Nasdaq Option Chain Analysis Navigating the world of options trading on the Nasdaq can be both exhilarating and daunting for investors. Understanding how to analyze and interpret option chains is a crucial skill for making informed trading decisions.

In this article, we will delve into the intricacies of Nasdaq option chains, exploring key metrics, strategies for analysis, and tips for effective decision-making. By the end of this journey, readers will have a solid foundation for harnessing the power of option chain analysis in their investment endeavors.

Introduction to Nasdaq Option Chain Analysis

Nasdaq Option Chain Analysis Options, a versatile financial instrument, offer traders the right (but not the obligation) to buy or sell assets at predetermined prices. Nasdaq, a prominent stock exchange, plays a crucial role in options trading, providing a platform for investors to engage in this dynamic market.

Overview of Options Trading

Nasdaq Option Chain Analysis Options trading involves speculating on the future price movements of underlying assets such as stocks. Investors can use options for various strategies, including hedging, speculation, and generating income through premiums.

Nasdaq as a Leading Options Exchange

Nasdaq Option Chain Analysis Nasdaq stands out as a leading options exchange, providing a wide array of options contracts for traders to choose from. With its efficient trading platform and liquidity, Nasdaq offers a robust environment for options trading.

Understanding Option Chains

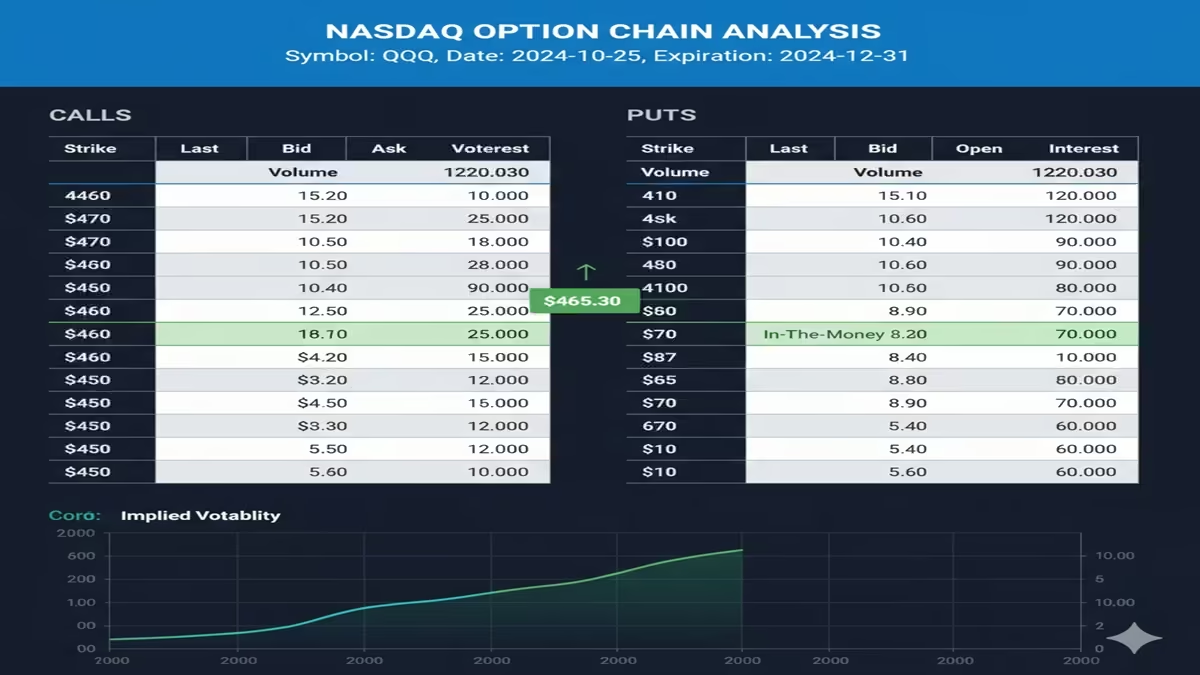

Nasdaq Option Chain Analysis Option chains display a list of available options contracts for a particular asset, detailing various strike prices and expiration dates. Understanding option chains is essential for investors looking to navigate the options market effectively.

Components of an Option Chain

Nasdaq Option Chain Analysis An option chain typically includes call and put options, strike prices, expiration dates, bid and ask prices, and open interest. These components provide vital information for investors to make informed decisions.

Interpreting Option Chain Data

Nasdaq Option Chain Analysis Interpreting option chain data involves analyzing key metrics such as implied volatility, Greeks (Delta, Gamma, Theta, Vega), and volume. By deciphering this data, investors can gauge market sentiment and potential price movements.

Importance of Option Chain Analysis

Nasdaq Option Chain Analysis Option chain analysis plays a crucial role in enhancing investment decision-making and managing risks effectively in the options market. By studying option chains, investors can gain valuable insights into market expectations and strategic positioning.

Enhancing Investment Decision-Making

Nasdaq Option Chain Analysis Analyzing option chains helps investors in identifying trading opportunities, adjusting positions, and optimizing risk-reward ratios. It provides a comprehensive view of market sentiment and potential price fluctuations.

Risk Management with Option Chain Analysis

Nasdaq Option Chain Analysis Option chain analysis enables investors to assess and manage risks associated with options trading effectively. By understanding factors like implied volatility and Greeks, investors can implement risk management strategies to protect their portfolios.

Key Metrics in Analyzing Nasdaq Option Chains

Nasdaq Option Chain Analysis Key metrics in analyzing Nasdaq option chains include open interest, volume, implied volatility, and Greeks. These metrics offer valuable insights into market activity, price expectations, and options pricing dynamics.

