Income Certificate For Caste Certificate: जाति प्रमाण पत्र बनवाने के लिए आय प्रमाण पत्र क्यों है अनिवार्य? जानें नियम, प्रक्रिया और जरूरी दस्तावेज!

Income Certificate For Caste Certificate: Introduction: भारत में सरकारी नौकरियों, शिक्षा में आरक्षण और विभिन्न सरकारी योजनाओं का लाभ उठाने के लिए ‘जाति प्रमाण पत्र’ (Caste Certificate) एक अत्यंत महत्वपूर्ण दस्तावेज है। लेकिन क्या आप जानते हैं कि कई श्रेणियों, विशेषकर OBC (Non-Creamy Layer) और EWS (Economically Weaker Section) के लिए जाति प्रमाण पत्र तब तक नहीं बनता जब तक आपके पास एक वैध आय प्रमाण पत्र (Income Certificate) न हो?

यदि आप भी “Income Certificate For Caste Certificate” के नियमों को लेकर उलझन में हैं, तो यह लेख आपकी सभी शंकाओं को दूर करेगा। यहाँ हम विस्तार से जानेंगे कि आय प्रमाण पत्र की आवश्यकता क्यों होती है, इसकी आय सीमा क्या है और आप इसके लिए आवेदन कैसे कर सकते हैं।

1. जाति प्रमाण पत्र के लिए आय प्रमाण पत्र की आवश्यकता क्यों? (Why is it Required?)

Income Certificate For Caste Certificate: भारतीय आरक्षण प्रणाली में ‘क्रीमी लेयर’ (Creamy Layer) और ‘नॉन-क्रीमी लेयर’ का कॉन्सेप्ट है।

- OBC श्रेणी के लिए: अन्य पिछड़ा वर्ग (OBC) के उन परिवारों को ही आरक्षण का लाभ मिलता है जिनकी वार्षिक आय एक निश्चित सीमा से कम होती है। इसे प्रमाणित करने के लिए आय प्रमाण पत्र देना अनिवार्य है।

- EWS श्रेणी के लिए: सामान्य वर्ग के आर्थिक रूप से कमजोर वर्ग (EWS) के लिए 10% आरक्षण का आधार ही परिवार की वार्षिक आय है।

- SC/ST श्रेणी के लिए: आमतौर पर SC/ST जाति प्रमाण पत्र के लिए आय प्रमाण पत्र अनिवार्य नहीं होता, लेकिन छात्रवृत्ति (Scholarship) का लाभ लेने के लिए इसे जमा करना पड़ता है।

2. आय सीमा और वैधता (Income Limit & Validity)

Income Certificate For Caste Certificate: सरकारी नियमों के अनुसार (वर्ष 2026 के अपडेट के साथ):

- OBC Non-Creamy Layer: परिवार की वार्षिक आय ₹8 लाख से कम होनी चाहिए। इसमें खेती से होने वाली आय को शामिल करने के नियम अलग-अलग राज्यों में भिन्न हो सकते हैं।

- EWS: यहाँ भी परिवार की कुल वार्षिक आय ₹8 लाख से कम होनी चाहिए।

- वैधता (Validity): आय प्रमाण पत्र आमतौर पर 1 वित्तीय वर्ष (31 मार्च तक) के लिए वैध होता है। इसलिए, नया जाति प्रमाण पत्र बनवाने से पहले सुनिश्चित करें कि आपका आय प्रमाण पत्र वर्तमान वित्तीय वर्ष का ही हो।

Income Certificate For Caste Certificate:

- निवास प्रमाण पत्र: बिजली का बिल, राशन कार्ड या किरायानामा।

- आय का प्रमाण: वेतन भोगी (Salary Slip/Form 16) या स्व-घोषणा पत्र (Self Declaration)।

- पटवारी रिपोर्ट: ग्रामीण क्षेत्रों में आय के सत्यापन के लिए पटवारी या लेखपाल की रिपोर्ट जरूरी होती है।

4. आवेदन कैसे करें? (Step-by-Step Apply Process)

