Loan vs. Credit Card Interest: A Comprehensive Comparison

Introduction

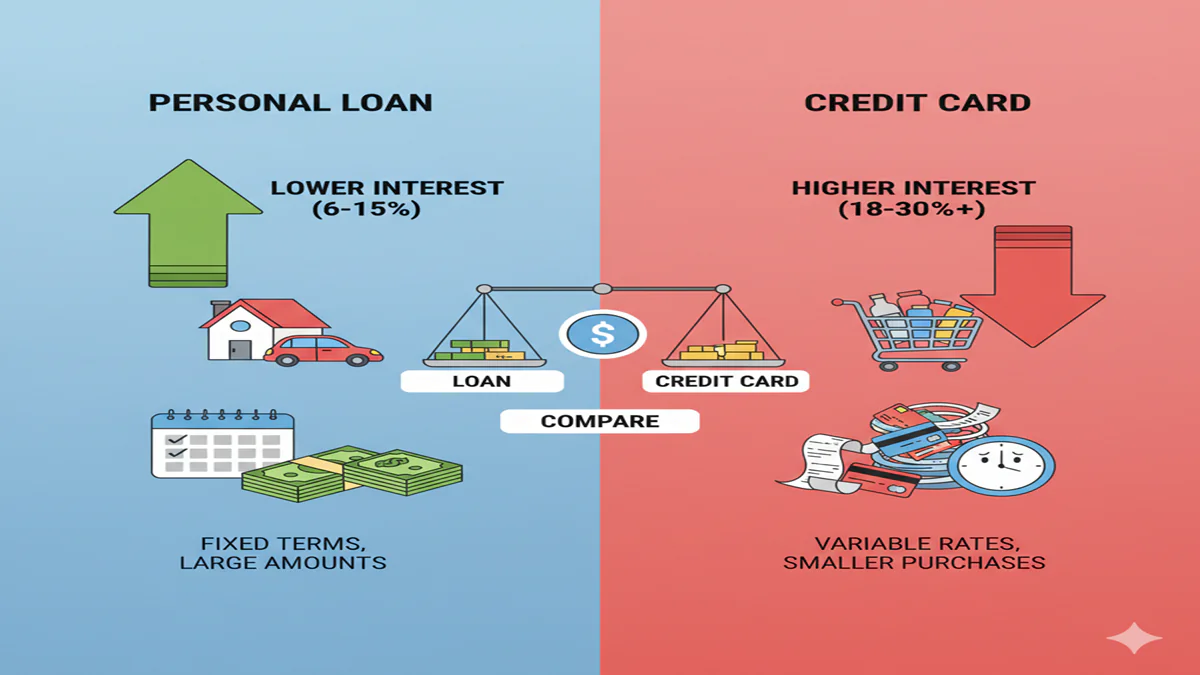

Loan Vs Credit Card Interest Comparison In today’s financial landscape, consumers have more borrowing options than ever before. Two of the most common instruments—personal loans and credit cards—serve fundamentally different purposes yet are often used interchangeably by borrowers. Understanding how their interest structures differ can save thousands of dollars and prevent debilitating debt cycles. This comprehensive 2,500-word guide examines the intricate details of loan versus credit card interest, providing clarity for informed financial decision-making.

Chapter 1: The Fundamental Structures

Personal Loans: Predictable and Planned

Personal loans representinstallment credit—a lump sum borrowed upfront and repaid through fixed monthly payments over a predetermined period (typically 1-7 years). The interest rate is generally fixed, meaning your monthly payment remains unchanged throughout the loan term. This predictability makes budgeting straightforward.

Lenders determine loan interest rates based on several factors:

- Credit score and history

- Debt-to-income ratio

- Loan amount and term

- Purpose (with secured loans often having lower rates)

Credit Cards: Revolving Flexibility

Credit cards operate asrevolving credit—a continuously available line of credit up to a predetermined limit. Minimum payments fluctuate based on your balance, typically calculated as 1-3% of the outstanding amount plus interest.

Credit card interest, expressed as an Annual Percentage Rate (APR), is notoriously higher. The average credit card APR in 2023 exceeded 22%, with some cards reaching 30%+ for borrowers with poor credit. Unlike loans, most credit cards feature variable rates tied to the prime rate, meaning your interest costs can increase with Federal Reserve rate changes.

Key Structural Difference: Loans provide a finite amount with a repayment end date; credit cards offer ongoing access to funds with no predetermined payoff timeline.

