How to File a Recovery Agent Complaint in 2026: A Comprehensive Step-by-Step Guide

Introduction: Understanding Your Rights in an Era of Evolving Debt Collection

Recovery Agent Complaint Kaise Kare The landscape of debt recovery in India has undergone significant changes, especially with the advent of digital lending, stringent data privacy norms, and heightened judicial scrutiny. While theSecuritisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002remains the primary legal framework governing asset reconstruction companies and their agents, the actual conduct of recovery agents is bound by a complex web of regulations set by theReserve Bank of India (RBI), rulings from theSupreme Court, and provisions under theIndian Penal Code (IPC).

If you are facing harassment, intimidation, or unethical practices from recovery agents in 2026, it’s crucial to know that the law is on your side. Filing a complaint is not just a remedy; it is a right. This guide will walk you through the entire process, from the first sign of harassment to escalating the matter to the highest authorities, incorporating the latest technological tools and legal updates relevant for 2026.

Part 1: Know the Boundaries – What Recovery Agents CANNOT Do

Before filing a complaint, recognize illegal practices. As per RBI guidelines and court orders, recovery agents are STRICTLY PROHIBITED from:

- Using Physical Force or Violence:Any form of assault or threat to cause bodily harm.

- Employing Intimidation or Coercion:Abusive language, verbal threats, false impersonation (e.g., posing as a police officer or court official).

- Invading Privacy at Odd Hours:Contacting you or visiting your residence/office before 7:00 AM and after 7:00 PM. This is a landmark directive upheld repeatedly.

- Publicly Humiliating You:Publishing your name on “defaulter lists” online or in public spaces, defaming you in your community or workplace.

- Harassing Family Members, Neighbors, or Colleagues:Repeatedly calling them or disclosing your debt details to them, violating your privacy.

- Making False or Misleading Claims:Threatening arrest, property seizure beyond legal process, or giving false information about the debt amount.

- Using Unauthorized Communication:Using WhatsApp, email, or social media for recovery without your explicit prior consent, as per 2024-25 data privacy advisories.

Key 2026 Update: The rise of AI-driven collection bots and communication platforms has led to new RBI guidelines on “Ethical Digital Recovery.” Agents must now provide a verifiable digital ID in all electronic communications, and all AI chat/call interactions must have an immediate option to connect to a human agent for grievance redressal.

