Digital Money Saving Tips for India: A Comprehensive Guide to Smart Savings in the Digital Age

Introduction

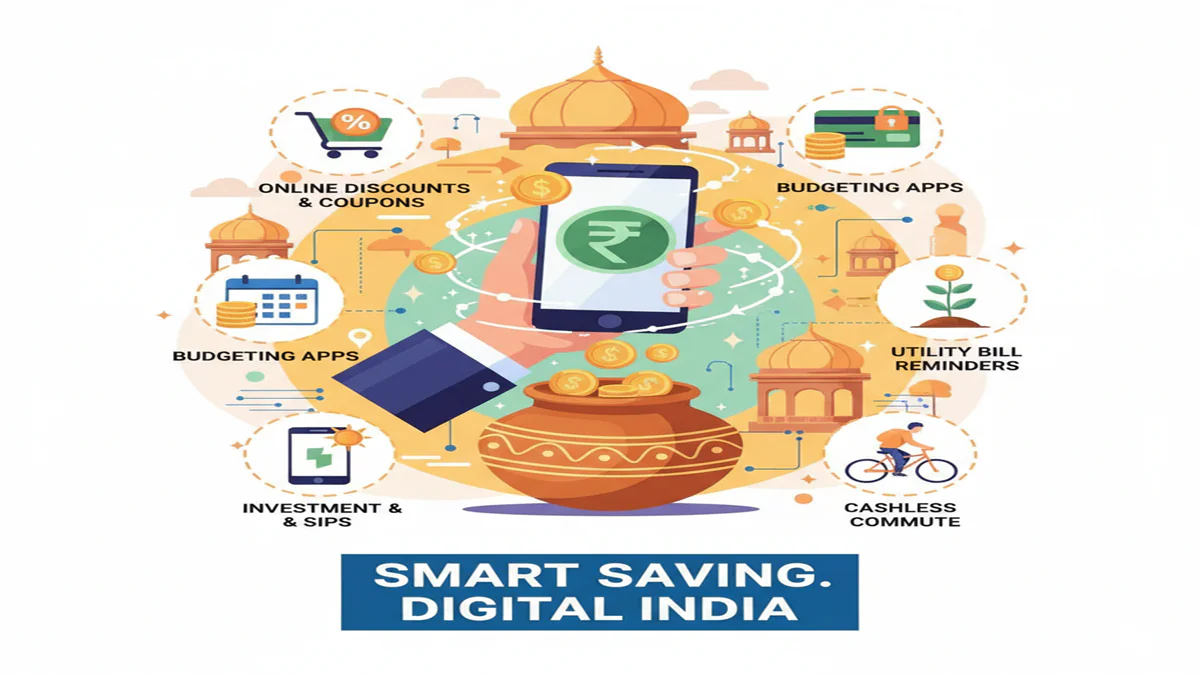

Digital Money Saving Tips India In the rapidly evolving economic landscape of India, where digital penetration is soaring, the art of saving money has transformed. Gone are the days of solely relying on physical piggy banks or tedious bank queues.

The digital revolution has ushered in a new era of financial management, offering unprecedented tools and opportunities to save smarter, not harder. For the Indian saver—from students and young professionals to homemakers and retirees—leveraging digital platforms is no longer a luxury but a necessity for building a secure financial future.

This comprehensive guide delves into practical, actionable digital money-saving tips tailored for the Indian context. We will explore how to harness the power of apps, online platforms, and digital habits to cut costs, optimize spending, and grow your savings effortlessly.

The cornerstone of any saving plan is knowing where your money goes.

1. Embrace Budgeting Apps: Move beyond spreadsheet complexity. Use intuitive apps like Walnut, ET Money, or GoodBudget. These apps automatically track your SMS from banks, categorize expenses (food, travel, entertainment), and provide crystal-clear visual reports. For a more goal-oriented approach, Goal-Based Savings apps like Savart can link savings directly to objectives like a vacation or a new gadget.

2. The Power of Auto-Debit for Savings: Fight the temptation to spend first and save later. Set up Standing Instructions (SI) or auto-debit mandates through your net banking or apps like Paytm Money or Groww. Schedule a transfer to a dedicated savings account, Recurring Deposit (RD), or a Mutual Fund SIP (Systematic Investment Plan) immediately after your salary is credited. This enforces “pay yourself first” discipline.

