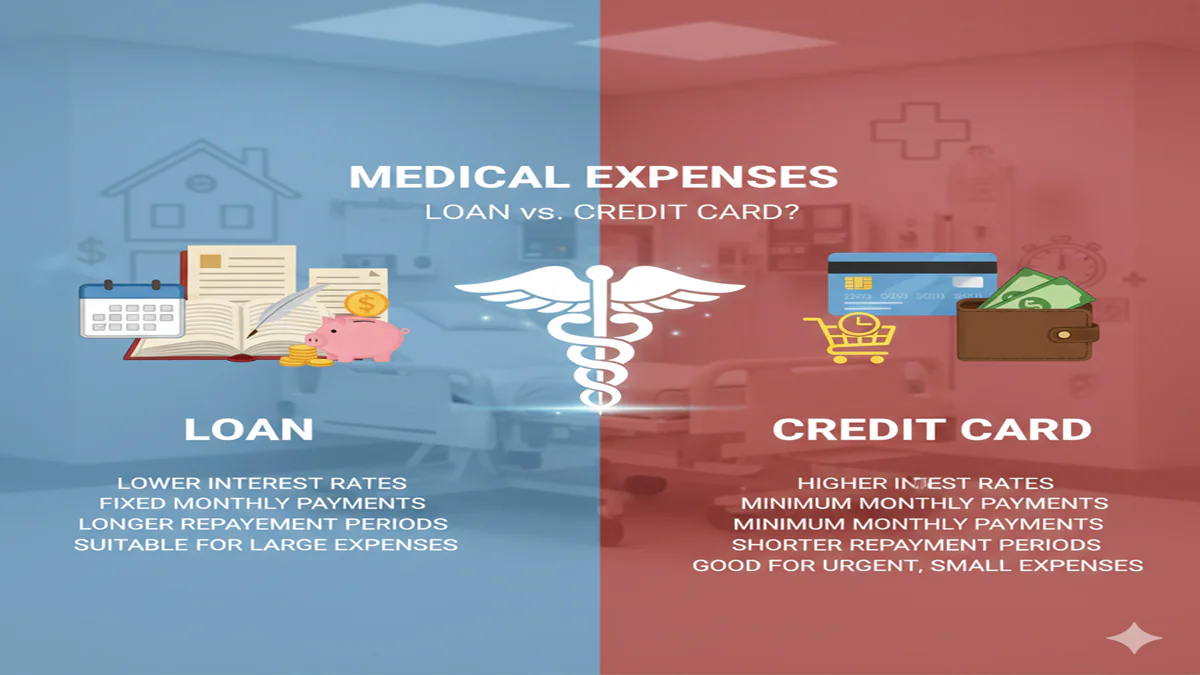

Before diving into specifics, it’s crucial to understand the context. Medical expenses are often unforeseen, urgent, and substantial. Unlike financing a car or a home, the decision is frequently made under duress, which can lead to suboptimal financial choices. The primary goal should be to obtain necessary care without crippling your financial future. This requires a clear-eyed analysis of two key financial products:

- Personal Loans for Medical Expenses:An unsecured installment loan (meaning no collateral is required) where you receive a lump sum of cash upfront. You repay it, plus interest, in fixed monthly payments over a predetermined period, typically 2 to 7 years.

- Credit Cards for Medical Expenses:Using an existing line of credit or opening a new card, you charge medical bills directly to the card. This creates a revolving balance with a variable minimum monthly payment and an interest rate that compounds if the balance is not paid in full.

Chapter 2: Personal Loans for Medical Expenses – The Structured Path

How It Works: You apply through a bank, credit union, or online lender for a specific amount, often from $1,000 to $50,000 or more. Lenders perform a hard credit check and assess your income, debt-to-income ratio, and credit score to determine your interest rate (APR) and loan terms. Upon approval, funds are deposited into your bank account, often within a few business days. You then use the cash to pay your medical provider directly.

Advantages:

- Predictable Repayment:The cornerstone benefit. Fixed monthly payments and a set payoff date make budgeting straightforward and eliminate uncertainty. You know exactly when you will be debt-free.

- Typically Lower Interest Rates (For Good Credit):For borrowers with good to excellent credit (FICO scores ~690+), personal loans often offer significantly lower APRs than standard credit cards. Rates can range from 6% to 36%, but the average for well-qualified borrowers is often in the 10-15% range, compared to the average credit card APR of over 20%.

- Fixed Term & Discipline:The installment structure enforces discipline. There’s no temptation to make only a minimum payment, as the required payment is the full installment. This prevents the debt from lingering indefinitely.

