How To Link Aadhaar With PAN online step by step Linking your Aadhaar number with your Permanent Account Number (PAN) is a crucial step in ensuring compliance with Indian tax regulations. This process not only simplifies the tax filing procedure but also helps in curbing tax evasion and promoting transparency in financial transactions. With the Indian government’s push for digitalization, the linking process has been made accessible online, allowing individuals to complete it from the comfort of their homes. This article provides a comprehensive, step-by-step guide to help you link your Aadhaar with PAN seamlessly, along with insights into the importance of this linkage and answers to common queries.

How To Link Aadhaar With PAN online step by step

Understanding Aadhaar and PAN: Importance of Linking

What is Aadhaar?

Aadhaar is a unique 12-digit identification number issued by the Indian government, acting as a digital fingerprint of sorts. It’s linked to your biometric and demographic data, making it a vital tool for establishing your identity in a country where IDs can sometimes feel like a game of hide and seek. Think of it as your official badge that says, “Yes, I exist!”

What is PAN?

PAN, or Permanent Account Number, is a unique identifier issued by the Income Tax Department of India to track financial transactions and ensure that everyone pays their fair share of taxes. It’s like a VIP pass for your finances—without it, you might as well be trying to enter a club wearing shorts and flip-flops.

Why Linking is Essential?

Linking your Aadhaar with PAN is crucial for a couple of reasons. Firstly, it helps to curb tax evasion, making it harder for the crafty folks who think they can outsmart the system. Secondly, it simplifies the tax filing process, making your life just a tad easier. Plus, if you don’t link them, you risk your PAN becoming invalid—talk about a major plot twist!

Pre-requisites for Linking Aadhaar with PAN

Required Documents

To link your Aadhaar with PAN, you’ll need, unsurprisingly, both your Aadhaar card and your PAN card. Make sure these documents are as clear as your grandma’s vision when she insists on cooking for the whole family—no smudges or blur, please!

Eligibility Criteria

You need to be an Indian resident with an Aadhaar number and a PAN card issued by the Income Tax Department. Sorry, folks, if you’re living in an imaginary land or haven’t yet applied for these, you might want to take care of that first.

Online Access Requirements

A stable internet connection is critical—because let’s face it, trying to link documents with the Wi-Fi going on and off is just asking for a mini meltdown. You’ll also need a computer, laptop, or a smartphone capable of browsing the web. And don’t forget your credentials—like PAN number and Aadhaar details—to make the magic happen!

Step-by-Step Guide to Link Aadhaar with PAN Online

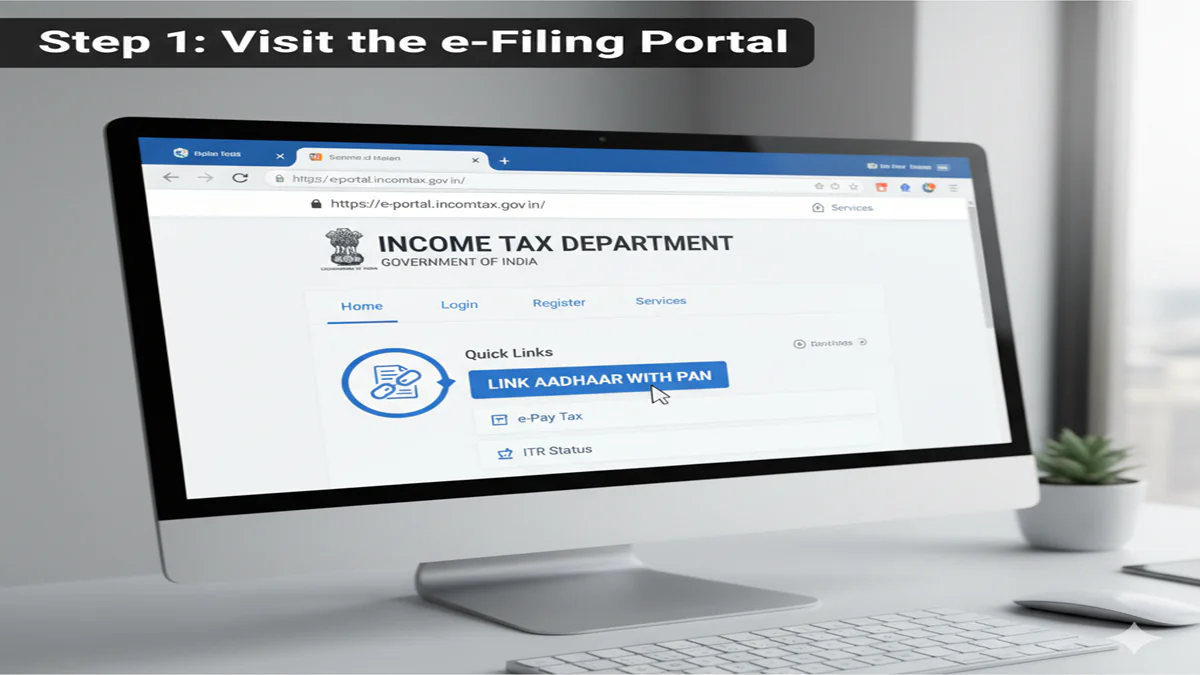

Step 1: Visit the Income Tax e-Filing Website

Grab your favorite device and head over to the Income Tax e-Filing website. Make sure you’re looking for the official site—it’s easier to find the right one if you avoid sketchy lookalikes.