3. Digitize the Envelope System:The traditional method of allocating cash to envelopes for different needs can be replicated digitally. Apps likeMonefyor the “Pots” feature inFi Moneyallow you to create virtual envelopes for monthly groceries, fuel, and leisure, preventing overspending in any category.

Chapter 2: Curbing Expenditure – Smart Spending in an Online World

Digital platforms can be a spending black hole if not managed wisely. Here’s how to turn them into saving allies.

1. Master the Art of Cashback and Rewards:Don’t just pay online; get paid to pay.

*Use Cashback Apps & Portals:Always check platforms likeCashKaro,GoPaisa, orAmazon Paybefore any online purchase. They offer significant cashback on everything from fashion and electronics to flight tickets.

*Leverage Credit Card Rewards Wisely:If you are a disciplined payer,

use credit cards for major expenses to earn points, air miles, or cashback. Cards likeSBI Cashback CardorAmazon Pay ICICI Bank Cardoffer excellent returns.CRUCIAL:Pay the FULL bill on time, every timeto avoid interest charges that negate all benefits.

*Unified Reward Points:Use apps likeCRED(for credit card bill payments) to earn and use coins for brand vouchers, orPaytmfor its ubiquitous reward points.

2. Become a Coupon and Deal Hunter: Never checkout without searching for a coupon code.

* Browser extensions like Honey or CouponDunia automatically find and apply the best discount codes at checkout.

* Subscribe to deal alert channels on Telegram or follow social media pages of your favorite brands for flash sales and exclusive promo codes.

3. The Subscription Audit:The “₹199/month” trap. Small recurring subscriptions (OTT platforms, music apps, news sites, software) add up to thousands annually.

* Use your banking app’s statement or a tracker likeBobby(on Android) to list all active auto-debits.

* Ask: Do I use this daily/weekly? Can I share a family plan? Can I rotate subscriptions (e.g., subscribe to one OTT platform at a time)?

* Cancel anything non-essential immediately via the app store or service provider’s website.

4. Smart Bill Payments:

* Timely Payments: Use reminders or auto-pay for electricity, mobile, DTH, and gas to avoid late fees.

* Cashback Offers: Platforms like Paytm, Mobikwik, and Freecharge frequently offer cashback or discounts on bill payments. Stock up on wallet balance during festive sales for additional savings.

Chapter 3: The Digital Investment & Saving Landscape

Saving is not just about spending less; it’s about making your idle money work for you.

1. High-Yield Digital Savings Accounts: Ditch your traditional savings account offering 3-4% p.a. Digital banks and certain neo-banks partner with licensed banks to offer accounts with interest rates up to 7-7.5% p.a. through sweep-in Fixed Deposits. Explore options like Axis Bank ASAP, Kotak 811, or services provided by Fi Money, Jupiter.

2. Micro-Investing with SIPs in Mutual Funds: You don’t need lakhs to start.

* Start Small: Use apps like Groww, Zerodha Coin, or Kuvera to start a SIP in a diversified equity or debt mutual fund for as low as ₹100 or ₹500 per month. The power of compounding over time is immense.

* Goal-Based Investing: These apps allow you to link your SIP to a goal (e.g., “Down Payment for Car – Target ₹5 Lakhs in 5 years”), making the process purposeful and trackable.

3. The Digital Gold & Sovereign Gold Bond (SGB) Route:For Indians’ favorite asset, go digital.

* Avoid physical gold’s making charges and storage risk. Buy 24k digital gold in milligrams throughPaytm Gold,Google Pay(with MMTC-PAMP), orSafeGold.

* For long-term savings,Sovereign Gold Bonds (SGBs)are superior. They offer 2.5% annual interestplusgold appreciation, are tax-efficient if held to maturity (8 years), and can be bought digitally via your bank’s net banking or broker apps.

4. Automate Your Emergency Fund: This is non-negotiable. Maintain 3-6 months of expenses in a liquid fund or a separate high-yield savings account. Set up a monthly auto-transfer to build this fund until it reaches the target.

Chapter 4: Daily Life Hacks – The Indian Context

Link fuel payments to UPI apps that offer rewards. For metro/train, use recharge apps that provide cashback.

2. Food & Groceries:

* Meal Planning & List Making: Use notes apps to plan weekly meals and create strict shopping lists to avoid impulsive buys.

* Compare Prices: Use BigBasket, Blinkit, Zepto, and Swiggy Instamart not just for convenience, but to compare prices on staples. Look for “weekly sale” sections.