- ऑनलाइन पोर्टल: अपने राज्य के ई-डिस्ट्रिक्ट (e-District) पोर्टल (जैसे- UP e-District, Aaple Sarkar Maharashtra, आदि) पर जाएं।

- पंजीकरण: अपना मोबाइल नंबर दर्ज कर अकाउंट बनाएं।

- फॉर्म भरें: ‘Income Certificate’ विकल्प चुनें और सभी व्यक्तिगत व आय संबंधी जानकारी भरें।

- दस्तावेज अपलोड: स्कैन किए हुए दस्तावेज और फोटो अपलोड करें।

- शुल्क भुगतान: मामूली सरकारी शुल्क (₹15 से ₹50) का भुगतान करें।

- सत्यापन: आपके आवेदन की जांच तहसील स्तर पर होगी और 10-15 दिनों में सर्टिफिकेट जारी कर दिया जाएगा।

5. आय प्रमाण पत्र मिलने के बाद क्या करें?

Income Certificate For Caste Certificate: एक बार जब आपके पास डिजिटल हस्ताक्षर वाला आय प्रमाण पत्र आ जाए, तो आप जाति प्रमाण पत्र के लिए आवेदन कर सकते हैं। आवेदन फॉर्म में आय प्रमाण पत्र का एप्लीकेशन नंबर (Application No) और सर्टिफिकेट आईडी (Certificate ID) दर्ज करना अनिवार्य होता है।

4. अक्सर पूछे जाने वाले प्रश्न (FAQs)

Q1: क्या पुराने आय प्रमाण पत्र से नया जाति प्रमाण पत्र बन सकता है?

Ans: नहीं, जाति प्रमाण पत्र (विशेषकर OBC NCL) के लिए पिछले 3 साल या वर्तमान वर्ष का आय प्रमाण पत्र मांगा जाता है। पुराना प्रमाण पत्र मान्य नहीं होगा।

Q2: क्या पिता की आय के आधार पर ही जाति प्रमाण पत्र बनता है?

Ans: हाँ, अविवाहित उम्मीदवारों के लिए पिता की आय और विवाहित महिलाओं के लिए भी मायके (पिता) की आय और जाति को ही आधार माना जाता है (राज्यों के नियमों के अनुसार)।

Q3: आय प्रमाण पत्र बनने में कितना समय लगता है?

Ans: ऑनलाइन आवेदन के बाद आमतौर पर 7 से 15 कार्य दिवस का समय लगता है।

Conclusion: समय पर करें आवेदन!

Income Certificate For Caste Certificate की प्रक्रिया को हल्के में न लें। अक्सर एडमिशन या सरकारी नौकरी के फॉर्म भरते समय छात्र इस दस्तावेज की कमी के कारण पिछड़ जाते हैं। सुनिश्चित करें कि आपके पास वैध और अद्यतन (Updated) आय प्रमाण पत्र है, ताकि आपका जाति प्रमाण पत्र बिना किसी रुकावट के बन सके।

The Essential Guide to Using an Income Certificate for Your Caste Certificate Application

Income Certificate For Caste Certificate In India’s complex tapestry of social welfare and affirmative action, two documents stand as critical gatekeepers to a wide array of opportunities: the Caste Certificate and the Income Certificate. While the Caste Certificate validates an individual’s social category (SC, ST, OBC, etc.), the Income Certificate is increasingly becoming a pivotal, and often misunderstood, component of this process, especially for availing benefits meant for the Economically Weaker Sections (EWS) or for non-creamy layer OBC candidates.

This comprehensive guide delves into the intricate relationship between these two documents, explaining why an Income Certificate is frequently required for a Caste Certificate, the detailed process involved, and how to navigate common pitfalls.

