Loan vs Credit Card: A Comprehensive Cost Comparison Guide

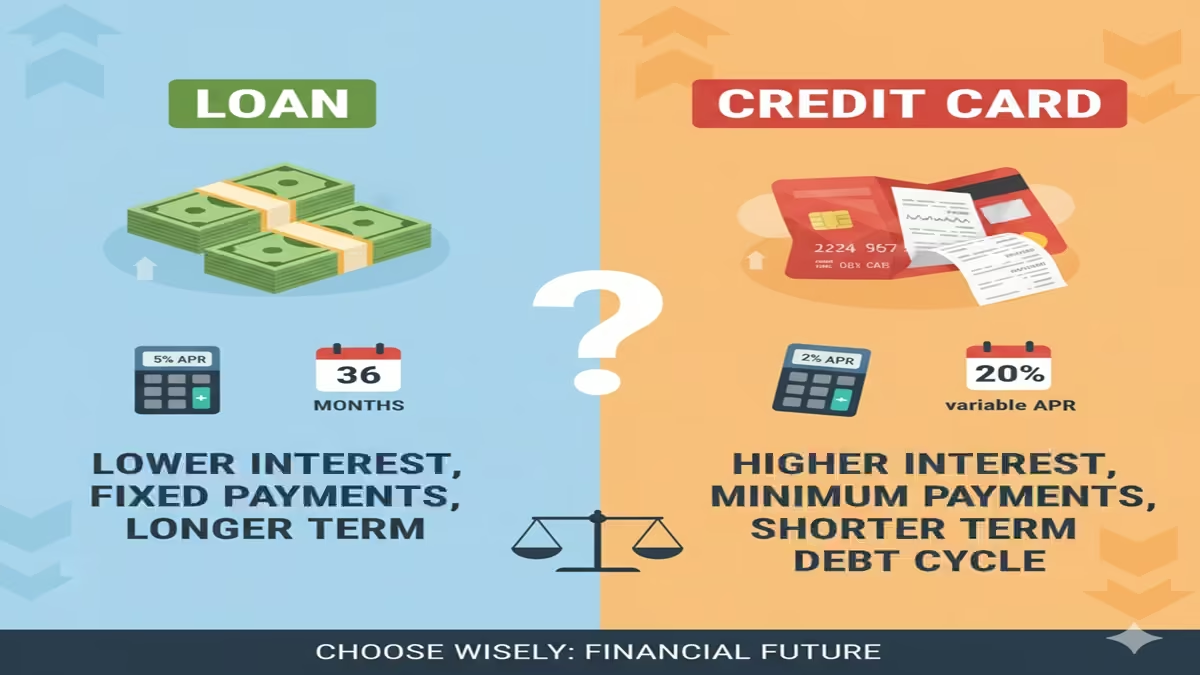

Loan Vs Credit Card Cost Comparison When faced with a significant expense or a cash shortfall, many consumers turn to two primary sources of borrowed funds: personal loans and credit cards. While both can provide the necessary capital, their financial architectures, cost implications, and ideal use cases are profoundly different. Choosing the wrong instrument can lead to thousands of dollars in unnecessary interest, strained cash flow, and prolonged debt. This 2500-word guide will dissect the true cost of loans versus credit cards, moving beyond simple APRs to explore scenarios, hidden fees, and strategic financial decision-making.

The Fundamental Structures: Installment Debt vs. Revolving Credit

To understand the cost, one must first understand the mechanism.

Personal Loansare a form ofinstallment debt. You receive a lump sum of money upfront, typically ranging from $1,000 to $100,000. This debt is repaid over a fixed term (e.g., 2 to 7 years) through equal monthly payments. The interest rate is usuallyfixed, meaning your payment never changes. The loan is closed-ended; once you repay it, the account closes. Loans are oftensecured(backed by collateral like a car or savings) orunsecured(based on creditworthiness).

Credit Cards are a form of revolving credit. You are granted a credit limit (e.g., $5,000) that you can draw from, repay, and draw from again indefinitely. There is no fixed repayment schedule—you must make only a minimum payment each month, but you can carry, or “revolve,” a balance from month to month. The interest rate is almost always variable, tied to an index like the Prime Rate. This is unsecured debt.

This structural difference is the bedrock of all cost comparisons.

Breaking Down the Cost Components

1. Interest Rates (APR): The Sticker Price

- Personal Loans:As of early 2024, interest rates for borrowers with good to excellent credit (FICO 690+) typically range from8% to 24% APR. Because they are fixed and often secured, they generally offer lower rates than credit cards for equivalent borrowers.

- Credit Cards:The average APR for credit cards in the U.S. hovers around22%, with a wide range from 18% for excellent credit to 29.99% or higher for those with poorer credit or premium reward cards. This rate is variable and can increase with market conditions.