- Potential for Single-Payment Simplicity:You can use the lump sum to negotiate and pay a provider in full, which may open the door for a “paid-in-full” discount that some hospitals offer for immediate cash payment.

- Credit Mix Diversification:Successfully repaying an installment loan can positively diversify your credit mix, potentially boosting your credit score over time.

Disadvantages:

- Less Flexibility:Once you receive the lump sum and repayments begin, you cannot access more funds without applying for a new loan. Your monthly payment is immutable.

- Potentially Slower Access:While some online lenders offer near-instant approval and next-day funding, the process is generally slower than swiping an existing card.

- Origination Fees:Many lenders charge an upfront fee (typically 1%-8% of the loan amount), which is deducted from the loan proceeds. This effectively increases your cost of borrowing.

- Rigidity in Overpayment:Some loans have prepayment penalties, though these are increasingly rare. Even without penalties, there’s less day-to-day flexibility than a credit card.

- Credit Impact of Application:The hard inquiry and new account will cause a temporary dip in your credit score.

Chapter 3: Credit Cards for Medical Expenses – The Flexible (but Perilous) Tool

How It Works: You use an existing credit card or apply for a new one. Medical providers, from hospitals to dentists, almost universally accept major credit cards. The expense becomes part of your revolving balance. If you do not pay the statement balance in full by the due date, interest begins to accrue.

Advantages:

- Immediate Access and Universal Acceptance:This is the most significant advantage. For an urgent expense, a credit card in your wallet provides instant, no-questions-asked financing. There’s no application wait time.

- Promotional Financing Offers:Many cards, especially those specifically marketed for healthcare, offer introductory 0% APR periods for 6, 12, or even 18 months. If you can pay the balance in full within this period, you effectively get an interest-free loan.

- Rewards and Benefits:Using a rewards credit card can earn cash back, points, or miles. Some premium cards also offer purchase protection or extended warranties, though these are less applicable to medical services.

- Flexible Payments:You have the freedom to pay any amount above the minimum monthly payment, allowing for aggressive repayment when you have extra cash or slower repayment during tight months (though this is costly).

- No Formal Application for Existing Credit:Using an existing card line doesn’t require a new credit check or application.

Disadvantages:

- High Ongoing Interest Rates:If you carry a balance beyond any intro period, the standard APR on credit cards is notoriously high, often exceeding 20%. This can cause medical debt to balloon rapidly.

- The Minimum Payment Trap:Making only the minimum payment (often 1-3% of the balance) is a recipe for long-term debt. A $10,000 balance at 20% APR could take over 30 years to pay off with minimum payments, costing a fortune in interest.

- Variable Payments:As you pay down the balance, your minimum payment decreases, which can reduce the urgency to pay it off and extend the debt’s life.

- Credit Score Impact:High credit card utilization (the ratio of your balance to your credit limit) is a major factor in credit scoring. A large medical balance can severely hurt your credit score until it is paid down.

- Potential for Fee-Laden “Healthcare” Cards:Some cards pushed by providers at the point of care are not traditional credit cards but closed-loop medical financing cards. These can come with deferred interest traps—if you don’t pay the full balance by the promo end, you may owe all the accrued interest from day one.

Chapter 4: Head-to-Head Comparison in Key Scenarios

- Scenario 1: The Large, Planned Procedure ($15,000)

- Personal Loan:Likely superior. A fixed-rate loan at 12% APR for 5 years results in a predictable $334 monthly payment and total interest of ~$5,000. The debt has a clear end date.

- Standard Credit Card:Risky. Even a $450 fixed monthly payment would take over 4 years and accrue ~$7,700 in interest.

- Winner: Personal Loanfor its structure and lower cost.

- Scenario 2: The Unexpected Emergency ($3,000)

- Personal Loan:May be impractical if you need funds instantly. For a smaller amount, origination fees can eat up a larger percentage.

- Credit Card with 0% Intro Offer:Excellent if you have one. You get immediate care and 12-18 months to pay it off interest-free, provided you have a disciplined repayment plan.

- Winner: Credit Card with 0% Promo, assuming disciplined repayment.

- Scenario 3: Ongoing, Uncertain Expenses (e.g., chronic condition)

- Personal Loan:Less suitable. It’s a one-time lump sum. If expenses are recurring or unpredictable, you may need to borrow too much upfront or apply for multiple loans.

- Credit Card:Offers revolving credit for ongoing costs. The flexibility to charge as needed is key, but requires extreme discipline to avoid runaway debt.

