The Great Financing Divide: Loan vs. Credit Card EMI – A Strategic Comparison for the Modern Consumer

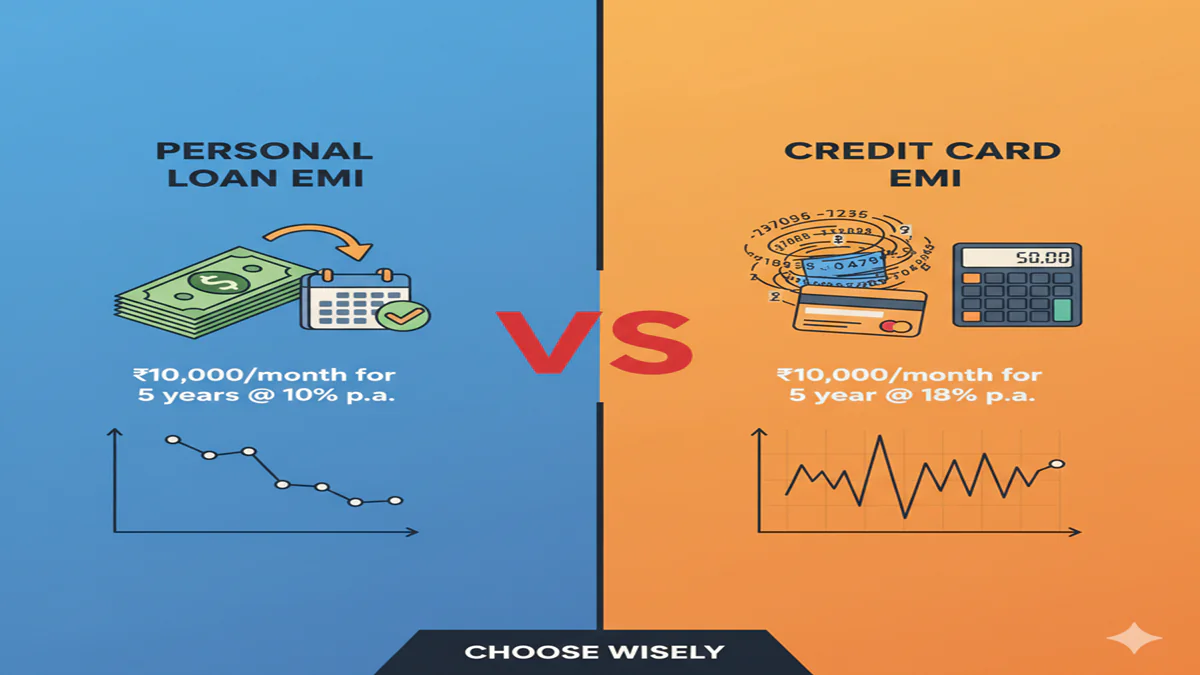

Loan Vs Credit Card Emi Comparison In the bustling landscape of personal finance, the moment arrives for nearly every individual: you need to make a significant purchase, but your savings aren’t quite enough to cover the cost upfront. Whether it’s a sleek new laptop, a necessary medical procedure, a dream vacation, or consolidating existing debt, two primary avenues emerge from the financial toolkit—the traditionalPersonal Loanand the ubiquitousCredit Card EMI(Equated Monthly Installment) conversion.

At first glance, both seem to serve the same purpose: providing immediate purchasing power with the convenience of repayment in smaller, monthly chunks. However, beneath this surface similarity lies a complex web of differences in cost, structure, flexibility, and impact. Choosing the wrong option can mean the difference between a smart financial move and a costly debt trap.

This comprehensive guide delves deep into the heart of the loan versus credit card EMI debate, equipping you with the knowledge to make an informed, strategic decision tailored to your specific financial scenario.

Part 1: The Fundamental Frameworks

The Personal Loan: Structured Debt with a Purpose

A personal loan is a lump-sum amount of money borrowed from a bank, credit union, or online lender. It is typically unsecured, meaning it doesn’t require collateral like a house or car. The loan is granted based on your creditworthiness, income, and financial history.

- Process:You apply for a specific amount (e.g., ₹300,000) for a specific tenure (e.g., 36 months). Upon approval, the entire sum is disbursed to your bank account. You then repay it via fixed EMIs comprising principal and interest.

- Nature:It is aclosed-end creditfacility. The principal amount is fixed, and once repaid, the credit line ceases to exist until you apply for a new loan.

- Best Suited For:Large, planned expenses where the exact amount needed is known upfront—home renovation, wedding funding, major appliance purchases, or high-cost medical treatments.

The Credit Card EMI: Converting a Revolving Line into Installment Debt

Credit card EMI is not a separate product but a feature of your existing revolving credit limit. When you make a large purchase (or sometimes convert an existing outstanding balance), you can opt to pay for it in monthly installments instead of the full amount on your next bill.