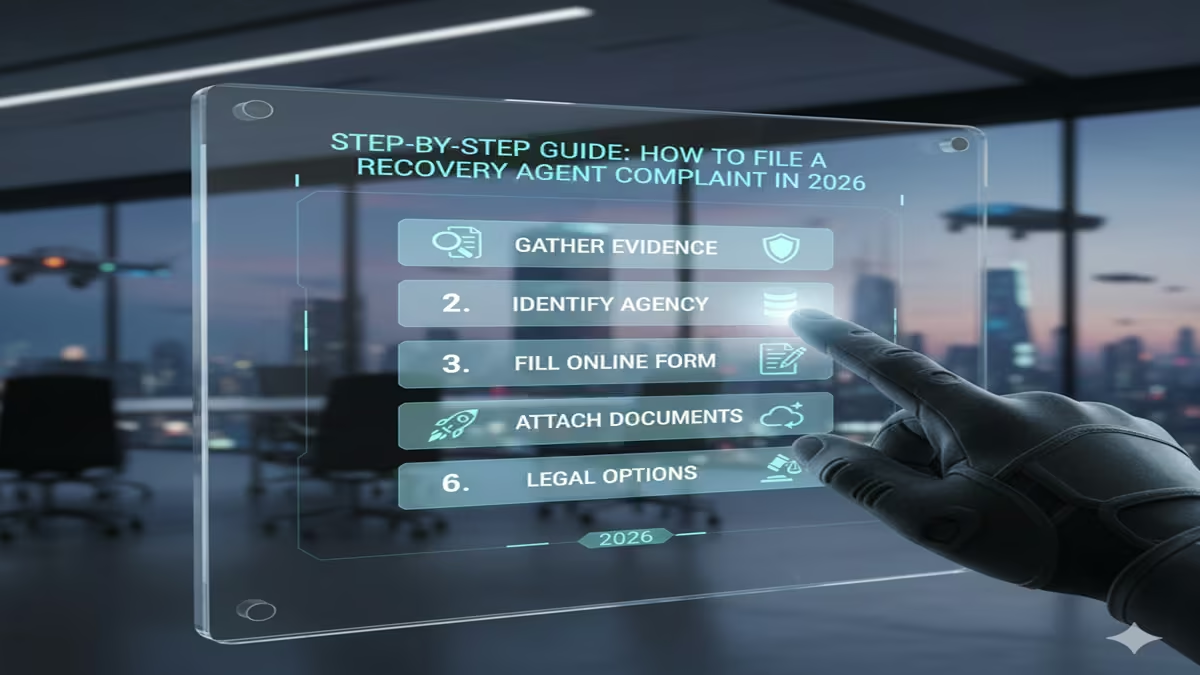

Part 2: The Step-by-Step Guide to Filing Your Complaint

Follow this hierarchical approach for maximum effectiveness.

Step 1: Document Everything Meticulously (Build Your Evidence File)

This is your most critical step. In 2026, digital evidence is paramount.

- Call Recordings:Use a call recording app (informing the agent you are recording, which often de-escalates the situation). Save dates and times.

- Screenshots & Archives:Capture all SMS, WhatsApp messages, social media posts, and emails. Use archive features.

- Video Evidence:If agents visit you, discreetly record the interaction on your phone, focusing on their language, threats, and identity.

- Witness Details:Note names and contact information of family members, neighbors, or colleagues who were harassed or witnessed the incident.

- Physical Evidence:Keep any threatening or defamatory notices left at your door or in your locality.

- Debt Verification:Obtain a recent statement from the lender/bank detailing the exact outstanding amount, as per RBI’sFair Practices Code.

Step 2: Lodge a Formal Written Complaint with the Lending Institution

Your first official step is to go directly to the source.

- Find the Right Channels:Look for the “Grievance Redressal Officer” or “Nodal Officer” details on the lender’s website, app, or your loan agreement.

- Compose a Detailed Email/Letter:

- Subject:Formal Complaint Against Harassment by Recovery Agents for Loan Account No. [Your Number].

- Clearly state your name, loan account number, and contact details.

- Chronologically list all incidents of harassment with dates, times, and agent names (if known).

- Explicitly quote the violated RBI guidelines (e.g., “harassment outside permissible hours as defined in RBI circular…”). Use this language.

- Attach ALL your evidence (audio files, videos, screenshots) as compressed files or cloud links.

- Demand a Specific Action:Immediate cessation of harassment, a written apology, and a correction of your credit report if damaged by their actions.

- Set a Deadline:Request a resolution within 15 days.

- Send via Tracked Means:Use registered post (with acknowledgment due) and email with read receipts. Keep the proof of sending.

Step 3: Escalate to the Banking Ombudsman (RBI)

If the institution doesn’t respond satisfactorily within 30 days, escalate to the RBI’s Integrated Ombudsman Scheme (2021).

- Portal:File your complaint online at.

- Process:

- Register and log in.

- Select the scheme (“Ombudsman for Digital Transactions” may be relevant for digital lenders).

- Fill in the detailed form, referencing your earlier complaint to the bank.

- Upload all evidence and the communication from the bank.

- The Ombudsman is a free and expedient mechanism. Their decision is binding on the bank up to ₹20 lakhs in value.

Step 4: File a Police Complaint (FIR)

For clear criminal offenses—threats, assault, criminal intimidation, defamation—approach the police.

- Draft a Precise Application:Detail the incidents under relevant IPC sections:

- Section 503:Criminal intimidation.

- Section 506:Punishment for criminal intimidation.

- Section 507:Criminal intimidation by anonymous communication.