* Dining Out: Use Dineout, EazyDiner, or Magicpin for heavy discounts (often 25-50%) at restaurants. Book tables in advance for better deals.

3. Entertainment on a Budget:

* Opt for annual plans over monthly ones for OTT platforms; they are usually 10-15% cheaper.

* Share subscription costs with family/friends using family plans (where allowed).

* Explore free content on YouTube, Spotify Free, or public libraries with digital media (like the Libby app).

4. Travel Smart:

* Incognito Mode & Clear Cookies: Use this when searching for flights/hotels to avoid dynamic price hikes.

* Aggregators are Key: Always check Skyscanner, Google Flights, and MakeMyTrip for flights. For hotels, compare on Booking.com, Agoda, and Goibibo.

* IRCTC Tricks: Book Tatkal tickets faster by using authorized IRCTC partner apps with auto-fill features, and ensure a speedy payment method like an IRCTC-preferred wallet.

Chapter 5: Security & Mindset – The Non-Negotiables

1. Security First: Digital savings can vanish in a phishing attack.

* Never share OTPs, UPI PINs, or CVV numbers.

* Use strong, unique passwords and enable Two-Factor Authentication (2FA) on all financial apps.

* Install apps only from official Google Play Store or Apple App Store.

2. Cultivate a Digital Detox Day: Designate one day a week where you avoid online shopping apps and promotional emails. This breaks the cycle of “scroll-and-spend” impulse buying.

3. Continuous Learning: Follow credible Indian financial educators on YouTube (like CA Rachana Ranade, Labour Law Advisor), podcasts, or blogs. Financial literacy is the best digital tool you can possess.

Conclusion

The journey to financial resilience in India is increasingly digital. By strategically combining budgeting apps, cashback ecosystems, automated investments, and daily life hacks, you can create a powerful, personalized money-saving system. The key lies in intentionality—using technology as a disciplined tool for empowerment, not as a gateway to impulsive consumption.

Start small, automate consistently, and watch your digital diligence translate into substantial real-world savings. Remember, in the new India, every click, swipe, and notification can be a step towards a more secure financial future.

Frequently Asked Questions (FAQs)

Q1: I’m new to digital finance. What is the single most important habit I should start with?

A: Start with automated savings. The moment your income hits your account, a pre-set amount should automatically move to a separate savings account or SIP. This “set-and-forget” method builds savings without requiring willpower every month and leverages the fundamental principle of “paying yourself first.”

Q2: Are these cashback and coupon apps safe to use? Do they sell my data?

A: Reputable apps like CashKaro or bank-backed rewards programs are generally safe for transactions. However, always read their privacy policy. They do aggregate spending data, often anonymously, for market analysis. To minimize risk: 1) Use a dedicated email ID for these sign-ups, 2) Avoid granting unnecessary permissions (like contacts), and 3) Never share your banking passwords or OTP with any such app. They only need you to shop through their links.

Q3: As a student with very low income, can digital tools really help me save?

A: Absolutely.Digital tools are perfect for micro-savings. Use budgeting apps (many have free versions) to track your limited funds meticulously.

Focus heavily on the “curbing expenditure” tips—hunting for student discounts (using your .ac.inemail ID), using coupon apps for every online purchase, and auditing small subscriptions can free up significant amounts relative to your income.

Q4: I’m worried about fraud. How do I balance convenience with security while using all these apps?

A:This is a valid concern. Follow alayered security approach: 1)Device Level:Use phone password/biometric lock and keep your OS updated. 2)App Level:Download apps only from official stores, check reviews, and grant minimal permissions.

3)Transaction Level:Use UPI with a strong PIN, never click on suspicious payment links, and enable transaction alerts for all accounts. For investments, only use SEBI-registered platforms (like Zerodha, Groww). Convenience should never override these basic security checks.

Q5: Between Digital Gold and Sovereign Gold Bonds (SGBs), which is better for saving for my child’s future?

A:For a long-term goal like a child’s future (10+ years),Sovereign Gold Bonds (SGBs)are unequivocally better. Here’s why: 1)They pay interest(2.5% p.a.) on your gold holding, which digital/physical gold does not. 2)Capital gains are tax-freeif held till maturity (8 years), making them highly tax-efficient.

3) They arebacked by the Government of India, eliminating storage and purity risks. Digital gold is more suitable for very short-term holding or for gifting in small amounts, but for core, long-term savings, SGBs are the superior digital instrument.