Loan vs. Credit Card: A Comprehensive Guide to Making the Right Financial Decision

Introduction

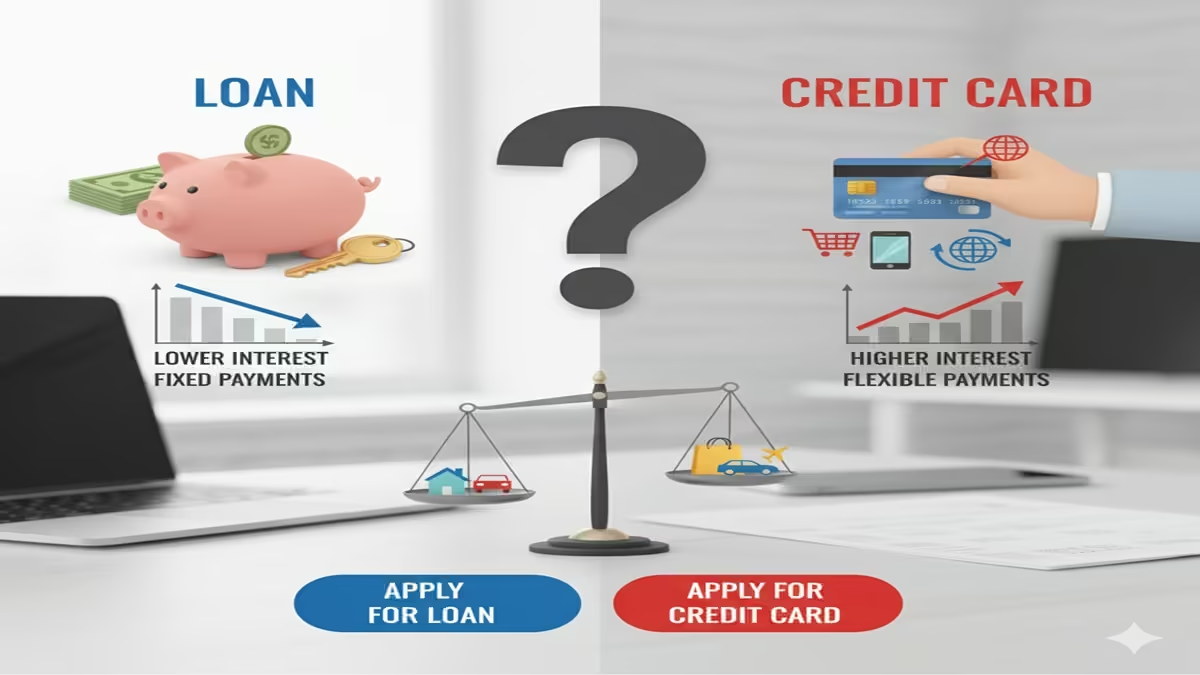

Loan Vs Credit Card Apply Decision In today’s financial landscape, consumers have more options than ever when they need access to funds. Two of the most common solutions—personal loans and credit cards—serve similar purposes but operate under fundamentally different structures. Whether you’re consolidating debt, financing a major purchase, or covering unexpected expenses, choosing between a loan and a credit card can significantly impact your financial health for years to come.

The decision isn’t always straightforward. Each option carries distinct advantages, drawbacks, and ideal use cases that vary based on individual circumstances. This comprehensive guide will explore the intricate details of both financial tools, providing you with the knowledge to make an informed decision aligned with your financial goals.

Understanding Personal Loans: Structure and Mechanics

What is a Personal Loan?

A personal loan is a lump-sum amount of money borrowed from a financial institution—such as a bank, credit union, or online lender—that is repaid with interest over a fixed period. These loans are typically unsecured, meaning they don’t require collateral, though secured options exist for those with poor credit or seeking lower rates.

Key Characteristics of Personal Loans:

- Fixed Amount and Terms: You receive the entire loan amount upfront and repay it through equal monthly installments over a predetermined period, usually ranging from 12 to 84 months.

- Fixed Interest Rates: Most personal loans come with fixed interest rates, providing predictability in monthly payments throughout the loan term.

