Understanding Subsidy Rejections: Common Reasons and How to Correct Them

Introduction: The High Stakes of Subsidy Applications

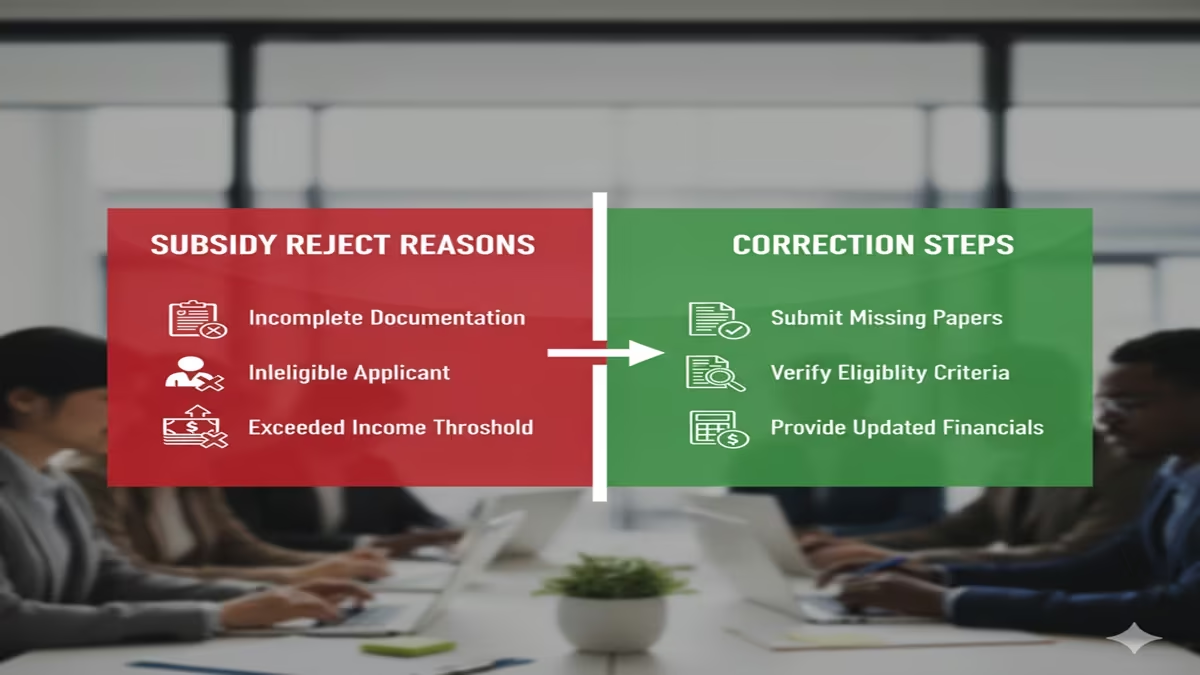

Subsidy Reject Reason & Correction In today’s economic landscape, subsidies serve as critical financial support mechanisms for businesses, farmers, students, researchers, and various sectors needing economic assistance. These government or institutional subsidies can mean the difference between a project’s success and failure, or in some cases, between an enterprise’s survival and closure. Yet, navigating the complex world of subsidy applications presents significant challenges, with rejection rates varying between 30-70% depending on the program and region.

The emotional and financial toll of a subsidy rejection can be substantial. For small business owners, a rejected grant might delay expansion plans or force employee layoffs. For researchers, it could mean shelving promising projects. For farmers, it might compromise their ability to invest in sustainable practices. Understanding why subsidies get rejected and how to address these issues is not merely bureaucratic knowledge—it’s a crucial survival skill in competitive economic environments.

This comprehensive guide examines the five most common reasons for subsidy rejections and provides actionable strategies for correction and resubmission.

The Anatomy of a Subsidy Rejection

Before delving into specific reasons, it’s important to understand the typical review process. Most subsidy programs employ evaluators who assess applications against predetermined criteria using scoring rubrics. These reviewers often have limited time per application (sometimes just 20-30 minutes for initial screening), making clarity, completeness, and alignment with program objectives absolutely critical.

