A Comprehensive Guide to Education Loan Subsidy Status Check: Navigating Government Schemes (2026)

Education Loan Subsidy Status Check Securing an education loan is a pivotal step for countless students aiming to pursue higher studies, both in India and abroad. To alleviate the financial burden, especially in the wake of economic challenges, the Government of India, along with various state governments and the Reserve Bank of India (RBI), has periodically introduced subsidy schemes and interest subvention programs.

The most notable among these in recent years have been the “Interest Subsidy Scheme for Education Loans” under the Central Scheme to Provide Interest Subsidy (CSIS) and the “Vidya Lakshmi” portal initiative. However, for beneficiaries, the crucial step after application is tracking the status of their subsidy. This comprehensive guide will walk you through everything you need to know about checking your education loan subsidy status, the schemes involved, and troubleshooting common issues.

Understanding Education Loan Subsidies: A Primer

Before diving into the status check, it’s essential to understand what a subsidy entails. An education loan subsidy, particularly an interest subsidy, means the government pays a portion of the interest on your loan for a specified period. You are responsible for repaying the principal and any interest not covered by the subsidy.

Key Central Government Schemes:

- Central Scheme to Provide Interest Subsidy (CSIS): This is the flagship scheme for economically weaker sections. It provides full interest subsidy during the moratorium period (course duration + one year or six months after getting a job, whichever is earlier) for students from households with an annual parental income of up to ₹4.5 lakh. The subsidy is available for professional/technical courses in India.

- Padho Pardesh Scheme: Offers interest subsidy to students from minority communities on education loans for studies abroad.

- Dr. Ambedkar Central Sector Scheme of Interest Subsidy: For students from Other Backward Classes (OBCs) and Economically Backward Classes (EBCs) for studies abroad.

- Vidya Lakshmi Portal: While not a subsidy scheme itself, it’s a first-of-its-kind portal that provides a single-window for students to apply to multiple banks for education loans, track their applications, and access information on various government schemes.

Why is Checking Your Subsidy Status Critical?

The subsidy approval and disbursement process is not always instantaneous. It involves coordination between your bank, the National Credit Guarantee Trustee Company Ltd (NCGTC) – which administers many central schemes – and government departments. Regularly checking your status helps you:

- Ensure Application Completion: Confirm your bank has correctly submitted your details to the subsidy authority.

- Identify & Rectify Errors: Spot discrepancies in income, course, or bank details early.

- Manage Finances: Plan your repayments with clarity on when the subsidy will be credited.

- Avoid Surprises: Prevent the accumulation of unexpected interest liability due to a failed subsidy claim.

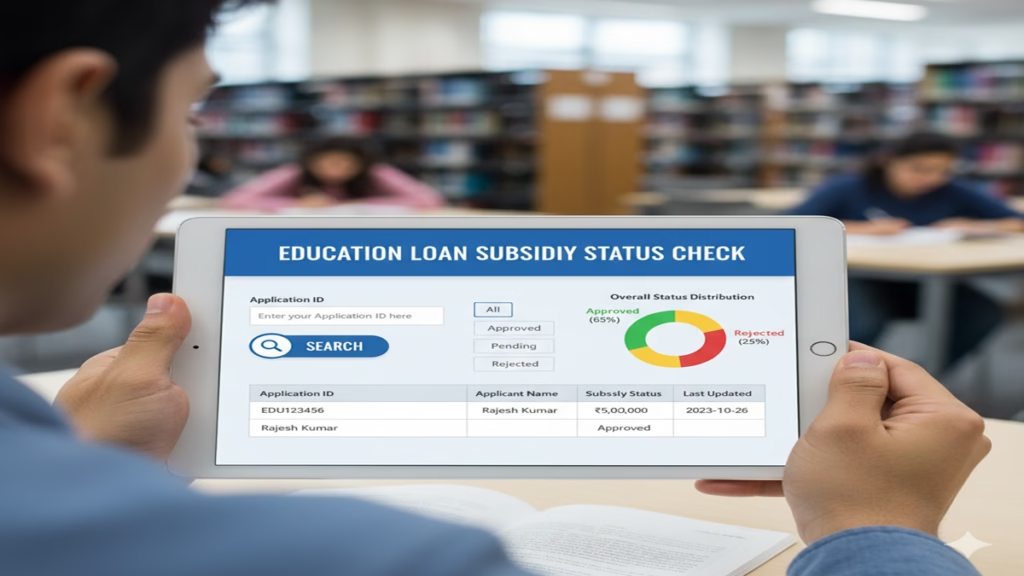

Step-by-Step: How to Check Your Education Loan Subsidy Status

The method for checking your status depends primarily on the scheme under which you applied and the bank through which your loan is sanctioned.