Chapter 2: Interest Calculation Methods

How Loan Interest Accumulates

Most personal loans use the simple interest method calculated on the declining balance. The formula:

text

Interest = Principal × Rate × Time

For a $10,000 loan at 10% APR over 3 years:

- Monthly interest rate: 10% ÷ 12 = 0.833%

- First month interest: $10,000 × 0.00833 = $83.33

- As the principal declines monthly, interest charges decrease accordingly

Loan amortization schedules front-load interest payments, meaning early payments contain more interest versus principal. This structure incentivizes borrowers to pay off loans early when possible.

How Credit Card Interest Compounds

Credit cards typically use daily compounding interest, calculated as:

text

Daily Periodic Rate = APR ÷ 365 Daily Interest = Balance × Daily Periodic Rate

If you carry a $5,000 balance on a card with 24% APR:

- Daily rate: 24% ÷ 365 = 0.06575%

- Daily interest: $5,000 × 0.0006575 = $3.29

- Monthly interest: approximately $100 (varies with billing cycle days)

The critical distinction: credit card interest compounds, meaning each day’s interest gets added to the principal, and subsequent interest calculations include previously accrued interest. This compounding effect, especially when combined with minimum payments, creates the notorious “debt spiral” phenomenon.

The Grace Period Exception

Credit cards offer a significant advantage when paid in full: the interest-free grace period. If you pay your statement balance completely by the due date each month, you pay zero interest—essentially a short-term, interest-free loan. This feature doesn’t exist with personal loans, which begin accruing interest immediately upon disbursement.

Chapter 3: Cost Comparison Scenarios

Scenario 1: $10,000 Borrowed Over 3 Years

Personal Loan at 10% Fixed APR:

- Monthly payment: $322.67

- Total interest paid: $1,616.12

- Total repayment: $11,616.12

Credit Card at 22% APR (Making Minimum Payments):

- Starting minimum payment (3%): $300

- As balance decreases, minimum payments reduce

- Time to repay: 7+ years

- Total interest paid: approximately $8,500

- Total repayment: approximately $18,500

Credit Card at 22% APR (Making Loan Equivalent $322.67 Payments):

- Time to repay: 3.5 years

- Total interest paid: $3,200

- Total repayment: $13,200

Analysis: Even making identical monthly payments, the credit card costs nearly double the interest due to higher APR. With minimum payments, costs quintuple.

Scenario 2: The Debt Consolidation Dilemma

Many borrowers consider using a low-interest loan to pay off high-interest credit card debt. This strategy makes mathematical sense but requires behavioral change.

Example: $20,000 credit card debt at 24% APR

- Minimum payments (2.5%): Starting at $500/month

- Time to pay off: 30+ years

- Total interest: $40,000+

Consolidation with 12% Personal Loan:

- 5-year term: $445/month

- Total interest: $6,700

- Savings: $33,300+

The consolidation loan saves enormous interest but removes the revolving credit line. Without addressing spending habits, many borrowers run up credit cards again while still paying the loan—doubling their debt burden.

Chapter 4: Strategic Use Cases

When Loans Make More Sense

- Large, One-Time Expenses:Major home renovations, weddings, or medical procedures where you know the exact amount needed.

- Debt Consolidation:As shown above, mathematically advantageous when moving high-rate debt to lower-rate installment loans.

- Credit Building:Installment loans add diversity to credit mix, potentially improving credit scores more than revolving accounts alone.

- Predictable Budgeting:Fixed payments simplify financial planning for those on tight budgets.

When Credit Cards Are Advantageous

- Short-Term Financing:When you can pay the balance within the grace period, effectively obtaining interest-free funds.

- Emergencies:Immediate access to funds when other options aren’t available.

- Rewards Optimization:Using cards for everyday purchases you’d make anyway, then paying in full to earn rewards without interest.

- Purchase Protections:Credit cards often provide extended warranties, fraud protection, and dispute resolution not available with loans.

- Cash Flow Management:Bridging temporary gaps between expenses and income when you have reasonable certainty of repayment within 1-2 billing cycles.

Chapter 5: Hidden Costs and Considerations

Loan-Related Fees

- Origination fees (1-8% of loan amount)

- Prepayment penalties (less common today but still exist)

- Late payment fees (typically $25-$50)

- Insufficient funds fees

Credit Card Pitfalls

- Cash advance fees (typically 5% with no grace period)

- Balance transfer fees (3-5%)

- Late payment fees (up to $40) plus potential penalty APRs

- Annual fees on premium cards

- Over-limit fees (if you opt-in to allow transactions over your limit)

The Psychological Factor

Research in behavioral economics reveals that mental accounting affects how we perceive different debt types. Loans feel like serious debt, prompting more diligent repayment. Credit card spending feels more abstract, leading to higher balances and slower repayment—even when interest rates are substantially higher.