- Structured Repayment Schedule: From day one, you know exactly how much you’ll pay each month and when the debt will be fully repaid.

- Origination Fees: Many lenders charge an upfront fee (typically 1-8% of the loan amount) for processing the loan, which is either deducted from the disbursed amount or added to the total balance.

- Credit Requirements: Personal loans generally require good to excellent credit (typically FICO scores of 660+) for the most favorable terms, though some lenders specialize in serving borrowers with lower scores.

Ideal Use Cases for Personal Loans:

- Debt Consolidation: Combining multiple high-interest debts into a single loan with a lower interest rate

- Major Purchases: Financing significant expenses like home renovations, weddings, or medical procedures

- Unexpected Large Expenses: Covering emergency costs that exceed typical savings

- Credit Building: Establishing a positive payment history through structured repayment

Understanding Credit Cards: Flexibility and Revolving Credit

What is a Credit Card?

A credit card provides a revolving line of credit that can be borrowed against repeatedly up to a predetermined limit. Unlike a loan, you’re not receiving a lump sum but rather access to funds that can be used as needed, with the balance fluctuating based on purchases and payments.

Key Characteristics of Credit Cards:

- Revolving Credit: As you pay down your balance, that credit becomes available to use again, creating a continuous borrowing cycle.

- Variable Interest Rates: Most credit cards have variable APRs that can change with market conditions, though some offer introductory fixed rates.

- Minimum Payments: Card issuers require only a minimum payment each month (typically 1-3% of the balance), though paying only the minimum extends the repayment period and increases interest costs dramatically.

- Additional Features: Credit cards often come with rewards programs, purchase protections, travel benefits, and other perks not typically associated with personal loans.

- Accessibility: While premium cards require excellent credit, options exist for virtually all credit profiles, including secured cards for those building or rebuilding credit.

Ideal Use Cases for Credit Cards:

- Everyday Purchases: Convenient payment method for daily expenses

- Building Credit History: Regular use and timely payments demonstrate creditworthiness

- Emergency Funding: Immediate access to funds in urgent situations

- Rewards Optimization: Earning cash back, points, or miles on routine spending

- Purchase Protection: Taking advantage of fraud protection, extended warranties, and dispute resolution services

Comparative Analysis: Loans vs. Credit Cards

Interest Rates and Cost Implications

Personal Loans typically offer lower interest rates than credit cards, especially for borrowers with good credit. According to recent Federal Reserve data, the average interest rate for a 24-month personal loan is approximately 9.5%, while the average credit card APR exceeds 16%. This significant difference makes loans more cost-effective for larger, longer-term financing needs.

However, this comparison isn’t always straightforward. Credit cards often feature introductory 0% APR periods on purchases and balance transfers (typically lasting 12-21 months), which can temporarily make them cheaper than loans. Additionally, rewards credit cards effectively provide a discount on purchases when paid in full each month.

Credit Cards generally carry higher ongoing interest rates but offer more flexibility in repayment. The true cost depends largely on usage behavior—those who pay their balance in full each month avoid interest entirely, while those carrying balances face compounding interest that can quickly escalate debt.

Repayment Structure and Discipline

The fixed repayment schedule ofpersonal loansprovides built-in discipline. Borrowers know exactly when they’ll be debt-free if they make all scheduled payments. This structure prevents the “debt trap” phenomenon common with revolving credit, where minimum payments barely cover interest charges.

Credit cards require greater financial discipline. The flexibility to pay only a small minimum each month can lead to prolonged debt repayment. According to a CreditCards.com analysis, making only minimum payments on a $5,000 credit card balance at 17% APR would take over 20 years to repay and cost more than $6,700 in interest.

Impact on Credit Score

Both products affect your credit score, but through different mechanisms:

Personal Loans initially cause a small dip in your score due to the hard inquiry and new account. However, they can positively impact your credit mix (which accounts for 10% of your FICO score) and, with consistent on-time payments, establish a positive payment history (35% of your score). Once paid off, closed loan accounts remain on your credit report for up to 10 years, continuing to contribute to your credit history length.

Credit Cards influence your score through several factors:

- Keeping this below 30%—and ideally below 10%—is optimal.