- Winner: It depends.A high-limit card with a low APR is better for flexibility, but a personal loan for a known large chunk of expense might be part of a hybrid strategy.

Chapter 5: Strategic Considerations & Best Practices

- Negotiate First, Finance Second:Always negotiate your medical bill directly with the provider. Ask for an itemized bill, question errors, request a cash discount, and inquire about interest-free payment plans. Many hospitals have charitable foundations or sliding-scale fees based on income.

- Check Your Credit Profile:Your creditworthiness is the key determinant of your rates. Know your score before applying. Good credit opens up the best personal loan rates and 0% credit card offers.

- Run the Numbers:Use online loan and credit card repayment calculators. Project total interest paid under different scenarios. Don’t guess—calculate.

- Read the Fine Print:For loans: watch for origination fees, prepayment penalties, and late fees. For cards: understand the 0% APR terms, the regular APR after the promo, and whether it’s adeferred interestplan (avoid these).

- Consider a Hybrid Approach:Use a 0% credit card for an initial expense to buy time, then take out a lower-interest personal loan to pay off the card balance before the promo period expires, consolidating the debt into a structured repayment plan.

Conclusion: Choosing Your Financial Triage Tool

There is no universal “best” option. The decision between a personal loan and a credit card for medical expenses is a function of amount, urgency, your credit profile, and—most importantly—your financial discipline.

- Choose a Personal Loan if:You have good credit, are financing a large, known amount, and value the psychological and financial security of a fixed payment with a clear end date. It is the tool for structured, disciplined debt retirement.

- Choose a Credit Card (with a 0% intro offer) if:You have a good credit score, are facing a smaller or medium-sized expense, can secure a lengthy promotional period, and possess the ironclad discipline to pay the balance in full before the standard high interest rate kicks in. It is the tool for strategic, short-term financing.

- Avoid Standard Credit Card Financing for Long-Term Debt:Carrying a large medical balance on a card with a high ongoing APR is one of the most expensive financial mistakes you can make. If you already have medical debt on a high-interest card, using a personal loan to consolidate it into a lower, fixed rate is often a wise move.

Ultimately, financing medical care is a burden no one should bear alone. Explore all options—provider payment plans, medical grants, and assistance programs—before turning to debt. But when borrowing is necessary, let knowledge be your antidote to panic. By understanding the mechanics, costs, and risks of personal loans versus credit cards, you can choose the path that heals your finances as effectively as your medical treatment heals your body.

Frequently Asked Questions (FAQ)

1. I have fair credit (score around 650). Which option is likely better for me?

For borrowers with fair credit, personal loans might be more accessible with a semi-reasonable rate, as lenders have more flexibility with installment loans. Credit card approvals, especially for those with strong 0% offers, often require good to excellent credit. However, be prepared for higher APRs on both. Compare a prequalified loan offer against available credit card options. You may also consider a credit union, which might offer more favorable terms on a medical loan to members.

2. Can I use a personal loan to pay off existing high-interest medical credit card debt?

Absolutely. This is one of the most strategic uses of a personal loan—debt consolidation. By taking out a personal loan at a lower fixed interest rate and using it to pay off high-interest credit card balances, you can lock in a lower monthly payment, set a clear payoff date, and save hundreds or thousands in interest. This also helps your credit score by lowering your overall credit utilization.

3. What is “deferred interest” on a medical credit card, and why is it dangerous?

Deferred interest (common in store cards and some healthcare cards) means that if you do not pay the entire promotional balance by the end of the 0% period, you will be charged interest retroactively from the original purchase date at a very high rate. This is different from a true 0% APR card, where interest simply begins accruing on the remaining balance after the promo ends. Deferred interest plans are extremely risky and should generally be avoided for large medical expenses where there’s any chance you can’t pay in full.

4. How do these options affect my credit score differently?

- Personal Loan:Causes a hard inquiry and adds a new installment account. Initially, your score may dip slightly. Over time, consistent on-time payments will build a positive payment history. It also diversifies your credit mix, which can be positive.

- Credit Card:Using an existing card heavily increases your credit utilization, which can significantly lower your score. Opening a new card adds a hard inquiry and lowers your average account age. High utilization is the primary negative factor, but it improves quickly as you pay down the balance.

5. Should I just use the payment plan offered directly by my hospital or doctor’s office?

Always inquire about this first. Many providers offer interest-free or low-interest installment plans directly. These often have simpler applications, no credit check (or a soft check), and no fees. This is frequently the best financial option as it avoids a third-party lender altogether. Only consider a personal loan or credit card if the provider’s plan is unaffordable, unavailable, or carries a high interest rate.