Winner on Rate: Personal Loans, significantly.

2. Fee Structures: The Hidden Architects of Cost

- Personal Loan Fees:

- Origination Fees:The most common loan fee, ranging from1% to 8%of the loan amount. This fee is usually deducted from the loan proceeds before you receive the money. A $10,000 loan with a 5% origination fee nets you $9,500, but you pay interest on the full $10,000.

- Prepayment Penalties:Rare in modern personal loans, but always verify. A good loan should allow penalty-free early repayment.

- Late Fees:Incurred for missed payments.

- Credit Card Fees:

- Annual Fees:From $0 to $695+ for premium travel cards. This is a cost of access, not borrowing.

- Balance Transfer Fees:Typically3% to 5%of the transferred amount. Crucial for consolidation strategies.

- Cash Advance Fees:The costliest credit card feature—usually5% of the amount(min $10) plus ahigher APR (often 29.99%)that accrues immediately with no grace period.

- Late Fees & Penalty APRs:Missing a payment can trigger fees and a punitive APR hike to nearly 30%.

- Foreign Transaction Fees:Usually 1-3% on purchases abroad.

Winner on Fee Simplicity: Personal Loans (often just one upfront fee). Credit cards have a more complex, usage-dependent fee landscape.

3. The Cost of Flexibility: How Repayment Behavior Dictates Total Cost

This is where the comparison becomes dynamic and highly personal.

A personal loan’s cost is predictable. The total interest is effectively baked into the fixed payment schedule. You can calculate it precisely at the outset using an amortization schedule.

Example: A $12,000 personal loan at 10% APR for 5 years has a monthly payment of $254.96. Total payments = $15,297.60. Total interest = $3,297.60.

A credit card’s cost is entirely dependent on your repayment behavior. Making only the minimum payment (often 1-3% of the balance) turns it into a financial quicksand.

The Minimum Payment Trap: Using the same $12,000 charged to a card with a 22% APR and a 2% minimum payment:

- Starting Minimum Payment:~$240.

- Time to Pay Off:Over30 years.

- Total Interest Paid:Approximately$23,000—nearly double the original debt.

To match the loan’s 5-year payoff period, you would need to pay about $304 per month on the card. Total payments = $18,240. Total interest = $6,240—almost double the loan’s interest.

Winner for Cost-Efficient Debt Retirement: Personal Loans, due to enforced discipline and lower rates.

4. The Grace Period vs. Immediate Interest

- Credit Cards:Offer a20-25 day grace periodonpurchases. If you pay your statement balance in full by the due date, you pay$0 in interest. This is their most powerful cost-saving feature.

- Personal Loans & Credit Card Cash Advances:Interest starts accruingimmediatelyfrom the day the funds are disbursed. There is no grace period.

Winner for Avoiding Interest Entirely: Credit Cards, but only if you pay the balance in full every month.

Scenario Analysis: Where Each Financial Tool Shines

Scenario 1: Debt Consolidation

- The Situation:$15,000 in high-interest credit card debt spread across three cards, with an average APR of 24%.

- Personal Loan Approach:Take out a $15,000 loan at 12% APR for 4 years. You’ll have one fixed payment of ~$395, pay off the cards immediately, and save thousands in interest. The psychological benefit of a clear end date is immense.

- Credit Card Balance Transfer Approach:Transfer the $15,000 to a new card offering a 0% intro APR for 18 months with a 3% transfer fee ($450). You must pay $833 per month to clear the balance before the promo ends to avoid back-interest. High discipline required.

- Cost Winner:Tie.The 0% card is cheaper if executed perfectly. The loan is cheaper than revolving the card debt and offers less behavioral risk.

Scenario 2: A Major One-Time Purchase (e.g., $7,000 for fertility treatment)

- Personal Loan:A fixed-rate loan provides predictable, budget-friendly payments.

- Credit Card:Charging it at 22% APR with a plan to pay it off over 3 years is far more expensive. However, if you can leverage a0% introductory purchase APR offer(e.g., 15 months), you could pay it off interest-free with disciplined monthly payments (~$467/month).

- Cost Winner:Credit Card with a 0% promo, if available and manageable. Otherwise,Personal Loan.

Scenario 3: Ongoing, Fluctuating Expenses (e.g., Home Renovation with staged costs)

- Credit Card:Ideal for its flexibility. You can draw funds as needed with contractors, track expenses easily, and earn rewards.Crucially, you must have a plan to pay it off quickly or via a subsequent loanto avoid catastrophic interest.

- Personal Loan:You must take the full amount upfront, paying interest on money you haven’t used yet. Ahome equity line of credit (HELOC)—a hybrid secured product—would be better here.