- Process:At the point of sale (POS) for a new purchase or later via your bank’s app/portal for past transactions, you select an EMI tenure. Your available credit limit is reduced by the full purchase amount, but you are only obligated to pay the EMI each month, plus any other new charges you incur.

- Nature:It is a conversion of a revolving credit facility into a structured installment planwithinthat revolving limit. The rest of your limit remains available for use.

- Best Suited For:Smaller, often spontaneous or promotional purchases on electronics, gadgets, or appliances, especially when a “No Cost EMI” offer is available.

Part 2: The Head-to-Head Comparative Analysis

1. Cost of Borrowing: The Interest Rate Arena

This is the most critical battlefield.

- Personal Loans:Interest rates are expressed as anAnnual Percentage Rate (APR). For borrowers with good to excellent credit scores, personal loan APRs are generallylower. They typically range from10% to 20% p.a.in most markets. The rate is fixed for the loan tenure, making future payments predictable.

- Credit Card EMI:Here, things get nuanced. There are two main types:

- Standard EMI:Carries an interest rate that is almost alwayssignificantly higherthan personal loan rates, often ranging from14% to 24% p.a.or more. This is the default if you convert a purchase after the fact.

- “No Cost EMI” or “Zero Interest EMI”:This is a major draw but is often misunderstood. The interest is not zero; rather, the merchant or bankrebates the interest amountto the customer. However, this is usually offered on select products at partnered retailers. Crucially,Goods and Services Tax (GST)is levied on theinterest component(even if rebated), which the customer bears.

Verdict: For standard rates, personal loans are almost always cheaper. “No Cost EMI” can be competitive for specific purchases, but you must factor in the hidden GST-on-interest cost and ensure the product’s cash price isn’t inflated.

2. Flexibility & Accessibility: Convenience vs. Formality

- Personal Loans:Require a formal application process involving documentation (income proof, identity, address). The funds are versatile; once disbursed, you can spend them anywhere, with any vendor. You can also often avail ofpart-prepayment or foreclosureoptions, sometimes with a small fee, which can reduce your total interest burden.

- Credit Card EMI:The pinnacle of convenience. It’s instantaneous—a click at checkout or on your banking app. No new paperwork is required (beyond your existing card). However, it’stied to specific purchases(especially for No-Cost offers). Foreclosure is usually possible but may come with hefty penalties that negate any interest savings.

Verdict: Credit Card EMI wins on speed and ease. Personal loans win on fund versatility and flexible repayment options.

3. Tenure and EMI Amount: The Repayment Landscape

- Personal Loans:Offerlonger tenures, commonly from 6 months up to 5-6 years. This allows for smaller, more manageable EMIs for large amounts, reducing monthly cash flow strain.

- Credit Card EMI:Typically comes withshorter tenures, usually from 3 to 24 months. This results in a higher EMI for the same loan amount compared to a longer personal loan tenure.

Verdict: For large amounts requiring a stretched-out repayment, personal loans are superior. Credit card EMIs force a quicker, often more expensive monthly payout.

4. Impact on Credit Score: The Silent Calculus

- Personal Loans:When you take a new loan, it causes a hard inquiry and creates a new “credit account.” Initially, this may cause a small, temporary dip in your score. However,consistent, on-time EMI payments are reported to credit bureaus and dramatically improve your “credit mix” and payment history, which are major positive factors. Successfully closing a loan boosts your profile.

- Credit Card EMI:It does not create a new account. However, itincreases your credit utilization ratiodramatically, as the full converted amount blocks your credit limit. High utilization (typically above 30-40%) is a key negative factor for credit scores. Timely EMI payments help, but the high utilization can drag your score down until the balance is paid substantially.

Verdict: Personal loans, managed well, are a stronger long-term credit-building tool. Credit card EMI poses a higher risk to your score through utilization spikes.

5. The Prepayment and Foreclosure Factor

- Personal Loans:Most lenders allow foreclosure or part-prepayment, often after a lock-in period (like 6-12 months). Aforeclosure charge(usually 2-5% of the principal outstanding) may apply, but the interest savings are usually substantial.

- Credit Card EMI:Foreclosure is frequently discouraged. Banks may chargeheavy penaltiesor, crucially, ask you to payall the remaining interestfor the entire tenure, nullifying any benefit of early closure.

Verdict: Personal loans offer a clearer, often cheaper path to early debt freedom.

Part 3: Strategic Scenarios – Which One to Choose?

Scenario 1: The Planned, Large Expense (₹200,000+ for a wedding, renovation)

- Choice: Personal Loan.

- Why:You know the exact amount, need a lower interest rate, and will benefit from a longer tenure to keep EMIs manageable. The versatility to pay different vendors is key.

Scenario 2: The Spontaneous Gadget Purchase (₹80,000 Laptop with a “No Cost EMI” offer)

- Choice: Credit Card EMI (if genuine No-Cost).