Step 2: Navigate to the Aadhaar Linking Section

The wording might change slightly, but you’re basically hunting for anything that screams “Link Your Aadhaar with PAN!”

Step 3: Enter Required Details

Fill in the required fields—this is where you’ll input your PAN number and Aadhaar number. Double-check these numbers; the last thing you want is to be that person who accidentally links the wrong document.

Step 4: Verification Process

After entering the details, hit “Submit” and let technology do its thing. You may need to complete a captcha to prove you’re not a robot plotting world domination.

Step 5: Final Submission

Once verification is complete, you’ll receive a confirmation message, and voilà! Your Aadhaar is now linked with your PAN. Just sit back and prepare to receive a sense of achievement—the adulting feels are real!

Common Issues and Troubleshooting

Incorrect Details Entered

If you’ve entered wrong details, don’t panic! Just go back, correct them, and try again. Remember, it’s not a race; there’s no trophy for speed here!

Technical Glitches

If the site suddenly decides to play hard to get, check your internet connection. If that’s not the issue, wait it out a bit and try again later. Sometimes, technology needs a coffee break too.

What to Do If Linking Fails?

If your linking attempt fails despite repeated efforts, don’t throw your device out the window just yet. You can reach out to the Income Tax Department’s helpline or visit your nearest tax office for assistance. They’re the superheroes in this saga—minus the capes!

Confirmation of Successful Linking

How to Verify Linking Status

Once you’ve hit that ‘submit’ button in your linking process, you might be wondering if your Aadhaar and PAN have finally decided to become best buddies. To verify the linking status, visit the Income Tax Department’s official website. Look for the Aadhaar-PAN linking status option, enter your PAN and Aadhaar numbers, and voila! You’ll see a message indicating whether they’re linked or if they’re still playing hard to get.

Expected Timeframe for Confirmation

Patience is a virtue, right? After successfully linking your Aadhaar and PAN, you might have to wait anywhere from a few minutes to a few hours for the confirmation to reflect online. The Tax Department usually updates the status pretty fast, but if you’re still in suspense after a day, give it another shot. Sometimes, technology can be a bit moody!

Benefits of Linking Aadhaar with PAN

Streamlined Tax Filing Process

Linking your Aadhaar with your PAN makes tax filing as easy as pie (and we all love pie!). With a unified identification system, you can enjoy a smoother, more streamlined tax filing experience. No more paperwork juggling and confusion! Just pull up your link, and it’s as simple as filling out a form and hitting submit. Easy peasy!

Reducing Tax Evasion

Let’s be real: tax evasion is like trying to hide under a blanket when the lights are on. Linking Aadhaar to PAN helps the government keep an eye on income sources and reduce the likelihood of tax evasion. By making sure everyone is accounted for, it promotes fairness and transparency. No more shadowy figures slipping through the cracks!

Enhanced Financial Inclusion

When Aadhaar and PAN join forces, they create a powerful duo that promotes financial inclusion. This linkage helps the underbanked and unbanked populations gain access to various financial services. With clear identity verification, individuals can open bank accounts, apply for loans, and participate in government schemes without all that red tape. It’s a real win-win for everyone!

Deadline for Linking Aadhaar with PAN

Current Deadlines

As of now, the deadline for linking your Aadhaar with your PAN is looming, but don’t panic! Make sure to check the Income Tax Department’s website for the most up-to-date information since deadlines can change. It’s like trying to catch a speeding train—better not miss it!

Consequences of Missing the Deadline

Should you find yourself in the unfortunate position of missing the linking deadline, brace yourself for some not-so-fun consequences. Your PAN may become inoperative, which means no filing taxes, and that can lead to additional penalties. Think of it as being stuck outside a party you really wanted to attend. Not a great spot to be in!

FAQs Related to Aadhaar-PAN Linking Process

Can I Link Aadhaar with More Than One PAN?

In short, no! You can’t link your Aadhaar with multiple PANs. It’s like dating—better to keep it exclusive! If you have multiple PANs, you’ll need to rectify that situation before linking, or you risk potential legal trouble.

What If My Details Don’t Match?

If you enter details that don’t match across your Aadhaar and PAN, you’ll be met with a big ol’ error message. If this happens, double-check the information for any typos or mismatches. If everything seems correct but you’re still having issues, it might be time to head to the nearest Aadhaar center or PAN office for assistance.

Are There Any Fees for Linking Aadhaar with PAN?

Good news! Linking your Aadhaar with your PAN is generally free of charge. Yes, you read that right—zero fees!. Just make sure you’ve got all your documents handy, and you’re good to go!In conclusion, linking your Aadhaar with your PAN is an essential process that offers numerous benefits, including simplified tax management and enhanced financial security. By following the step-by-step guide provided, you can easily complete the linking process online. Remember to check your linking status and stay informed about deadlines to avoid any penalties. If you have any further questions, refer to the FAQs section for additional clarity. Take this important step today to ensure your financial records are in order.