A Comprehensive Guide to Applying for an Income Certificate Online Through CSC

Income Certificate Online Apply Csc In an increasingly digital India, access to essential government documents has been transformed by initiatives like the Common Service Centre (CSC) scheme. Among the most crucial documents for availing of government subsidies, scholarships, and welfare schemes is the Income Certificate. This document serves as official proof of the annual income of an individual or a family, playing a pivotal role in determining eligibility for numerous state and central benefits. For millions, especially in rural and semi-urban areas, the CSC portal has become the trusted gateway to apply for this certificate online, bridging the digital divide and simplifying bureaucratic processes.

This comprehensive guide will walk you through everything you need to know about applying for an Income Certificate online via CSC, its importance, the step-by-step process, required documents, and much more.

Income Certificate Online Apply Csc

What is an Income Certificate?

An Income Certificate is an official document issued by the concerned state government’s Revenue Department or Tahsildar’s office. It certifies the total annual income of an individual or a family from all sources—including salary, business, agriculture, rents, and other means. The certificate typically categorizes holders into groups such as Below Poverty Line (BPL), economically weaker sections (EWS), Low Income Group (LIG), or general category, based on state-defined financial thresholds.

Why is it Essential?

- Scholarships & Fee Reimbursements: Mandatory for students applying for state and national scholarships.

- Government Subsidies: Required for schemes like LPG subsidy, housing schemes (PMAY), and food security benefits.

- Legal & Official Purposes: Needed for court cases, loan applications, and passport verification in some instances.

- Reservation Benefits: Crucial for availing reservations in education and jobs under EWS, OBC (Non-Creamy Layer), etc.

- Healthcare Schemes: Used to access subsidized treatment under health insurance schemes.

The Role of Common Service Centres (CSCs)

Common Service Centres are the physical front-end delivery points for Government of India’s Digital India initiative. Operated by Village Level Entrepreneurs (VLEs), they are the “one-stop-shop” for accessing a wide array of government and private services in rural and remote locations. For applying online for an Income Certificate, CSCs offer:

- Digital Assistance: For citizens unfamiliar with online procedures.

- Document Digitization: Help in scanning and uploading necessary documents.

- Application Tracking: Assistance in checking the status of your application.

- Certificate Collection: In many cases, you can collect the printed certificate from the CSC once approved.

Step-by-Step Guide: How to Apply for an Income Certificate Online via CSC

The process can be broken down into two parts: the applicant’s preparation and the CSC-assisted online application.

Part 1: Preparation Before Visiting Your Nearest CSC

- Identify Your Nearest CSC: Use the official CSC locator portal (https://locator.csc.gov.in/) or a simple web search for “CSC near me” to find an authorized centre.

- While specifics vary slightly by state, the general list includes:

- Identity Proof: Aadhaar Card (mandatory in most states), Voter ID, PAN Card, or Driving License.

- Address Proof: Aadhaar Card, Ration Card, Electricity/Water Bill, or Registered Rent Agreement.

- Income Proof: This is the core requirement. Gather all relevant documents:

- Salaried Individuals: Salary slips (last 3-6 months), Form 16, Employment Certificate from employer.

- Agriculturists: Land revenue records, Affidavit declaring annual farm income.

- Pensioners: Pension book or bank statement showing pension credit.

- Others: Affidavit/sworn statement before a notary declaring all sources of income (used when formal documents are lacking).

- Bank Account Details: Passbook or cancelled cheque.

- Ration Card: Often required as family composition proof.

- Passport-sized Photographs.

- Existing Income Certificate (if applying for renewal).

- Prepare for Fees: A nominal service fee is charged by the CSC VLE for their assistance. This varies but is usually between ₹50 to ₹200. There is typically no government application fee for the Income Certificate itself.

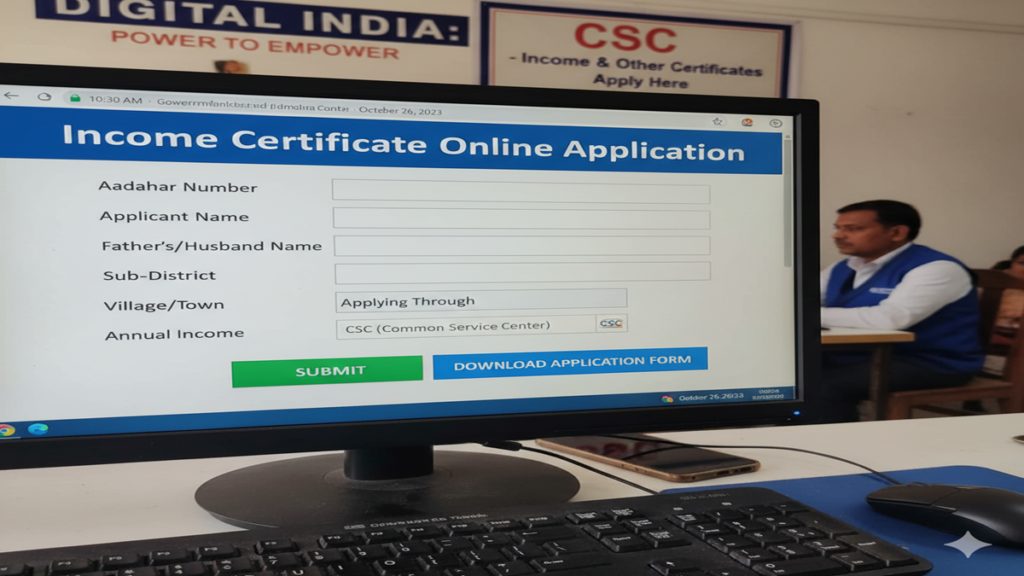

Part 2: The Online Application Process at the CSC

The VLE will guide you through the online process, which generally follows these steps:

- Registration/Login: The VLE will log in to the respective state’s dedicated e-District or Revenue portal (e.g., BangaloreOne for Karnataka, e-District Delhi, MahaOnline for Maharashtra) via the CSC’s system.

- Filling the Application Form: The VLE will select the “Income Certificate” service and fill the online form with your details. You must carefully provide:

- Applicant’s full name (as per Aadhaar).

- Father’s/Mother’s/Husband’s name.

- Date of Birth, Gender.

- Category (SC/ST/OBC/General).

- Residential Address (Permanent and Current).

- Details of all family members.

- Breakdown of total annual income from all sources.

- Document Upload: The VLE will scan and upload clear, legible copies of all the documents you have brought.

- Review and Submission: You will be asked to review all entered data on the screen. Verify every detail meticulously. Once confirmed, the VLE will submit the application.

- Acknowledgment Receipt: Upon successful submission, a unique Application Reference Number (ARN) or acknowledgment slip will be generated. Collect this receipt. It is crucial for tracking your application status online.

Post-Application: Tracking and Downloading

- Track Status: Use the ARN on the respective state’s e-District portal or through the CSC’s tracking service. Statuses typically are: “Under Review,” “Forwarded to Tehsil,” “Approved,” or “Rejected.”

- Processing Time: It usually takes 7 to 15 working days, depending on state procedures and verification workload.

- Issuance: Once approved, the digitally signed Income Certificate can be:

- Downloaded by you directly from the portal using your ARN/Aadhaar number.

- Collected as a hard copy from the CSC or the Tehsil office, as per local practice.

Common Reasons for Rejection & How to Avoid Them

Applications can be rejected due to:

- Incorrect or Incomplete Information: Double-check all entries in the form.

- Unclear Document Copies: Ensure all uploaded documents are clear and complete.

- Income Discrepancy: Declared income not matching proof documents.

- Pending Verification: Failure to respond to a verification call from revenue officials.

- Duplicate Application: Applying multiple times for the same certificate.

Tip: Be truthful, provide accurate documents, and ensure your mobile number (linked to Aadhaar) is active for verification calls.

Advantages of Applying Through CSC

- Expert Guidance: VLEs are trained to handle the process, reducing errors.

- Infrastructure Access: No need for personal computer, scanner, or high-speed internet.

- Local Language Support: Services are offered in the local language.

- Physical Support: Help with affidavits, photocopies, and follow-ups.

Frequently Asked Questions (FAQs)

1. Can I apply for an Income Certificate online by myself without visiting a CSC?

Yes, in most states, you can apply directly through your state’s e-District portal. However, the CSC is recommended for those who need assistance with the digital process, document scanning, or lack reliable internet access. The CSC simplifies it for everyone.

2. Is an Affidavit for income self-declaration valid for the application?

Yes, an affidavit sworn before a notary/public magistrate is a commonly accepted document, especially for individuals with informal income sources like daily wages or small-scale farming. However, it must be supplemented with other ID and address proofs. The final discretion lies with the issuing revenue officer.

3. My application status has been “Under Process” for over a month. What should I do?

First, use your ARN to track the status on the portal. If there is no update, contact your CSC VLE—they can often follow up with the local revenue office. You can also visit the Tehsildar’s office directly with your acknowledgment receipt for a status inquiry.

4. Are Income Certificates issued through CSCs valid nationwide?

The Income Certificate is issued by a state government authority and is primarily valid for availing schemes within that state. For central government schemes, it is accepted across India. However, if you move to another state permanently, you may need to apply for a fresh certificate from your new state of residence.

5. What is the difference between an Income Certificate and a Non-Creamy Layer Certificate?

Both are income proofs but serve different purposes. An Income Certificate states your exact total annual income and is used for a broader set of schemes (EWS, scholarships, subsidies). The Non-Creamy Layer (NCL) Certificate is specifically for OBC category individuals to prove they belong to the “non-creamy” layer (income below a specific limit, currently ₹8 lakhs p.a.) to avail OBC reservations. The application processes are separate.

Conclusion

Applying for an Income Certificate online through the Common Service Centre network is a testament to India’s successful push for democratizing digital governance. It has made a critical document accessible to the farthest corners of the country. By preparing the right documents, partnering with your local CSC VLE, and patiently following the process, you can obtain your Income Certificate efficiently, unlocking doors to essential benefits and opportunities. Remember, this certificate is more than just a piece of paper; it is a key to social and economic inclusion.

Disclaimer: The specific process, document requirements, and portals differ from state to state. Always confirm the exact requirements with your local CSC VLE or the official e-District website of your state.