Method 1: Through the NCGTC/CSIS Portal (For Central Interest Subsidy Scheme)

The NCGTC is the nodal agency for the CSIS. They host a dedicated portal for beneficiaries.

Steps to Check Status:

- Visit the Portal: Go to the official NCGTC CSIS portal: https://www.cgsncgtc.com/ or the specific CSIS page.

- Locate the Student Corner/Section: Look for tabs like “Interest Subsidy for Education Loans,” “Student Login,” or “Track Application.”

- Login or Use Reference Number: You may need to log in with credentials provided by your bank or use a unique reference number. This reference number is often given by your bank after they submit your claim to NCGTC. If you don’t have it, contact your bank’s education loan department.

- Track Status: Once logged in, you can view your application status. Typical statuses include:

- Received by NCGTC: Your bank has submitted the claim.

- Under Process/Verification: NCGTC is verifying your details with bank and academic institution.

- Approved: Subsidy is sanctioned. It will be disbursed to your bank.

- Rejected/Pending Clarification: Check for reasons—often due to document mismatch or income limit exceedance.

- Subsidy Disbursed: The amount has been sent to your bank. Contact your bank to confirm it’s been adjusted against your loan account.

Method 2: Through the Vidya Lakshmi Portal

This portal is a master dashboard for all your education loan-related activities.

Steps to Check Status:

- Visit the Portal: Go to https://www.vidyalakshmi.co.in/.

- Log In: Use your registered username and password.

- Navigate to ‘Loans Applied’: You will see a list of loans you’ve applied for through the portal.

- Check Status Column: The status of your loan application from the bank will be displayed here. Important: For subsidy status specifically, you may need to dig deeper. Look for a link or section titled “Subsidy Linkage” or “Scheme Details.” The portal might provide updates if your bank has tagged your loan with a subsidy scheme.

- Use as a Reference: The portal’s primary strength is loan application tracking. For detailed subsidy status, the NCGTC portal or your bank remains the primary source, but Vidya Lakshmi offers a good starting point.

Method 3: Directly Through Your Bank

This is often the most reliable and direct method, as the bank is the entity that finally receives and applies the subsidy to your loan account.

Steps to Check Status:

- Contact Your Bank Branch/Loan Officer: Reach out to the specific branch where you availed the loan. The education loan officer or the relationship manager will have access to the subsidy tracking system.

- Provide Your Details: Have your Loan Account Number and Customer ID ready.

- Inquire About the NCGTC Claim Reference: Ask them for the NCGTC reference number for your subsidy claim and its current stage (e.g., “sent to NCGTC,” “awaited from NCGTC,” “received, under process”).

- Online Banking/Net Banking: Some banks display subsidy-related statuses under the loan account details section in their net banking portal or mobile app. Check the “transaction history” or “interest details” of your education loan account.

Method 4: For State-Specific Subsidy Schemes

Many states (e.g., Kerala, Karnataka, Andhra Pradesh) have their own education loan subsidy schemes. The process here usually involves:

- Visiting the State’s Higher Education/Technical Education Department website.

- Looking for the scholarship/subsidy portal (e.g., Kerala’s e-grantz, Karnataka’s Mahiti Kanaja).

- Logging in with application details to track the status.

Common Reasons for Subsidy Status Delays or Rejection

Finding your status as “Pending” or “Rejected” can be stressful. Here are common reasons:

- Document Discrepancy: Mismatch between names on academic records, bank accounts, or income certificates. Ensure all documents use the same name and spelling.

