The Debt Dilemma: Navigating the Repayment Burdens of Personal Loans vs. Credit Cards

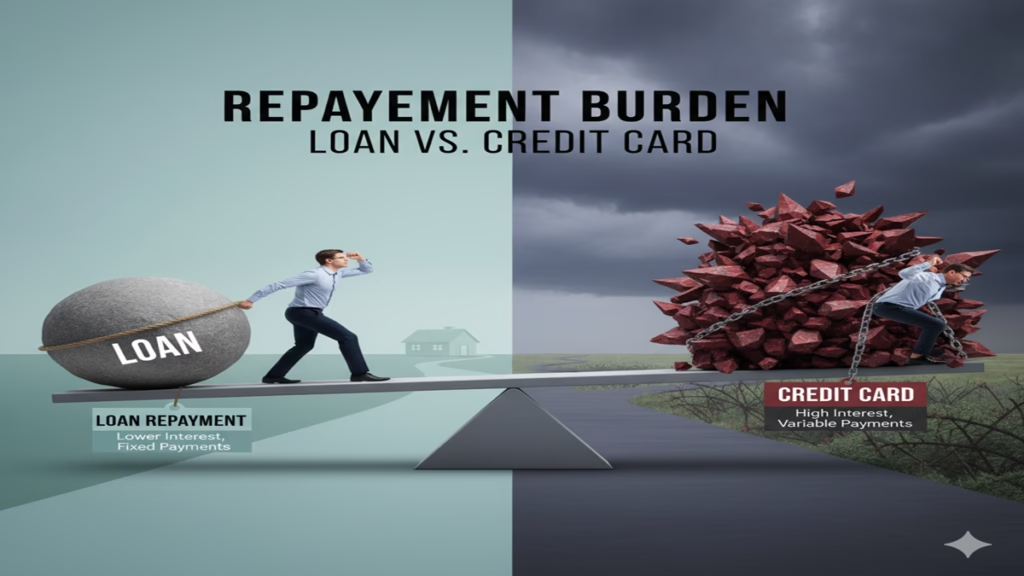

Loan Vs Credit Card Repayment Burden In the landscape of personal finance, debt is a tool—a double-edged sword that can build a future or bury it. Each represents a fundamentally different approach to borrowing, structuring repayment, and, ultimately, imposing a “burden” on the borrower.

Understanding the nature of this burden—its weight, its shape, and its long-term implications—is crucial for anyone seeking to finance a goal, navigate an emergency, or simply manage their cash flow. This article delves beyond the surface features of loans and credit cards to explore the psychological, financial, and structural anatomy of their respective repayment burdens, providing a roadmap for making empowered, sustainable choices.

Part 1: The Structural Foundations – Installment vs. Revolving Debt

The core difference lies in their DNA: an installment loan versus revolving credit.

The Personal Loan: The Structured Marathon

A personal loan is a financial contract for a fixed sum, disbursed upfront, to be repaid over a predetermined period (the term) via equal, scheduled payments (installments). This structure creates a closed-end system. From the moment you receive the funds, the roadmap is clear: Payment X, due on the 15th of each month, for Y months, after which the debt is extinguished. This predictability is its greatest strength in managing burden.

- Burden Characteristic: Fixed and Predictable. Your principal and interest payments are locked in (assuming a fixed rate). This allows for seamless integration into a monthly budget. The “burden” is a known, constant variable, making long-term planning possible. The psychological weight is that of a disciplined, steady slog—a marathon with a visible finish line.

The Credit Card: The Open-Ended Sprint (That Can Turn into an Ultramarathon)

A credit card provides a line of revolving credit up to a certain limit. You can borrow, repay, and borrow again within this limit. There is no fixed term or mandatory repayment schedule for the full amount. The minimum payment—often a small percentage of the balance (e.g., 1-3%) plus interest—is the only required commitment each month.

- Burden Characteristic: Flexible and Potentially Perpetual. This is an open-end system. The burden here is defined by the borrower’s behavior. Pay the statement balance in full each month, and the burden is effectively zero (excluding annual fees). Make only minimum payments while continuing to spend, and the burden transforms into a compounding monster. The psychological weight is that of a cyclical struggle—a sprint to pay off last month’s charges, only to face a new set the next. Without discipline, the finish line vanishes.

Part 2: Dissecting the Components of the Burden

The “repayment burden” is not a single metric but a composite of cost, cash flow impact, mental toll, and risk.