- Winner for Appropriateness:Credit Card + Strategic Payoff Plan.

Scenario 4: Emergency Cash Need

- Credit Card Cash Advance:A terrible option due to exorbitant fees and immediate high interest. A last resort only.

- Personal Loan:A better, lower-cost option for a true emergency lump sum.

- Hidden Winner:Using a credit card for thepurchase(preserving cash) while applying for a personal loan to pay the card off in full before the grace period ends.

The Impact on Credit Health

- Credit Utilization:This is 30% of your FICO score. Maxing out a credit card severely damages your score. A personal loan doesn’t affect utilization ratio, as it’s installment debt.

- Hard Inquiries & New Accounts:Both trigger hard inquiries. A new loan creates a new account, which may cause a small, temporary dip.

Strategic Synthesis: How to Choose

Choose a PERSONAL LOAN when:

- You have alarge, known expenseupfront.

- You needpredictable, fixed paymentsfor budgeting.

- You areconsolidating high-interest debtand want behavioral guardrails.

- You prioritize thelowest possible interest ratefor a multi-year repayment.

- You want aclear, mandatory path to being debt-freeby a specific date.

Choose a CREDIT CARD (and revolve a balance) only when:

- You cansecure a 0% introductory APR offer(purchase or balance transfer) AND have arock-solid planto pay it off before the period ends.

- You needultimate flexibilityfor uncertain or staggered costs, with a concurrent payoff plan.

- You can and will pay the statement balance in full every month, rendering interest irrelevant and making rewards lucrative.

The Cardinal Rule: Never use a credit card for a cash advance or to finance a long-term purchase at its standard variable APR without a specific, short-term exit strategy. The compound interest is devastating.

Conclusion: Discipline is the Ultimate Cost-Saver

The cold math overwhelmingly favors personal loans for carrying debt. Their lower, fixed rates and amortizing structure provide a cheaper, safer path to repayment. Credit cards, with their variable high rates and minimum payment traps, are among the most expensive consumer debt instruments in existence.

However, the grace period and promotional offers inject a powerful nuance. For the organized, disciplined borrower with a precise plan, a credit card’s 0% window can be a cost-free tool. For most, however, that grace period is a siren song, leading to decades of high-interest payments.

Ultimately, the “cost comparison” is not just between products, but between future versions of yourself. The personal loan is a contract with your responsible self, locking in a prudent outcome. The credit card is a test of your ongoing financial discipline, with severe penalties for failure. Choose the tool that not only fits the financial need but also honestly aligns with your money habits and future goals.

Frequently Asked Questions (FAQ)

1. I have excellent credit and a 0% credit card offer. Isn’t that always better than a loan?

Not always. It depends on the amount, the length of the 0% term, and your discipline. For a $20,000 debt, a 0% offer for 18 months requires payments of over $1,111 per month to avoid interest. If you can’t sustain that, a personal loan at 8% with a 4-year term ($488/month) may be a more realistic and still relatively low-cost option. Always calculate the required monthly payment for the 0% plan first.

2. What’s the real difference between an APR and an interest rate on these products?

For personal loans, the Interest Rate and APR are often very close. The APR includes the interest rate plus certain fees (like an origination fee), giving you a truer annual cost of borrowing. For credit cards, the stated APR is the interest rate you’ll be charged on revolving balances. There is no separate “interest rate” quote; the APR is the key number.

3. Can I use a loan to pay off my credit card, and then use the card again? Won’t that put me in a worse spot?

Yes, this is a major risk called re-leveraging. You consolidate $15,000 from Card A, B, and C onto a loan. Then, with those cards now at a $0 balance, you are tempted to use them for new spending. You end up with the new loan payment and new credit card debt—a financial disaster. The strategy only works if you cut up or freeze the old cards and change spending habits.

4. Are there any situations where a credit card cash advance is justified?

Almost never. The combination of an upfront fee (often 5%) and an immediate, sky-high APR (often 29.99%) with no grace period makes it arguably the most expensive form of mainstream credit. It should only be considered in a genuine, immediate emergency where no other funds (loan, family, payment plan) are available, and only for the absolute minimum amount needed.

5. How does my credit score specifically affect the costs in this comparison?

Your credit score is the primary determinant of the rates you’ll receive.

- Forpersonal loans, a score above 720 will get you the best advertised rates (e.g., 8-12% APR). A score below 630 may see rates jump to 25-36%, if you qualify at all.

- Forcredit cards, those with excellent credit qualify for the best standard purchase APRs (still ~18-22%) and the most attractive 0% balance transfer offers. Those with poor credit may only get cards with APRs at 29.99%+ and no promotional offers.

A low score makes personal loans relatively more attractive, as the gap between loan APRs and card APRs widens significantly.