Understanding the Core Documents: Caste vs. Income Certificate

Income Certificate For Caste Certificate: First, let’s establish a clear distinction:

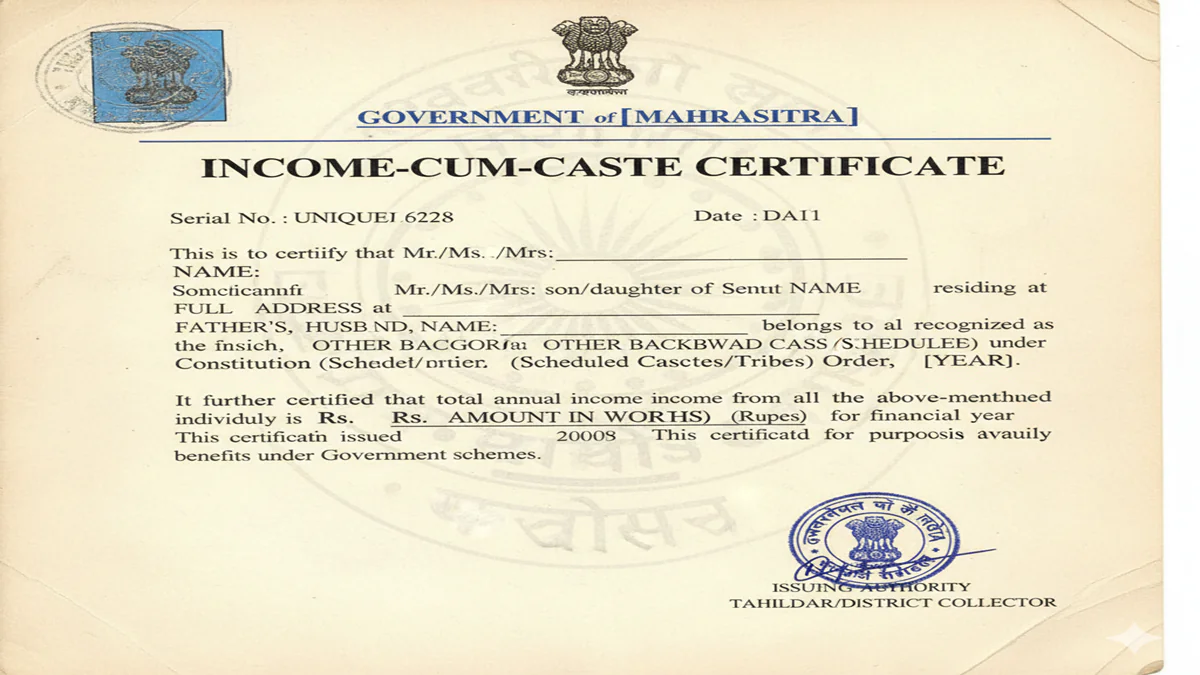

- Caste Certificate: This is an official document issued by the competent authority (usually a Tehsildar, SDM, or District Magistrate) that certifies that a person belongs to a specific caste, particularly those listed in the Scheduled Castes (SC), Scheduled Tribes (ST), and Other Backward Classes (OBC) as per the state and central lists. It is the primary document for claiming reservations in education, government jobs, and legislative seats.

- Income Certificate: This document, issued by the revenue department (often the Tehsildar), certifies the total annual income of an individual or a family from all sources. It is a testament to the economic standing of the applicant.

The Crucial Intersection: Why an Income Certificate is Required for a Caste Certificate

Income Certificate For Caste Certificate: The linkage arises from the principle of ensuring that the benefits of reservation reach the most deserving sections within a reserved category. The concept of the“creamy layer”is central here.

- For OBC Candidates (The Creamy Layer Concept):

The Mandal Commission and subsequent Supreme Court rulings introduced the “creamy layer” exclusion. It states that individuals from OBC backgrounds whose family income exceeds a certain threshold (currently ₹8 lakh per annum for central lists, but varies by state) should not avail of reservation benefits, as they are not economically disadvantaged.- Requirement: When applying for an OBC caste certificate, especially one that specifies “non-creamy layer,” you must submit an Income Certificate to prove that your family income is below the stipulated limit. Without this, you may only receive a general OBC certificate, which is invalid for most central government jobs and admissions.