Open Interest and Volume

Nasdaq Option Chain Analysis Open interest reflects the number of outstanding options contracts, while volume indicates the trading activity within a specific timeframe. Monitoring open interest and volume can help investors gauge market participation and liquidity levels.

Implied Volatility and Greeks

Nasdaq Option Chain Analysis Implied volatility measures the market’s expectations of future price volatility, influencing options prices. Greeks (Delta, Gamma, Theta, Vega) quantify the sensitivity of options prices to various factors, aiding investors in understanding and managing risk exposures.

Strategies for Utilizing Option Chain Data

Identifying Trends and Patterns

Nasdaq Option Chain Analysis When diving into the world of options trading, analyzing the option chain can provide valuable insights into market trends and patterns. By examining the volume and open interest of different strike prices and expiration dates, traders can identify potential price movements and market sentiment. Whether it’s detecting bullish or bearish signals or spotting unusual activity, the option chain can serve as a roadmap for making informed trading decisions.

Implementing Options Trading Strategies

Nasdaq Option Chain Analysis ption chain analysis offers a plethora of strategies for traders to harness. From covered calls to straddles and strangles, understanding the data within the option chain can help traders craft effective trading strategies. By evaluating factors like implied volatility, delta, and theta, traders can optimize their risk-reward profiles and position themselves strategically in the market.

Tips for Effective Option Chain Analysis

Research and Due Diligence

Successful option chain analysis starts with thorough research and due diligence. Traders should stay informed about market news, company earnings, and economic indicators that could impact options prices. By conducting comprehensive research, traders can make more informed decisions based on a nuanced understanding of market dynamics.

Utilizing Technology and Tools

In today’s digital age, traders have a wealth of tools and technologies at their disposal to enhance their option chain analysis. From advanced trading platforms with real-time data to sophisticated option chain scanners, leveraging technology can streamline the analysis process and uncover valuable insights. By harnessing these tools effectively, traders can stay ahead of the curve in the fast-paced world of options trading.

Case Studies and Examples

Real-World Applications of Option Chain Analysis

Exploring real-world applications of option chain analysis can illuminate the practical benefits of this analytical approach. Whether it’s identifying unusual options activity ahead of earnings announcements or leveraging the option chain to predict market trends, case studies provide tangible examples of how traders can use this analysis to their advantage.

Success Stories and Lessons Learned

Behind every successful trade lies a story of strategic decision-making and calculated risk. By examining success stories and lessons learned from seasoned traders, aspiring option traders can glean valuable insights into best practices, pitfalls to avoid, and key takeaways for navigating the complexities of the options market.

Conclusion and Future Trends

Summary of Key Takeaways

In conclusion, option chain analysis serves as a powerful tool for traders looking to decode market behavior and craft effective trading strategies. By honing their skills in identifying trends, conducting thorough research, and leveraging technology, traders can position themselves for success in the dynamic world of options trading.

Emerging Trends in Options Trading and Analysis

Looking ahead, the landscape of options trading is evolving rapidly, driven by technological advancements and shifting market dynamics. Emerging trends like algorithmic trading, machine learning, and alternative data sources are reshaping how traders approach option chain analysis.

By staying attuned to these developments, traders can adapt to new opportunities and stay ahead of the curve in an ever-changing market environment.In conclusion, mastering the art of analyzing Nasdaq option chains opens up a realm of possibilities for investors seeking to navigate the dynamic world of options trading.

By leveraging key metrics, implementing sound strategies, and heeding valuable tips, individuals can enhance their decision-making processes and optimize their trading outcomes. As we look towards the future, staying attuned to emerging trends in options trading will be essential for staying ahead in the ever-evolving financial landscape.

Frequently Asked Questions

What is the significance of open interest in option chain analysis?

Open interest in option chain analysis refers to the total number of outstanding option contracts for a particular strike price and expiration date. It is a crucial metric as it indicates the liquidity and activity level of options contracts. High open interest suggests greater market interest and liquidity, making it easier for traders to enter and exit positions without significant price impact. Additionally, changes in open interest can provide insights into market sentiment and potential future price movements, making it an essential component of option chain analysis.

How can implied volatility impact trading decisions based on option chain data?

Implied volatility reflects the market’s expectation of future price fluctuations of the underlying asset, as indicated by option prices. High implied volatility suggests greater uncertainty and potential for larger price swings, while low implied volatility indicates more stable market conditions. Traders often use implied volatility to assess the relative attractiveness of options premiums and adjust their trading strategies accordingly. For example, traders may choose to buy options when implied volatility is low and sell options when implied volatility is high to capitalize on potential changes in volatility levels.

Are there any free tools available for analyzing Nasdaq option chains?

Yes, several free tools are available for analyzing Nasdaq option chains. Some popular options include:

Nasdaq’s official website, which provides access to basic option chain data and analysis tools.

Third-party financial websites and platforms like Yahoo Finance, Google Finance, and MarketWatch, which offer comprehensive option chain data and analysis features.

Online brokerage platforms that provide access to real-time option chain data and advanced analysis tools for active traders.

How can beginners effectively start utilizing option chain analysis for their investment strategies?

Beginners can effectively start utilizing option chain analysis for their investment strategies by following these steps:

Familiarize themselves with the basic concepts of options trading, including call and put options, strike prices, expiration dates, and option chain data.

Start by studying option chain data for a few select stocks or ETFs to understand how different factors, such as open interest, implied volatility, and volume, influence option prices.

Use free online resources and tools to analyze option chain data and identify potential trading opportunities based on their investment objectives and risk tolerance.

Consider paper trading or using virtual trading platforms to practice implementing option chain analysis strategies without risking real capital.

Continuously educate themselves and stay updated on market trends and developments to refine their option chain analysis skills and improve their investment outcomes over time.