Chapter 6: Impact on Credit Scores

Credit Utilization Ratio

Maxed-out credit cards hurt scores significantly, while installment loans don’t factor into utilization calculations.

Credit Mix

Having both installment (loans) and revolving (cards) accounts can benefit scores, demonstrating ability to manage different credit types.

New Credit Inquiries

Both loan applications and new credit cards generate hard inquiries, temporarily lowering scores by 5-10 points typically.

Average Account Age

Closing old credit cards to get a loan can shorten credit history length, potentially lowering scores.

Chapter 7: The Tax Considerations

Personal Loan Interest

Generally not tax-deductible for consumers. The sole exception is if loan proceeds are used for business purposes, investment property, or qualifying educational expenses.

Credit Card Interest

Similarly not deductible for personal purchases. Business credit card interest may be deductible as a business expense if properly documented.

Contrast: Mortgage and student loan interest often provide deductions, making their effective interest rates lower than nominal rates suggest. This tax advantage doesn’t extend to personal loans or credit cards.

Chapter 8: Choosing What’s Right For You

Decision Framework

- Calculate the true costusing online calculators, factoring in all fees.

- Evaluate your repayment disciplinehonestly. Will you pay more than minimums?

- Consider your credit scoreand which option provides better approval chances.

- Analyze the purpose:Is this a planned expense or emergency?

- Review existing debt:How will this affect your overall debt-to-income ratio?

Hybrid Approaches

- Balance transfer cards:0% introductory APRs can provide temporary relief for credit card debt.

- Secured personal loans:Using collateral for lower rates.

- Credit union alternatives:Often offer lower rates on both loans and cards.

Conclusion

The loan versus credit card interest comparison reveals a fundamental financial truth: structure determines cost. Loans provide lower rates and forced discipline through amortization schedules. Credit cards offer flexible revolving credit but at substantially higher costs when balances revolve.

For planned, substantial expenses with predictable repayment capacity, personal loans generally prove more economical. For short-term, smaller expenses that can be paid quickly—or for true emergencies—credit cards offer appropriate flexibility.

The most expensive choice is using either instrument without understanding its terms. By calculating true costs, acknowledging behavioral tendencies, and aligning borrowing methods with specific needs, consumers can leverage debt as a tool rather than succumb to it as a burden.

Financial literacy transforms interest from an abstract percentage into tangible dollars saved or wasted. In an era of economic uncertainty, that understanding represents not just savings, but security.

5 Frequently Asked Questions

1. If I have good credit, which typically offers a lower interest rate: personal loans or credit cards?

For borrowers with good to excellent credit (FICO scores 700+), personal loans almost always offer significantly lower interest rates. While excellent credit might secure a credit card with a 15-18% APR, the same borrower could qualify for a personal loan at 6-10% APR. The fixed nature of loan rates provides additional protection against future rate increases.

2. Can I use a personal loan to pay off credit card debt even if my credit score has dropped due to high balances?

Yes, this is possible and sometimes referred to as “debt consolidation for damaged credit.” While you may not qualify for the very best rates, personal loans for fair credit (scores 580-669) often range from 15-25% APR—still potentially lower than credit card APRs averaging 22-30%. The approval and rate depend on your complete financial picture, including income, other debts, and recent credit behavior.

3. How does making minimum payments on credit cards compare to fixed loan payments in total interest paid?

The difference is staggering. Making only minimum payments on credit cards (typically 1-3% of balance) can extend repayment periods to 15+ years on large balances, with interest often exceeding the original debt. For example, a $10,000 balance at 20% APR with 2% minimum payments would take approximately 30 years to repay with $15,000+ in interest. The same amount via a 5-year personal loan at 10% would incur about $2,750 in interest.

4. Do personal loans or credit cards have more flexible repayment options?

Credit cards offer more flexible repayment in the short term—you can pay anywhere from the minimum to the full balance each month. Personal loans have rigid repayment schedules, though many lenders now offer flexibility such as:

- Payment date changes

- One-time payment skips (with extended term)

- No prepayment penalties (allowing early payoff)

- Some even offer unemployment protection

For long-term predictability, loans win; for month-to-month flexibility, credit cards have the advantage.

5. Which option is better for building or repairing credit: getting a personal loan or a credit card?

Both can build credit when managed properly, but they impact different aspects of your score:

- Keeping balances below 30% of limits helps significantly.

- Personal loansadd to your credit mix (10% of score) and establish a history of installment repayment.

For credit repair, a secured credit card (requiring a deposit) is often the easiest to obtain with poor credit. Once you’ve established some positive history, a small installment loan can further diversify your credit profile. The most effective approach combines both types with impeccable payment history.