- Visit Your Local Police Station:Submit your application along with evidence. Demand anFIR under Section 154 of the CrPC.

- If Police Refuse:Send the application by registered post to the Deputy Commissioner of Police (DCP) of your zone and file a complaint online at your state’s citizen portal. This creates an official record.

Step 5: Seek Legal Recourse

For serious violations or if other steps fail, consult a lawyer.

- Send a Legal Notice:A lawyer-drafted notice to the lender and the recovery agency, demanding compensation for mental harassment and cessation of illegal activities.

- File a Consumer Case:Under theConsumer Protection Act, 2019, you can file a complaint in the District/State Consumer Commission for “deficiency in service” and “unfair trade practice.”

- File a Writ Petition:In cases of gross violation of fundamental rights (Right to Life & Privacy under Article 21), a writ petition in theHigh CourtunderArticle 226can be filed. Courts have repeatedly held that banks are vicariously liable for the actions of their agents.

In 2026, public and regulatory visibility is key.

- RBI’s Sachet Portal:Report the specific lender for unfair practices on the RBI’s Sachet portal. This puts them under direct regulatory scrutiny.

- National Consumer Helpline:File a complaint via their portal or app.

- Social Media (Use Judiciously):A factual, evidence-based post (not a rant) tagging the lender’s official handle, the RBI, and handles like@CyberDost(for digital harassment) can prompt a swift customer service response. Avoid disclosing overly personal financial details.

Part 3: Proactive Measures & The Road Ahead in 2026

- Communication is Key:If facing genuine financial difficulty, proactively contact your lenderbeforedefaults occur. Explore restructuring options like aOne-Time Settlement (OTS)or loan rescheduling.

- Know Your Loan Agreement:Understand the clauses related to default and recovery.

- Credit Counselling:Use services offered by non-profit credit counselling agencies for debt management advice.

- Biometric call authentication for agents and blockchain-based audit trails for all recovery communications are likely on the horizon, mandated by evolving RBI norms.

Conclusion: Empowerment Through Action

Harassment by recovery agents is not a “part of the process.” It is an illegal overreach that the system provides clear mechanisms to combat. By following this structured, evidence-first approach, you move from being a victim to an empowered consumer. In 2026, with technology making documentation easier and regulators becoming more proactive, your right to dignity and fair treatment is stronger than ever. Act decisively, document meticulously, and escalate methodically.

Frequently Asked Questions (FAQ)

Q1: Can recovery agents seize my property without a court order?

A:No. For secured loans (like home loans), under SARFAESI, banks have the power to seizesecuredassets (the property mortgaged) after a detailed, legally mandated process involving written notices. However, this action is taken by the bank, not by agents arbitrarily. For unsecured loans (like personal loans), they cannot seize any property without a court decree.

Q2: What is the single most important thing to do when a recovery agent calls?

A:Stay calm, inform them you are recording the conversation (as per law), and ask for their (a) Full Name, (b) Employee ID, and (c) the name and registered address of the recovery agency they represent. Legitimate agents will provide this. Immediately note the date and time.

Q3: I’m being harassed for a loan I never took (a fraud loan). What should I do?

A:This is a serious issue. Immediately file anFIR for identity theft and fraudat your local police station. Simultaneously, file a complaint with the bank’s nodal officer and the RBI Ombudsman, attaching the FIR copy. Also, check your credit report via CIBIL/Experian and file a dispute for the fraudulent account.

Q4: Are digital lending apps allowed to use recovery agents?

A:Yes, but they must beRBI-registered entitiesand strictly follow the same guidelines as banks. Harassment via unauthorized access to phone contacts, morphing photos, or using obscene language is absolutely illegal. Complain via the RBI’s Sachet portal specifically for digital lending harassment.

Q5: How long does the entire complaint process usually take?

A:A resolution from the bank’s grievance officer should come within 15-30 days. The RBI Ombudsman aims to resolve cases within 30-60 days of admission. Police and court actions can take longer, depending on the complexity. The initial steps of documentation and complaint to the bank often yield the fastest results.