Applications that survive initial screening undergo more thorough review, possibly including financial analysis, project viability assessment, and evaluation of potential impact. At each stage, applications can be eliminated for deficiencies that might seem minor to the applicant but are significant to evaluators following strict guidelines.

FAQ 1: Incomplete or Incorrect Documentation

The Problem

The most straightforward yet surprisingly common reason for subsidy rejection is incomplete or incorrectly filled documentation. This includes missing signatures, outdated forms, insufficient supporting evidence, or failure to include mandatory attachments. According to several government audit reports, approximately 25-40% of subsidy rejections stem primarily from documentation issues.

Why It Happens

- Complex Requirements:Subsidy applications often require numerous documents—business plans, financial statements, tax returns, identity verification, project proposals, quotations, and more. Keeping track of everything can be overwhelming.

- Evolving Guidelines:Application requirements sometimes change between funding cycles, and applicants may use outdated templates or guidelines.

- Overconfidence:Experienced applicants sometimes become complacent, assuming they know what’s needed without thoroughly checking current requirements.

- Time Pressure:Applicants rushing to meet deadlines may overlook required documents or submit incomplete forms.

Correction Strategies

- Create a Master Checklist:Before starting your application, compile a comprehensive checklist of all required documents. Update this checklist for each new application, even if you’ve applied to similar programs before.

- Implement a Document Management System:Establish a centralized digital repository for commonly required documents (financial statements, registration certificates, tax documents) that can be easily updated and accessed for multiple applications.

- Utilize the “Four Eyes” Principle:Have at least two people review the complete application package before submission—one familiar with the project details and another with fresh eyes to spot omissions or errors.

- Validate Against Official Sources:Cross-reference each requirement against the most current official guidelines, not secondary sources or previous applications. Program websites often have “common mistakes” sections worth reviewing.

- Pre-submission Audit:Conduct a formal audit of your application 72 hours before the deadline. This allows time to correct any discovered deficiencies without last-minute panic.

Case Example

A renewable energy startup spent three months preparing a $500,000 green technology subsidy application. Despite an innovative proposal and strong financials, their application was rejected because they used the previous year’s application form, which lacked a new required section on community impact assessment. By resubmitting with the correct form and adding the impact assessment, they secured funding in the next cycle.

FAQ 2: Ineligibility Based on Program Criteria

The Problem

Applicants sometimes apply for subsidies for which they fundamentally don’t qualify based on geographic, sectoral, size, or other eligibility restrictions. This accounts for approximately 20-35% of rejections. These applications are often screened out quickly, wasting both applicant and evaluator time.

Why It Happens

- Assumption-Based Applications:Applicants assume eligibility based on partial information or anecdotal evidence from peers.

- Broad Interpretation of Criteria:Applicants stretch their qualifications to “sort of fit” program descriptions.

- Program Misunderstanding:Complex or vaguely worded eligibility requirements lead to misinterpretation.

- Changing Circumstances:An applicant’s situation may have changed since they last qualified for similar programs.

Correction Strategies

- Conduct Rigorous Eligibility Self-Assessment:Before investing time in an application, conduct a formal eligibility assessment. Create a spreadsheet listing each eligibility criterion alongside evidence of how you meet it. If you cannot provide concrete evidence for any criterion, reconsider applying.

- Seek Pre-application Clarification:Many programs offer clarification services—use them. Submit specific questions about your eligibility before preparing a full application.

- Review Past Awardees:Examine public records of previous recipients. Do they share characteristics with your organization? This can provide practical insight beyond formal criteria.

- Understand “Spirit” and “Letter”:Some programs have unwritten priorities or preferences. Research the program’s background, political context, and broader objectives to understand what they’re truly seeking.

- Consider Alternative Programs:If ineligible for one program, research alternatives. Many applicants fixate on a particular subsidy when others might be better fits.

Case Example

A mid-sized manufacturing company applied for a small business innovation grant despite having 280 employees. The program had a 250-employee ceiling. The company wasted approximately 80 staff hours on the application. After rejection, they identified a different program specifically for medium enterprises expanding into export markets—a better fit that they successfully secured.

FAQ 3: Weak or Unconvincing Project Proposal

The Problem

Even with perfect documentation and eligibility, applications fail if the project proposal itself is unconvincing. This includes poorly defined objectives, unrealistic timelines or budgets, unclear methodology, or insufficient evidence of need or impact. Approximately 15-30% of rejections fall into this category.