- Income Certificate Issues: The income certificate must be from the competent authority (Tahsildar/SDM), recent, and clearly show the family income is within the prescribed limit (e.g., ₹4.5 lakh for CSIS).

- Bank’s Delay in Claim Submission: The bank must submit your claim to NCGTC after your loan is disbursed and you join the course. This process can sometimes be slow.

- Course/Institution Not Eligible: Double-check that your course and institute are recognized and covered under the specific scheme.

- Moratorium Period Ambiguity: The subsidy is typically for the moratorium period only. Any delay in course completion or reporting to the bank can affect it.

- Technical Errors at Portal Level: Data sync issues between bank and NCGTC systems.

What to Do If Your Status is Delayed or Rejected?

- Step 1: Immediate Contact with Bank: Your first point of contact is always your bank. They can clarify the exact reason from their system or from NCGTC’s feedback.

- Step 2: Gather Corrected Documents: If it’s a document issue, get the corrected documents attested and re-submit them to the bank for re-processing.

- Step 3: Escalate if Necessary: If the bank is unresponsive, you can escalate the matter within the bank (to the zonal/regional manager) or lodge a grievance on the NCGTC portal or the Reserve Bank of India’s (RBI) Integrated Ombudsman Scheme portal.

- Step 4: Persist and Follow Up: Keep a record of all communications (emails, application numbers, officer names). Polite but persistent follow-ups are key.

Proactive Tips for a Smooth Subsidy Journey

- Document Diligence: Before applying, ensure every document—income certificate, admission letter, fee structure, KYC—is accurate, clear, and as per the scheme’s checklist.

- Maintain Communication with Your Bank: Establish a good rapport with your loan officer. Inform them immediately after course commencement and provide necessary documents like the course completion certificate on time.

- Regular Status Checks: Make it a habit to check your status quarterly, especially during the moratorium period.

- Understand Your Loan Account Statements: Periodically check your loan statements. When the subsidy is applied, you will see a credit entry labeled “Interest Subsidy,” and the outstanding interest amount will reduce correspondingly.

The Future of Subsidy Tracking: Towards Greater Transparency

The government is continually working on integrating systems for smoother tracking. Initiatives like API integration between banks and Vidya Lakshmi/NCGTC aim to provide real-time status updates. As a student or parent, staying informed about the official portals and maintaining meticulous records are your best tools to ensure you benefit fully from these empowering financial support schemes.

Navigating the education loan subsidy process may seem daunting, but by understanding the pathways and proactively managing your application, you can ensure that this valuable financial support reaches you seamlessly,

FAQs: Education Loan Subsidy Status Check

1. What is the most reliable way to check my education loan subsidy status?

The most reliable method is to contact your bank’s education loan department directly with your loan account number. They have the most up-to-date information on the status of the subsidy claim they submitted on your behalf and can confirm when it’s credited to your account.

2. I have lost my NCGTC reference number. How can I check my status?

Don’t worry. Your bank maintains a record of the NCGTC reference number they generated for your subsidy claim. Contact your bank’s loan officer to retrieve it. You can also try logging into the Vidya Lakshmi portal or your bank’s net banking to see if the reference number is mentioned in your loan application details.

3. My subsidy status has been “Under Process at NCGTC” for months. What should I do?

First, ask your bank to confirm they have provided any additional information NCGTC might have requested. If the bank confirms all is submitted, you can try raising a polite inquiry through the contact/helpdesk on the official NCGTC CSIS portal. However, continuous follow-up with your bank remains the primary action, as they are the intermediary.

4. How will I know the subsidy has actually been applied to my loan?

You will see a credit entry in your education loan account statement, typically labeled as “Interest Subsidy,” “Govt. Subsidy,” or similar. This credit will directly reduce the outstanding interest component of your loan. Your bank should also notify you, but proactively checking your loan statement after the status shows “Disbursed” is recommended.

5. Can I check my state government education loan subsidy status online?

Yes, most states with such schemes have online scholarship/subsidy portals. You will need your application ID or registration details. Visit the website of your state’s Higher Education/Technical Education or Social Welfare Department and look for the relevant scholarship/financial aid section.