- Payment History(35%): Like loans, timely payments are crucial.

- Length of Credit History(15%): Older cards contribute positively to this factor.

- New Credit(10%): Opening several cards in a short period can temporarily lower your score.

Responsible credit card use—keeping balances low and paying on time—can build credit more quickly than installment loans in some cases, particularly through the utilization component.

Flexibility and Accessibility

Credit cards offer superior flexibility. You can use them for virtually any purchase, borrow only what you need when you need it, and have continuous access to funds as you pay down balances. Many cards also provide additional benefits like travel insurance, extended warranties, and price protection.

Personal loans provide less flexibility once disbursed. You receive a lump sum upfront and cannot typically borrow additional funds without applying for a new loan. Some lenders offer loan “top-ups,” but these usually require reassessment of your financial situation.

Fees and Hidden Costs

Personal loan fees may include:

- Origination fees (1-8% of loan amount)

- Late payment fees

- Prepayment penalties (less common now but still exist with some lenders)

- Check processing fees

Credit card fees may include:

- Annual fees (for premium rewards cards)

- Balance transfer fees (typically 3-5%)

- Cash advance fees (often 5% with higher interest rates)

- Foreign transaction fees (though many cards now waive these)

- Late payment and over-limit fees

Strategic Decision Framework: When to Choose Each Option

When a Personal Loan Is Preferable

- Debt Consolidation: If you have multiple high-interest debts (especially credit cards), consolidating them with a personal loan at a lower fixed rate can save thousands in interest and simplify repayment.

- Large, One-Time Expenses: For major predictable expenses like home renovations, medical procedures, or weddings where you know the exact cost upfront, a personal loan provides appropriate funding with predictable repayment.

- When Discipline Is a Concern: If you struggle with spending discipline or tend to carry balances, the structured repayment of a loan prevents the revolving debt cycle.

- Lower Interest Needs: For borrowers with good credit who need to finance a purchase over time, personal loans generally offer lower rates than credit cards for terms beyond introductory periods.

- Fixed Budgeting Preference: Individuals who prefer consistent monthly payments for easier budgeting benefit from loan structures.

When a Credit Card Is Preferable

- Everyday Spending and Rewards: For regular purchases that you can pay off monthly, credit cards offer convenience, protection, and valuable rewards without interest costs.

- Short-Term Financing with 0% APR Offers: For planned purchases you can repay within an introductory 0% period, credit cards provide interest-free financing.

- Emergency Funding Without Predetermined Amounts: When you need access to funds but don’t know exactly how much, a credit line provides flexibility.

- Building Credit History: Responsible use of a credit card (keeping utilization low, paying on time) can effectively build or rebuild credit.

- Travel and Purchase Protections: For significant purchases or travel, credit card protections like extended warranties, rental car insurance, and fraud liability limits provide valuable security.

Hybrid Approaches

In some situations, a combination of both products might be optimal:

- Taking apersonal loanfor a major expense while using acredit cardfor daily purchases to earn rewards (paid in full monthly).

- Using acredit cardfor immediate emergency expenses while applying for apersonal loanto pay off the balance if repayment will extend beyond a few months.

Case Studies: Real-World Applications

Case Study 1: Debt Consolidation

Situation: Maria has $15,000 in credit card debt across three cards with APRs ranging from 19-24%. She’s paying $450 monthly but making little progress on the principal.

Loan Solution: A 3-year personal loan at 10% APR would require $484 monthly payments, saving approximately $4,200 in interest compared to minimum credit card payments and paying off the debt in a fixed period.

Credit Card Solution: A balance transfer to a card with 0% APR for 18 months and a 3% transfer fee would cost $450 in fees. If Maria could pay $833 monthly during the promotional period, she could eliminate the debt interest-free.

Verdict: If Maria can maintain the higher payment during the promotional period, the balance transfer card saves more money. If not, the personal loan provides structured discipline with still-significant savings.

Case Study 2: Home Renovation

Situation: James needs $25,000 for a kitchen renovation with a 4-month timeline for contractors to complete the work.

Loan Solution: A 5-year personal loan at 8% APR would provide all funds upfront with predictable $507 monthly payments.