Why It Happens

- Internal Perspective:Applicants understand their project intimately but fail to communicate it effectively to outsiders.

- Jargon and Assumptions:Overuse of industry-specific language or assumptions that evaluators share specialized knowledge.

- Ambiguous Outcomes:Failure to define specific, measurable, achievable, relevant, and time-bound (SMART) outcomes.

- Underdeveloped Justification:Insufficient evidence demonstrating why the project deserves funding over competing proposals.

Correction Strategies

- Employ the “Grandmother Test”:Can someone unfamiliar with your field understand what you propose to do and why it matters? If not, simplify your language and clarify your concepts.

- Adopt a Logical Framework Approach:Structure your proposal using a logframe matrix that clearly links activities to outputs, outcomes, and impacts. This forces clarity about project logic and measurement.

- Quantify Everything Possible:Instead of “increasing sales,” specify “achieving $500,000 in new sales within 18 months through three new distribution channels.” Quantifiable goals are more credible and measurable.

- Demonstrate Sustainability:Show how the project will continue or create lasting value after subsidy funds are exhausted. Evaluators want to fund initiatives with long-term impact, not temporary fixes.

- Incorporate Risk Management:Acknowledging potential challenges and having mitigation strategies demonstrates professionalism and realistic planning. Pretending nothing can go wrong undermines credibility.

Case Example

A community health organization sought funding for a diabetes prevention program but simply stated they would “educate people about healthy living.” Their application was rejected as vague. They revised to specify: “Reduce pre-diabetes indicators by 15% among 200 at-risk community members within 12 months through 10 cooking workshops, 20 exercise sessions, and personalized coaching, with results measured by quarterly A1C testing.” The revised proposal secured funding.

FAQ 4: Insufficient Financial Justification or Planning

The Problem

Subsidies are ultimately financial instruments, and applications often fail due to financial shortcomings. This includes unrealistic budgets, insufficient matching funds, unclear financial management plans, or inadequate demonstration of financial need or viability. Financial issues cause approximately 10-25% of rejections.

Why It Happens

- Underestimating Costs:Optimism bias leads to underestimating true project costs.

- Poor Financial Presentation:Even sound finances appear weak if poorly presented or explained.

- Inadequate Matching Funds:Many programs require co-funding, which applicants may not properly secure or demonstrate.

- Weak Financial Management Plans:Failure to explain how funds will be managed, monitored, and reported.

Correction Strategies

- Develop Detailed Line-Item Budgets:Break down costs into specific categories with clear justifications for each item. Explain how you calculated each cost (e.g., not just “$5,000 for marketing” but “$5,000 for Facebook ads targeting X demographic at Y cost per click based on three-month pilot results”).

- Secure Matching Funds Before Applying:Don’t just promise matching funds—have commitment letters, bank statements, or other verifiable proof ready. This demonstrates serious commitment and reduces perceived risk.

- Demonstrate Financial Need Clearly:Use financial ratios, projections, and comparisons to industry benchmarks to substantiate why you need the subsidy and what difference it will make.

- Present Strong Financial Management:Include details about accounting systems, internal controls, audit arrangements, and reporting procedures. This assures evaluators that funds will be properly managed.

- Conduct Sensitivity Analysis:Show how your project would withstand financial uncertainties (e.g., “Even if material costs increase by 10%, we can adjust by…”). This demonstrates robust planning.

Case Example

A technology startup seeking R&D funding projected revenues that seemed implausibly high based on their stage and market. Evaluators questioned their financial acumen. The startup revised their application with more conservative projections, clearer assumptions, and a detailed “what-if” analysis showing break-even under various scenarios. They also included letters from potential customers expressing interest, strengthening their revenue projections. The revised application succeeded.

FAQ 5: Poor Alignment with Program Objectives

The Problem

Even excellent proposals fail if they don’t align with the specific objectives, priorities, or unstated missions of the funding program. This misalignment accounts for approximately 10-20% of rejections. Applicants sometimes propose good projects that simply aren’t what the funder wants to support at that time.