- Why:The convenience is unmatched. If it’s a genuine offer from a reputable retailer (compare the effective price after GST), the cost is low or negligible for a short tenure. A personal loan would be overkill.

Scenario 3: Debt Consolidation (Paying off multiple high-interest credit card debts)

- Choice: Personal Loan, almost unequivocally.

- A personal loan at 15% p.a. saves you a fortune. You also convert multiple payments into one, simplify finances, and protect your credit score from high utilization.

Scenario 4: The Medical Emergency (₹150,000 needed immediately)

- Choice: Personal Loan.

- Why:Hospitals may not always accept credit card EMI for large bills, or might charge extra. The personal loan provides direct cash in your account, giving you the flexibility to pay the hospital, buy medicines, and cover ancillary costs.

Scenario 5: The Small, Urgent Cash Need (₹25,000 for car repairs)

- Choice: Depends.

- If you can repay quickly: Use your credit card inrevolving modeand pay the full amount next statement to avoid interest.

- If you need 3-6 months: Ashort-tenure Credit Card EMIconversion might be simpler than applying for a tiny loan.

- If you need longer: A small personal loan could still be cheaper than a standard card EMI rate.

Part 4: The Hidden Pitfalls & Final Checklist

Beware of These Traps:

- The “No Cost” Mirage:Always ask for the total breakup (processing fee, GST, shipping cost if any). Compare the final outflow with the product’s cash price.

- Credit Limit Lock-up:A ₹100,000 EMI on a ₹150,000 limit leaves you with only ₹50,000 for emergencies, hurting your utilization ratio.

- The Missed Payment Avalanche:Missing a credit card EMI payment can lead topunitive interestbeing applied from the original purchase date on the entire amount, and late fees. It’s catastrophic.

- Product Return Hassles:Returning a product bought on EMI involves a lengthy process of EMI cancellation and credit note issuance, which can be messy.

Your Decision Checklist:

- What is the exact amount needed?(Known = Loan, Approximate/Point-of-Sale = Card EMI)

- What is theeffectiveinterest rate?Calculate the total cost of the card EMI (with fees & GST) vs. the personal loan APR.

- How long do I need to repay?(>24 months = lean towards Loan).

- Is my credit limit sufficiently higher than the purchase?(To avoid utilization shock).

- Is there a prepayment option I might use?(If yes, Loan is safer).

Conclusion

The choice between a loan and a credit card EMI is not a binary one of good vs. bad, but a strategic decision of “right tool for the job.”

Think of a Personal Loan as a surgical scalpel—ideal for planned, significant financial procedures. It’s a disciplined, cost-effective instrument for major life events, offering structure, lower cost, and credit-building potential when used responsibly.

Consider Credit Card EMI as a versatile multi-tool—perfect for smaller, opportunistic fixes, especially when attached to a genuine promotional offer. Its power lies in instant access and convenience, but it requires careful handling to avoid nicking your financial health.

In the grand orchestra of your finances, let discipline be the conductor. Use credit as an instrument to enhance your life’s melody, not as a crutch that leads to a cacophony of debt. Assess your situation against the detailed parameters above, resist impulsive convenience when the cost is high, and you will master the art of choosing wisely, ensuring your financial future remains harmonious and secure.

Frequently Asked Questions (FAQs)

2. Which option is better for my credit score in the long run?

A properly managed personal loan is generally better for long-term credit building. It adds to your “credit mix” (showing you can handle different types of debt) and, with consistent on-time payments, builds a strong positive history. Credit card EMI, while also reporting payments, can severely hurt your score in the short term by spiking your credit utilization ratio, a key scoring factor.

3. Can I prepay or foreclose my Credit Card EMI early? What are the charges?

Yes, but it is often disadvantageous. Most banks charge a foreclosure fee (e.g., 2-3% of the outstanding) and, more critically, many will levy the entire remaining interest for the tenure as a penalty. This often negates any interest savings from early repayment. Always check your bank’s specific terms before opting for foreclosure.

4. I have an existing credit card outstanding. Should I convert it to EMI or take a personal loan to pay it off?

Taking a personal loan to pay off credit card debt is almost always the smarter financial move. Credit card revolving interest rates are exorbitantly high (often 36-48% p.a.). A personal loan at 12-18% p.a. will significantly reduce your interest burden, fix your repayment schedule, and help you get out of debt faster. Converting the card balance to an EMI on the same card usually carries a high standard EMI rate.

5. For a very small amount (say, under ₹25,000) and a short period (3 months), which is better?

For such small, short-term needs, aCredit Card EMI conversionmight be more convenient and efficient, avoiding the formal loan application process. If you can find a “No Cost EMI” offer, it becomes a very good option. A personal loan for such a small amount may have higher processing fees proportionally, making it less economical.