Credit Card Solution: A card with a 0% introductory period on purchases for 15 months would allow interest-free financing if James can repay approximately $1,667 monthly.

Verdict: If James has the cash flow to support the higher payment, the credit card option saves interest. If he prefers lower monthly payments, the personal loan is more suitable despite higher long-term costs.

Case Study 3: Emergency Medical Expense

Situation: Lisa faces an unexpected $8,000 medical bill with no emergency savings.

Loan Solution: A 3-year personal loan at 12% APR would create fixed monthly payments of $266.

Credit Card Solution: Putting the expense on a card with 16% APR would require minimum payments starting around $160 but extending repayment indefinitely if only minimums are paid.

Verdict: Given the unpredictability of Lisa’s financial recovery, the personal loan provides structured repayment that ensures the debt will be paid in a reasonable timeframe, likely making it the better choice despite potentially higher initial payments.

Future Considerations and Evolving Landscape

The financial landscape continues to evolve, with several trends impacting the loan vs. credit card decision:

- Digital Lending Platforms: Online lenders now offer faster personal loan approvals with more flexible criteria, making loans more accessible for various credit profiles.

- Specialized Credit Products: Industry-specific financing options (like medical credit cards with deferred interest) create new alternatives that blur traditional boundaries.

- Financial Technology Integration: Apps that help optimize debt repayment across multiple products are changing how consumers manage hybrid approaches.

- Regulatory Changes: Evolving regulations around lending practices, fee structures, and transparency continue to reshape both markets.

- Economic Factors: Interest rate environments, inflation, and economic conditions influence the relative attractiveness of fixed versus variable rate products.

Conclusion

The decision between a personal loan and a credit card depends fundamentally on your specific financial situation, discipline, and goals. Personal loans generally offer better value for large, predictable expenses requiring longer repayment periods, especially for debt consolidation. Credit cards provide superior flexibility for everyday spending, short-term financing needs, and those who can pay balances in full monthly.

Before deciding, consider these key questions:

- What is the exact amount needed?

- How long will I need to repay this debt?

- What is my credit profile and what rates am I likely to qualify for?

- How disciplined am I with repayment?

- Are there specific benefits (like rewards or protections) that sway the decision?

Ultimately, the “right” choice aligns with both your immediate financial need and your long-term financial health strategy. By understanding the mechanics, costs, and implications of each option, you can select the tool that not only addresses your current situation but supports your broader financial wellbeing.

Frequently Asked Questions

1. Which is easier to get approved for: a personal loan or a credit card?

Approval difficulty depends on your credit profile and the specific product. Generally, entry-level credit cards (particularly secured cards) are more accessible to those with poor or limited credit. Personal loans typically require fair to good credit (FICO scores of 580+) for unsecured options, though secured personal loans exist for those with lower scores. For premium products with the best rates and terms, both require good to excellent credit (scores of 670+).

3. What happens if I miss payments on either option?

For both personal loans and credit cards, missed payments typically trigger late fees and negative reporting to credit bureaus after 30 days, damaging your credit score. With credit cards, missed payments may also cause your APR to increase through penalty rates. With personal loans, consistent missed payments could lead to default and potentially legal action or debt collection. Both options offer hardship programs in some cases—contact your lender immediately if you anticipate payment difficulties.

4. Are there tax differences between personal loans and credit card debt?

Generally, neither personal loan interest nor credit card interest is tax-deductible for personal expenses. However, there are exceptions: interest on debt used for business purposes, investment property, or qualified educational expenses may be deductible in some circumstances. Additionally, if you use a personal loan for qualifying home improvements, the interest might be deductible (consult a tax professional for your specific situation).

5. How do balance transfer credit cards compare to debt consolidation loans?

Balance transfer cards with 0% introductory periods (typically 12-21 months) can be more cost-effective if you can pay off the entire balance during the promotional period, despite typical 3-5% balance transfer fees. Personal loans generally offer lower ongoing rates than credit cards after introductory periods expire and provide structured repayment timelines. The better option depends on: the total debt amount, how quickly you can repay it, your discipline with payments, and the specific terms you qualify for.