Why It Happens

- Generic Applications:Applicants use boilerplate proposals with minor modifications for different programs.

- Misreading Priorities:Focusing on secondary rather than primary program objectives.

- Ignoring Political or Strategic Context:Not considering the funder’s broader agenda, which may include job creation, regional development, innovation in specific sectors, or political priorities.

- Overlooking Evaluation Criteria Weighting:Not understanding which criteria carry the most points in evaluation.

Correction Strategies

- Conduct a “Funder Analysis”:Research the funding organization thoroughly. What is their mission? What have they funded recently? What political or strategic pressures might they face? Tailor your proposal to their worldview, not just their formal criteria.

- Mirror Program Language:Use the same terminology and phrasing found in the program guidelines. This creates subconscious alignment and makes it easier for evaluators to map your proposal to their criteria.

- Address Weighted Criteria Explicitly:If the program allocates 40% of points to innovation and 20% to job creation, structure your proposal accordingly, with emphasis matching the weighting.

- Connect to Broader Impacts:Show how your project advances not just the program’s stated objectives but also related priorities like sustainability, diversity, regional development, or technological advancement.

- Seek Feedback on Alignment:If possible, discuss your project concept with program officers before applying to gauge their interest and receive alignment suggestions.

Case Example

An agricultural cooperative applied for a rural development subsidy focusing entirely on their increased production capabilities. The program, however, prioritized environmental sustainability and community resilience. Their application was rejected. They revised to emphasize how their proposed irrigation system would reduce water usage by 30% and include training for neighboring farms, directly aligning with the program’s true priorities. The revised application succeeded.

The Resubmission Process: Turning Rejection into Success

Receiving a rejection is disappointing, but it need not be final. Many successful subsidy applications are improved versions of initially rejected proposals.

Steps for Effective Resubmission:

- Request Detailed Feedback:If not automatically provided, formally request specific reasons for rejection. Some programs offer debriefing sessions.

- Analyze Rejection Reasons Objectively:Separate emotional reaction from factual analysis. Categorize the reasons using the framework above.

- Develop a Revision Plan:Create a systematic approach to addressing each deficiency. Don’t just fix surface issues—strengthen the entire application.

- Consider Timing:Some programs allow immediate resubmission, while others require waiting for the next cycle. Use waiting time to strengthen your proposal and address weaknesses.

- Document Changes:When resubmitting, include a cover letter summarizing how you’ve addressed previous shortcomings. This demonstrates responsiveness and improvement.

Prevention: Building a Subsidy-Ready Organization

Beyond correcting individual applications, organizations can adopt practices that increase their overall subsidy success rate:

Institutionalize Subsidy Management

- Designate a subsidy coordinator or team

- Maintain a calendar of opportunities and deadlines

- Create standardized templates for common application elements

- Develop a document repository for frequently required materials

Foster Continuous Improvement

- Conduct post-submission reviews regardless of outcome

- Maintain a “lessons learned” database

- Benchmark against successful applicants

- Invest in training for staff involved in subsidy applications

Build Relationships

- Engage with funding organizations before applying

- Network with successful applicants

- Consider joining industry associations that share insights on funding opportunities

- Attend information sessions and workshops offered by funders

Conclusion: Transforming Rejection into Refinement

Subsidy rejections, while frustrating, provide valuable learning opportunities. By systematically addressing the five common causes—documentation errors, eligibility issues, weak proposals, financial shortcomings, and program misalignment—applicants can significantly improve their success rates.

The most successful applicants treat subsidy acquisition not as a periodic necessity but as an ongoing strategic function. They build organizations that are “subsidy-ready,” with systems, knowledge, and relationships that support strong applications. They view rejection not as failure but as feedback, using it to refine and strengthen subsequent attempts.

In an increasingly competitive funding environment, understanding the nuances of subsidy applications becomes a distinct competitive advantage. By mastering both the technical requirements and strategic dimensions of subsidy acquisition, organizations can secure vital resources to advance their missions, innovations, and contributions to society.

Remember: Every rejected application contains the seeds of a future successful one. The difference lies in whether you cultivate those seeds through analysis, adaptation, and persistent improvement. With the right approach, today’s rejection reason becomes tomorrow’s correction strategy and ultimately, next year’s funding success.