- Income Certificate For Caste Certificate: For EWS (Economically Weaker Sections) Certification:

The EWS quota (10% reservation) is purely based on economic criteria, irrespective of caste (except those already covered under SC/ST/OBC). To obtain an EWS certificate (which functions similarly to a caste certificate for this quota), anIncome Certificate is the primary documentto prove that your family’s annual income is below ₹8 lakh. - For State-Specific Schemes:

Many states have their own welfare schemes, scholarships, or fee reimbursements for SC/ST students or families where an income ceiling exists. Here, a Caste Certificate must often be accompanied by an Income Certificate to demonstrate eligibility. - Income Certificate For Caste Certificate: Preventing Misuse:

Requiring an Income Certificate acts as a checkpoint against the misuse of caste-based benefits by economically advanced individuals within the community, ensuring a more equitable distribution of opportunities.

Step-by-Step Process: Obtaining an Income Certificate for Caste Certificate Purposes

The process can vary slightly from state to state, but the core steps remain consistent.

Stage 1: Preparation of Documents

Income Certificate For Caste Certificate: This is the most critical phase. Incomplete or incorrect documentation is the leading cause of rejection.

Key Documents Required:

- Application Form: Available from the local Tehsildar office or the state’s e-district portal.

- Proof of Address: Aadhaar Card, Ration Card, Electricity/Water Bill, Registered Rent Agreement.

- Proof of Income: This is the crux.

- Salaried Individuals: Salary slips (last 6-12 months), Form 16 from employer, Income Tax Returns (ITR) acknowledgment of the last financial year.

- Agriculturists: Affidavit declaring income from agriculture, land revenue receipts, or 7/12 extract of land records.

- Others: Affidavits for any other sources of income (rent, interest, etc.), pension statements.

- Income Certificate For Caste Certificate: Family Details:A joint declaration or family composition certificate, often combined with the ration card. This defines the “family” (usually self, spouse, and dependent children/parents).

- Affidavit: A self-declared affidavit on a non-judicial stamp paper (value as per state rules) stating the particulars of family income. It must be signed in the presence of a Notary Public or Oath Commissioner.

- Income Certificate For Caste Certificate: Photographs:Passport-sized photographs of the applicant and sometimes the head of the family.

- Existing Caste Certificate (if applying for Non-Creamy Layer): In some cases, you may need to submit your basic OBC certificate first.

Stage 2: Application Submission

- Online Method (Recommended):

- Visit your state’s e-District or Revenue Department portal (e.g.,

edistrict.delhigovt.nic.in,ap.gov.in,maharashtra.gov.in). - Register/Log in using your mobile number or Aadhaar.

- Locate the “Income Certificate” service and fill the application form meticulously.

- Upload scanned copies of all the above documents as per specified size and format.

- Pay the requisite fee online, if applicable.

- Note the application acknowledgement number for tracking.

- Visit your state’s e-District or Revenue Department portal (e.g.,

- Income Certificate For Caste Certificate: Offline Method:

- Visit the office of the Tehsildar or the Sub-Divisional Magistrate (SDM) of your area.

- Collect the form, fill it, and attach self-attested copies of all documents.

- Submit the application packet at the designated counter and obtain a receipt.

Stage 3: Verification & Scrutiny

- Income Certificate For Caste Certificate: After submission, afield verificationis conducted. A revenue officer (like a Patwari or Village Officer) may visit your residential address to verify the details provided.

- They might interview you or your neighbours about your economic and social status.

- The documents are cross-checked internally.

Stage 4: Issuance of Certificate

- Upon satisfactory verification, the approving authority (Tehsildar/SDM) signs off on the certificate.

- Online: You can download the digitally signed certificate directly from the portal.

- Offline: You will be notified to collect it from the office, or it may be mailed to your address.

Income Certificate For Caste Certificate: Typical Timeline:The entire process can take anywhere from15 to 30 days, depending on the state’s efficiency and the completeness of your application.