1. The Cost Burden: Interest & Fees

- Personal Loans: Typically offer lower Annual Percentage Rates (APRs), especially for borrowers with good to excellent credit. Interest is calculated on the declining principal, and the cost is spread evenly across payments. There’s usually no penalty for paying off early (though check for prepayment fees). The total interest cost is knowable from the start.

- Credit Cards: Carry significantly higher APRs, often ranging from 18% to 30% or more. The compounding effect—where interest is charged on previously accrued interest—is devastating when carrying a balance. Making only the minimum payment can mean repaying two to three times the original amount over decades. This is where the cost burden becomes crushing.

Verdict: For carrying a balance, personal loans impose a lower, fixed cost burden. Credit cards impose a variable, often exponentially higher cost burden.

2. The Cash Flow & Budgeting Burden

- Personal Loans: The fixed payment is a budgeting boon but also a rigid obligation. Whether your month is lean or flush, that payment is due. This reduces flexibility and can be a strain if income is variable.

- Credit Cards: The minimum payment is low, offering short-term cash flow relief—a seductive but dangerous feature. It frees up cash today at the expense of your future financial health. To make meaningful progress, you must consciously pay far more than the minimum, requiring high discipline.

Verdict: Personal loans burden your budget with predictable rigidity. Credit cards burden your future self with the temptation of present-day flexibility.

3. The Psychological & Behavioral Burden

- Personal Loans: Create a “sunk cost” feeling. The money is spent, and the repayment is a non-negotiable line item. This can reduce the temptation to spend further. The clear amortization schedule provides a powerful motivational tool—watching the principal shrink is gratifying.

- Credit Cards: Foster what behavioral economists call “the pain of paying.” Swiping a card numbs the immediate financial pain, making overspending easy. The ever-replenishing credit line creates an illusion of available wealth. The minimum payment is a psychological trap, making a large debt feel manageable and kicking the can of true repayment down the road. This creates a chronic, low-grade stress of persistent debt.

Verdict: Personal loans impose a focused, finite psychological burden. Credit cards impose a diffuse, potentially endless behavioral burden linked to spending temptation.

4. The Risk Burden: Impact on Credit & Financial Security

- Personal Loans: A successfully repaid installment loan is a gold star on your credit report, demonstrating your ability to handle long-term debt. It diversifies your credit mix positively. However, a missed payment is a significant negative event on a large sum.

- Credit Cards: Utilization ratio—the percentage of your limit you’re using—is a major credit score factor. High balances (>30% of your limit) hurt your score. Consistently high utilization or missed payments signals risk to lenders. The revolving nature means damage can be ongoing.

Verdict: Both burden your credit if mismanaged. Personal loans offer a clearer path to credit-building through fixed repayment. Credit cards constantly test your creditworthiness through utilization and payment behavior.

Part 3: Strategic Application: Choosing Your Burden

The right choice isn’t about which product is “better,” but which burden is more manageable and appropriate for your specific goal and financial personality.

When to Choose the Structured Burden of a Personal Loan:

- Debt Consolidation: Rolling multiple high-interest credit card balances into a single, lower-interest personal loan is the classic and often wisest move. It replaces multiple, chaotic, high-cost burdens with one manageable, lower-cost burden. It turns revolving debt into installment debt, shutting the door on re-borrowing.

- Large, One-Time Expenses: For a known cost like a home renovation, wedding, or major medical procedure, a personal loan provides a lump sum with a clear payoff plan. It separates the project cost from your daily spending tools.

- For the “Set-and-Forget” Borrower: If you value predictability, lack the discipline to aggressively pay down revolving debt, or need the psychological closure of an end date, the loan’s burden is designed for you.

When the Credit Card’s Burden Can Be Managed (or Avoided):

- For Cash Flow Smoothing, Not Financing: If you can pay the statement balance in full every month, you avoid interest entirely. The “burden” is just the logistical one of paying a bill for money you’ve already spent. You gain rewards, buyer protections, and flexibility without cost.

- True Emergencies (As a Last Resort): When an unexpected expense arises and you lack an emergency fund, a credit card can be a stopgap. The key is to treat this as a trigger to activate a aggressive repayment plan, not as permission to make minimum payments.

- This requires a strict, written plan to pay it off before the promotional period ends.