Common Pitfalls and How to Avoid Them

- Incorrect Income Calculation: The most common error. Remember, income is calculated from all sources for the entire family (as defined). This includes salary, business profits, agricultural income, rent, dividends, interest, etc. Do not omit any source.

- Income Certificate For Caste Certificate: Discrepancy in Documents:The income declared in your application must match your ITR, salary slips, and affidavit. Mismatches lead to immediate suspicion and rejection.

- Incomplete Family Definition: Failing to include the income of a working spouse or a high-earning dependent parent can be seen as concealment.

- Poor Documentation for Non-Salaried Individuals: Agriculturists and small business owners must prepare a credible income affidavit backed by available proofs (land records, bank statements).

- Ignoring State-Specific Rules: Income ceilings and required document formats differ. Always refer to the latest guidelines on your state’s Backward Classes Welfare or Revenue Department website.

The Legal and Ethical Imperative

Income Certificate For Caste Certificate: Furnishing false information to obtain an Income Certificate (or subsequently a Caste Certificate) is aserious criminal offenceunder sections of the Indian Penal Code (like 420 – Cheating) and relevant state laws. It can lead to:

- Cancellation of the certificate.

- Disqualification from the admission or job obtained using it.

- Recovery of monetary benefits availed.

- Registration of a criminal case, leading to fines or imprisonment.

The ethical dimension is equally important. These instruments are designed for social justice. Their misuse undermines the very purpose of uplifting the marginalized.

FAQs: Your Top Questions Answered

1. Is an Income Certificate mandatory for all types of Caste Certificates?

Income Certificate For Caste Certificate: No, it is primarily mandatory for:

- Obtaining an OBC Non-Creamy Layer Certificate.

- Obtaining an EWS Certificate.

- Applying for certain state-specific caste-based scholarships or schemes with an income cap. A plain SC/ST certificate usually does not require it, but always check specific application requirements.

2. My father is retired and we have no formal income proof. How can I apply?

Income Certificate For Caste Certificate: You can still apply. Submit:

- Pension payment statements or bank passbook showing pension credits.

- An affidavit detailing all income sources (e.g., savings interest, family support).

- A declaration of being financially dependent on a specific income, if applicable. The authorities will consider the affidavit and field verification report.

3. What if my family income exceeds the creamy layer limit during the validity of my certificate?

Income Certificate For Caste Certificate: Your existing certificate remains valid until its expiry date. However, for future applications (e.g., for a new academic session or a job), you must declare the updated income. You are legally obligated not to use a certificate based on outdated information if you are no longer eligible.

4. How long are these certificates valid?

- Income Certificate: Usually valid for one financial year from the date of issue, as income is dynamic.

- OBC Non-Creamy Layer Certificate: Typically valid for one to three years (as per central guidelines, it’s often for one year from the date of issue). It must be renewed with a fresh Income Certificate.

- EWS Certificate: Generally valid for one financial year.

5. Can I use my central government Income Certificate for a state-level caste certificate application, or vice-versa?

Income Certificate For Caste Certificate: It depends. Many states accept certificates issued by their own or other state authorities if properly verified. However, for central government benefits, the certificate often must be issued by the competent authority of the state of your permanent residence.Always confirm the specific accepting authority’s requirements.When in doubt, obtain a fresh certificate from the jurisdiction where you are applying.

Conclusion: A Tool for Equity, Not Entitlement

Income Certificate For Caste Certificate: The requirement of an Income Certificate for a Caste Certificate is not a bureaucratic hurdle but a necessary refinement in the architecture of social justice. It aims to target benefits with precision, ensuring they serve as a ladder for those who need it most. As an applicant, your responsibility is to approach this process with diligence, honesty, and a clear understanding of the rules. By preparing your documents thoroughly, declaring your income accurately, and following the prescribed process, you not only secure your rightful opportunity but also uphold the integrity of a system designed to create a more equitable society.

Start your journey by visiting your state’s official e-District portal today and familiarizing yourself with the exact checklist. A well-prepared application is the first and most significant step toward success.