Part 4: The Hybrid Approach and Escape Routes

The most financially savvy often use both tools, but with intentionality.

The Credit Card Float with a Loan Backstop: Use a rewards card for all daily spending to earn points, but always pay it in full from your cash reserves. This leverages the card’s benefits while nullifying its debt burden. A pre-approved personal line of credit or a healthy emergency fund acts as the backstop for true crises.

Escaping the Burden: If you’re already under the burden of high-interest credit card debt:

- Stop Using the Cards. This is non-negotiable.

- Explore a Personal Loan for Consolidation. Get a rate quote. If it’s significantly lower than your card APRs, it’s a mathematical win.

- Consider a Balance Transfer Card. A card with a 0% introductory APR on balance transfers can be a powerful tool for a time-bound, disciplined sprint to pay down principal interest-free. Understand the transfer fee (typically 3-5%) and the deadline.

- Budget for Aggressive Repayment. Whether you consolidate or not, you must free up cash to pay more than the minimum. Use the debt avalanche (target highest APR first) or debt snowball (target smallest balance first) method.

Conclusion: The Burden of Choice

The repayment burden of a loan is like a structured weightlifting regimen—specific, scheduled, and leading to a defined outcome. The burden of credit card debt is like carrying a leaking backpack—you can keep adding to it, and the slow drain of water (interest) makes it increasingly heavier without you always realizing why.

In the contest of Loan vs. Credit Card repayment burden, the personal loan, with its lower costs and fixed timeline, generally imposes a more manageable and less expensive financial burden for carried debt. However, the credit card’s burden is uniquely dangerous because it is self-determined, psychologically insidious, and can perpetuate itself.

The ultimate goal is not to avoid debt at all costs, but to choose the form of burden you are best equipped to bear. Choose the structured, finite burden of a loan for deliberate financing. Use the flexible burden of a credit card only with the discipline to neutralize its costs. Your financial well-being depends not just on what you borrow, but on the shape of the weight you agree to carry.

Frequently Asked Questions (FAQ)

1. I have $10,000 in credit card debt at 24% APR. Is a personal loan at 12% APR always the better option?

Mathematically, yes—consolidating into the lower-rate loan will save you significant money on interest and provide a clear payoff date. However, the “better” option also depends on behavior. The loan only works if you stop using your credit cards while paying it off. Otherwise, you risk having both the new loan payment and fresh credit card debt—a far worse situation. The loan is a tool, not a cure; discipline is the medicine.

2. My credit card minimum payment is so low and manageable. Why is that a bad thing?

The minimum payment is designed to be manageable for the bank’s risk model, not for your financial health. It is calculated to keep you in debt for decades while maximizing the interest you pay. For example, a $5,000 balance at 20% APR with a 2% minimum payment would take over 40 years to pay off and cost over $9,000 in interest. It’s an illusion of affordability that creates a perpetual, costly burden.

3. How does my choice between a loan and credit card debt affect my credit score differently?

- Personal Loan: Adds to your “credit mix,” which can help. It creates a new installment account. Your timely payments build a positive history. Initially, the hard inquiry and new account may cause a small dip, but consistent repayment boosts your score. High loan balances relative to the original amount don’t hurt like high credit card utilization.

- Credit Card: Your utilization ratio (balance/limit) is critical.Consistently making only minimum payments or missing payments severely damages your score over time.

4. Is that smarter than a personal loan for my debt?

It can be, but it’s a high-stakes strategy. The 0% card is superior if (and only if):

- You can pay off the entire transferred balance before the promotional period ends (usually 12-21 months).

- You have the discipline not to use the new card (or the old, now-free cards) for new spending.

If you cannot pay in full within the promo period, you’ll face deferred interest or a high regular APR, often making the personal loan the safer, more predictable choice.

5. I have variable income (e.g., freelancer, sales commissions). Which repayment burden is easier to handle?

This is complex. The credit card’s minimum payment offers more month-to-month cash flow flexibility, which is tempting but dangerous. The personal loan’s fixed payment is a rigid obligation that can be stressful in a lean month.

The best strategy is a hybrid approach: Use a modest emergency fund to smooth your income. For planned, large expenses, a personal loan can still work if you budget based on your lowest expected monthly income. Relying on credit cards for flexibility without a concrete payoff plan tied to your high-income months is a recipe for spiraling debt. Your variable income requires stricter budgeting and more conservative debt choices, not more flexible debt tools.